What Are The Trust Tax Rates For 2021

Trust income up to 1000. Over 2650 but not over 9550.

It S That Special Time Of Year Again Tis The Season To File Our Federal Income Taxes In 2021 Income Tax Federal Income Tax Tax Return

The lifetime gift tax exemption for gifts made during 2021 is 117 million increased from 1158 million in 2020.

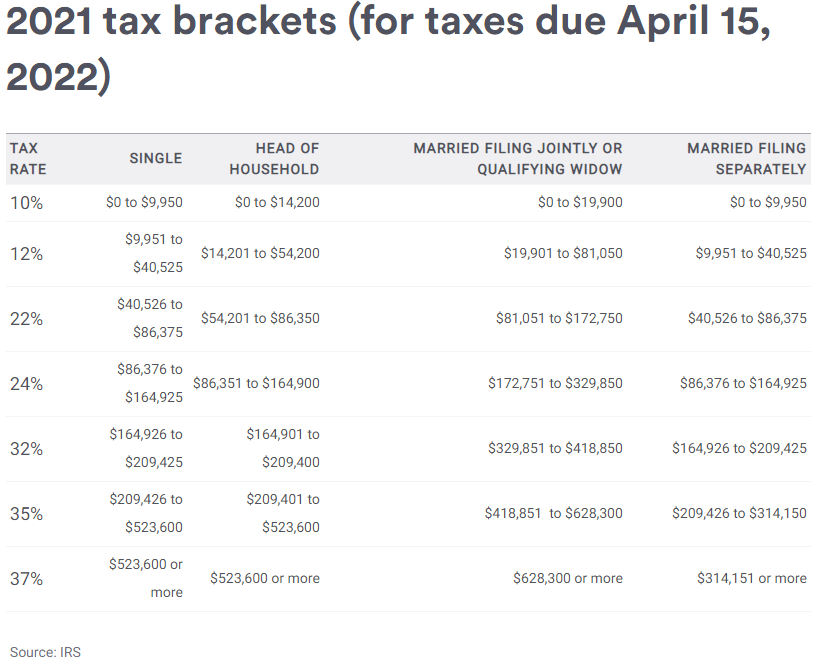

What are the trust tax rates for 2021. The tax rates are below. By comparison a single persons income is taxed at bracket rates of 10 12 22 24 32 35 and 37 with income exceeding 518401 taxed at that 37 rate. Trust tax rates follow similar rates to those paid by individuals but reach those rates at much lower thresholds.

10 12 22 24 32 35 and 37 there is also a zero rate. 97 Zeilen Top federal marginal tax rate for ordinary income applicable for taxable income over 622050 joint and 518400 single in 2020 and 628300 joint and 523600 single in 2021 37 Federal tax rate for long-term capital gains assets held for more than one year and qualified dividends for individuals with taxable income of up to 80000 joint and 40000 single in 2020 and 80800. Taxable Income Tax Rate.

2021 Earned Income Tax Credit The maximum Earned Income Tax Credit in 2021 for single and joint filers is 543 if the filer has no children Table 5. For tax year 2021 the 20 rate applies to amounts above 13250. Tax rates surcharge in the years 1 July 2014 and 1 July 2017.

Trust income tax rates While income tax rates for trusts are similar to those for individuals the thresholds differ significantly and have for a number of years. 0 2600 10. The maximum credit is 3618 for one child 5980 for two children and 6728 for three or more children.

265 plus 24 percent of the excess over 2650. For the 2020 tax year a simple or complex trusts income is taxed at bracket rates of 10 24 35 and 37 with income exceeding 12950 taxed. Dividend tax rate up to 1000 per annum 75.

The 15 rate applies to amounts between the two thresholds. There are still seven 7 tax rates in 2021. 2601 9450 24.

Previously already 47 moves to 49. Capital gains tax rate. What is the Annual Exempt Amount AEA In the normal case the trustees are entitled to an AEA of half that allowed to individuals namely 6150 for tax year 2020 to 2021.

2021 Tax Rates and Exemption Amounts for Estates and. The rate incorporating a Medicare factor ie. Dividend tax rate above.

The Obama-care net investment income tax of 38 started in 2013 and applied to trust income above the 12150 level. The rate remains 40 percent. Over 9550 but not over 13050.

The top marginal rate remains 40 percent. Below are the 2020 tax brackets for trusts that pay their own taxes. Trust Tax Rates.

The 0 rate applies to amounts up to 2700. Jan 22 2021 2021 Gift GST and Trusts Estates Income Tax Rates Gift tax. The gift tax annual.

Inheritance tax transfers into discretionary trusts 20. The exemption level is indexed for inflation and is 117 million in 2021. Heres how those break out by filing status.

Federal Budget 2014-15 measures increased the top marginal tax rate before Medicare by 2 to 47 for a period of 3 years commencing 1 July 2014. Here are the rates and thresholds for 2020. These rates apply to estates and trusts.

The lifetime gift tax exemption for gifts made during 2021 is 117 million increased from 1158 million in 2020. If taxable income is. The gift tax annual exclusion amount remains 15000.

