What Is The Maryland Unemployment Tax Rate

In this economic time the Division of Unemployment Insurance has implemented an initiative to assist employers that may find themselves in a position of financial hardship. Executive Order Relating to Unemployment Insurance Contributions Frequently Asked Questions FAQs.

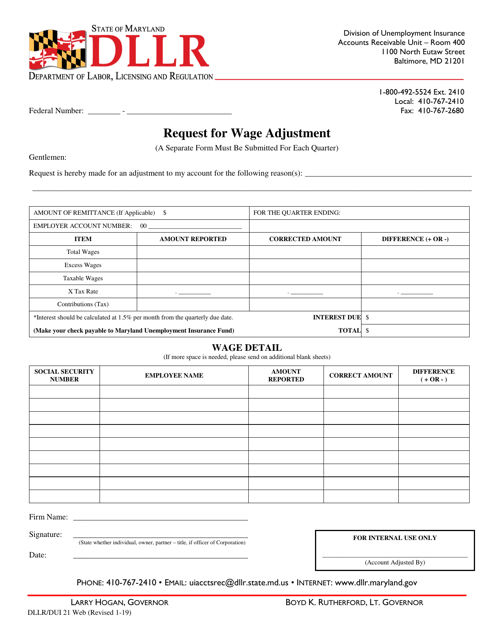

Form Dllr Dui21 Download Printable Pdf Or Fill Online Request For Wage Adjustment Maryland Templateroller

In recent years Maryland has required UI taxes on the first 8500 of each employees wages.

What is the maryland unemployment tax rate. 20 plus 300. Find Your Maryland Tax ID Numbers and Rates. The UI tax rate for new employers is also subject to change.

Note that some states require employees to contribute state unemployment tax. The rate for new employers will be 23. Under the measure SB 496 the computation date July 1 2019 is to be used to determine.

Due to the change in the applicable tax table all employers will see an increase in their tax rate for the calendar year 2021. Unemployment Insurance. Important Information about Marylands Unemployment Insurance 2021 Tax Rates.

Recently the new employer rate has been 26. Maryland Unemployment Insurance Tax Rate The default Unemployment Insurance UI tax rate for new businesses is 26 Once you receive your Maryland Division of Unemployment Insurance Employer Number you can look up your tax rate online. For questions about the Unemployment Insurance Income Tax Subtraction please contact the Comptrollers Taxpayer Services Division at.

What if I have more questions. Marylands 2021 unemployment taxable wage base will also remain at 8500 for 2021 unchanged from 2020. Taxpayers Filing Joint Returns Head of Household or Qualifying WidowsWidowers.

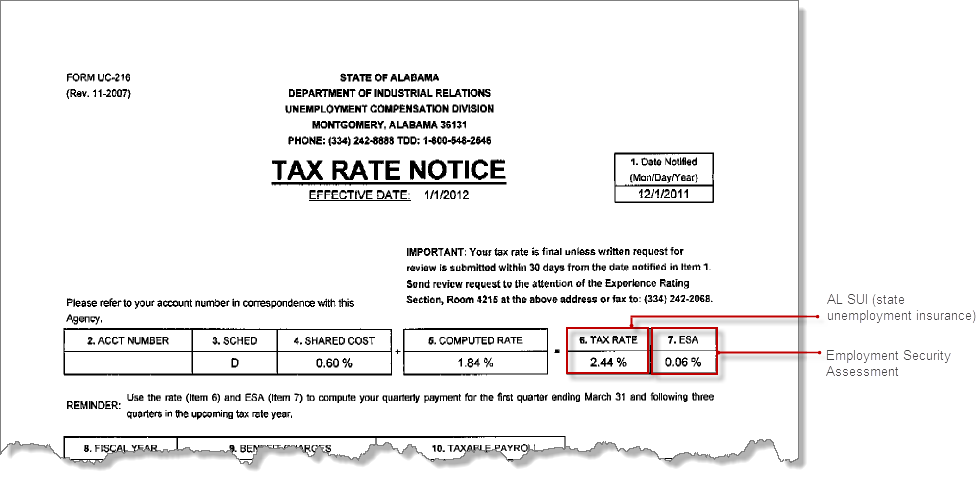

2020 Maryland Income Tax Rates. State Unemployment Tax Rate In Maryland the new employer SUI state unemployment insurance rate is 260 percent on the first 8500 of wages for each employee. Each county in Maryland charges a different rate and they range from 25 to 32.

For questions about the Unemployment Grants please contact the Maryland Department of Labor. To apply for Maryland unemployment benefits click here The most recent figures for Maryland show an unemployment rate of 61. Marylands Unemployment Insurance Payment Plans - Unemployment Insurance Tax Rates for 2021 - Unemployment Insurance.

The States labor force participation rate which is the number of employed and unemployed workers divided by the civilian population number was 654. Unemployment Insurance Contributions - Unemployment Insurance. The range of tax rates for contributory employers in 2021 will be between 22 to 135 which is the Table F tax rate schedule.

These rates of course vary by year. This an employer-only tax. Employers with previous employees may be subject to a different rate.

Marylands Division of Unemployment Insurance has issued a 1099-G tax form to all claimants that received unemployment insurance benefits during the calendar year 2020 from January 1 2020 through December 31 2020 based on the delivery preference chosen in their BEACON portal. 52 rows SUI tax rate by state. Maryland employers are required to pay their quarterly unemployment insurance taxes by the quarterly due date four 4 times each year.

This insurance is funded through taxes that employers are required to. Of the 3122554 civilian workers in Maryland 2932231 were employed and 190323 were unemployed. Maryland State Unemployment Tax For 2021 Marylands Unemployment Insurance Rates range from 22 to 135 and the wage base is 8500 per year.

Since the beginning of the pandemic over 15 billion in benefits have been awarded from the Unemployment Insurance Trust Fund. Pay by E-Check free at the time of the filing through BEACON. Pay by paper check and.

Under Maryland UI law there is a separate rate for new employers that are in the construction industry and headquartered in another state which will be 70 in 2021. Maryland unemployment insurance is a state-managed program that provides financial assistance to help laid-off workers make ends meet until they can find another job. You may claim the subtraction on your 2020 and 2021 Maryland State Tax Return.

In May 2021 Marylands unemployment rate dropped to 61 while the national rate fell to 58. For employers filing in the BEACON system. Here is a list of the non-construction new employer tax rates for each state and Washington DC.

The Maryland Department of Labor Licensing Regulation announced that unemployment tax rate calculations for 2021 are to exclude unemployment benefits claimed during the COVID-19 outbreak in a measure signed February 15 2021 by Governor Larry Hogan. The tax rate for new non-construction employers is to be 260 unchanged from 2020. However that amount known as the taxable wage base could change.

Taxpayers Filing as Single Married Filing Separately Dependent Taxpayers or Fiduciaries.

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Maryland Md Unemployment Benefits News And Updates On Early End To 2021 Extensions Of 300 Weekly Stimulus Pua Peuc And Eb Programs Aving To Invest

Maryland Unemployment Request For Separation Jobs Ecityworks

23 States Change Unemployment Insurance Taxable Wage Base For 2019 501 C Agencies Trust

How To Calculate Unemployment Tax Futa Dummies

Md Unemployment Tax Rates Have Increased For 2021 Bormel Grice Huyett P A

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Historical Maryland Tax Policy Information Ballotpedia

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Https Secure 2 Dllr State Md Us Webtax Images Usermanual Pdf

Unemployment Benefits Comparison By State Fileunemployment Org

Are Employers Responsible For Paying Unemployment Taxes

Maryland Unemployment Insurance Beacon One Stop Overview Of Claimant Portal Youtube

Posting Komentar untuk "What Is The Maryland Unemployment Tax Rate"