The tax rate schedule for estates and trusts in 2021 is as follows. Trust Tax Rates Table The rates in the table were set in the Tax Cuts and Jobs Act and updated for 2021 cost of living increases. As of 2021 the top tax rate of 37 on ordinary income eg interest nonqualified dividends and business income begins after reaching a threshold of only 13051.

The 0 and 15 rates continue to apply to amounts below certain threshold amounts. 20 28 for residential property. However if the settlor has set up 5 or more trusts the standard rate band for each trust is 200.

The maximum tax rate for long-term capital gains and qualified dividends is 20. The Medicare levy is not included if the trust is. All net unearned income over a threshold amount of 2200 for 2021 is taxed using the brackets and rates of the childs parents 2021 Tax Rate Schedule Standard Deductions Personal Exemption FILING STATUS STANDARD.

The top marginal rate remains 40 percent. 10 percent of taxable income. Because the trusts tax brackets are much more compressed trusts pay more taxes than individual taxpayers.

Transfers in excess of the exemption amounts are subject to gift or estate tax at a flat rate of 40 percent. ESTATES AND TRUSTS 0 2650 0 100 0 2650 9550 265 240 2650 9550 13050 1921 350 9550 13050 3146 370 13050 Kiddie Tax.

Avoid Tax When You Sell Appreciated Assets Charitable Estate Planning Trust

The Generation Skipping Transfer Tax A Quick Guide

What Is The 401 K Tax Rate For Withdrawals Smartasset In 2021 Tech Stocks The Motley Fool Real Estate Investment Trust

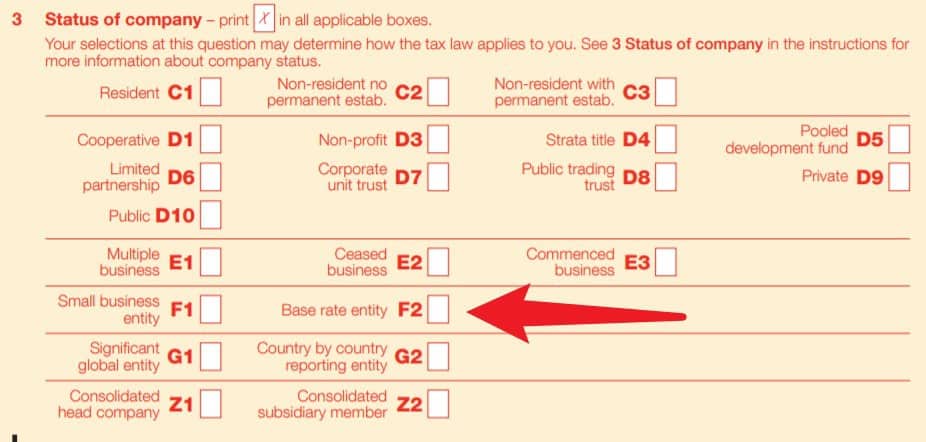

Company Tax Rates 2021 Atotaxrates Info

Ay 2020 21 Income Tax Return Filing Tips Which Itr Form Should You File Income Tax Return Income Tax Return Filing Income Tax

Budget 2020 Affordable Homes Get Tax Holiday Boost Income Tax Tax Payment Tax Attorney

The Generation Skipping Transfer Tax A Quick Guide

Reit Investments Tax Implications In India Real Estate Investment Trust Investing Reit

How Is A Family Trust Taxed In Australia Liston Newton Advisory

Taxation Of Charitable Religious Trust

2020 2021 Federal Income Tax Brackets

Irs Updates Estate And Trust Tax Brackets Exemptions Rates

How Is A Family Trust Taxed In Australia Liston Newton Advisory

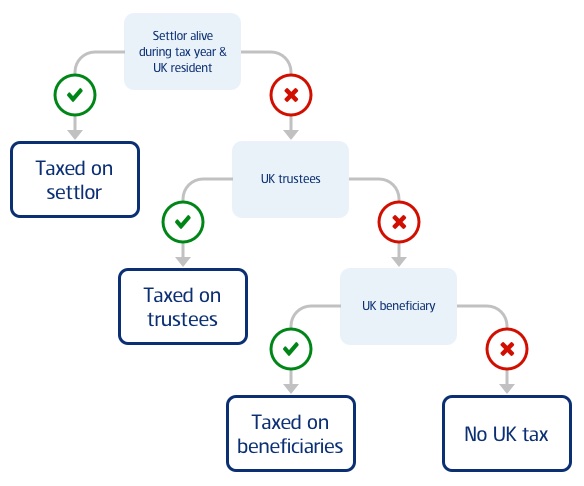

How Do Taxes Work In A Living Trust Vaksman Khalfin Lawyers

Pin By Mohit Jha On The Tax Consultants Finance Relatable Announcement

Income Tax Slab Rates For Fy 2021 22 Budget 2021 Highlights

Fm Tds Itreturns Duedates Taxaudit Gst Taxation Services Audit And Assurance It Consulting Accoun Accounting Services Corporate Business Announcement

Posting Komentar untuk "What Are The Trust Tax Rates For 2021"