What Is Secondary Tax Rate Nz

The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 39 for wages greater than 180000 NZD. Our current tax rates for individuals are as follows.

Pink And Blue Forms Is Gender Based Tax Really As Crazy As It Sounds Tax The Guardian

Tax codes for individuals.

What is secondary tax rate nz. Individuals pay progressive tax rates. Special tax code If you feel youre paying too much or not enough tax you can apply for a special tax code for example if you get NZ Super and other income or if youre. Your marginal tax rate is the tax rate you would pay on one more dollar of taxable income.

He has no student loan so the higher income source uses a primary tax code and the lower source uses the SH tax code. To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. The current secondary tax codes are 21 33 and 39.

If you have more than one source of income you pay secondary tax. What are our tax rates. 0 - 14000 105.

If your annual income from all sources is less than NZ14000 your tax code is SB. The new bottom rate will be added to this range of rates. 48001 - 70000 30.

This means you pay a graduated amount depending on how much income you get. Taxation in New Zealand Income Tax is a gradual tax that has four brackets. The tax rate you pay depends on your total annual income including the retirement lump sum.

Jay has a second job and uses the ST tax code. If your employee is under the wrong tax code theyre going to end up with a big tax bill at the end of the year. If you earn up to 14000 a year youll pay 105 per cent in tax.

Rate of the secondary tax depends on the total amount of income from ALL jobs. Income Tax is calculated at different rates ranging from 105 to 33 for individuals depending on how much you earn. What are the tax rates in New Zealand.

In the last four weeks Jay has earned 2695 from her second job. Income between 14000 and 48000 is taxed at a rate of 175 per cent. Her secondary employer wants to pay her a one-off bonus of 40000.

You take on a second job earning 5000 per year. New Zealands Best PAYE Calculator. Rate of the secondary tax depends on the total amount of income from ALL jobs.

The amount of secondary tax you pay depends on the secondary tax code. Such as New Zealand superannuitants and beneficiaries. The Taxation Annual Rates for 2018-19 Modernising Tax Administration and Remedial Matters Bill passed its third reading and will come into effect on 1 April.

Tax rates are used to work out how much tax you need to pay on your total income for the year from all sources. If your employer gives you a sum of money when you retire from your job you pay tax on it. We promised to eliminate unnecessary secondary tax for workers with more than one job.

The table below will automatically display your gross pay taxable amount PAYE tax ACC KiwiSaver and student loan repayments on annual monthly weekly and daily basis. The taxes are collected at a national level by the Inland Revenue Department IRD on behalf of the Government of New Zealand. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

Ensure that your workers notify you whenever their circumstances change. Choosing the right tax rate means youre less likely to have a tax bill at the end of the tax year. A 125 secondary tax code is being introduced to cater for low income people that have a second job.

Our PAYE calculator shows you in seconds. We have a progressive tax system so that individuals pay a higher rate of tax as they earn more. If your employee is under the wrong tax code theyre going to end up with a big tax bill at the end of the year.

70001 33. You can choose to have tax deducted at any rate - from 10 to 100. This helps you pay the right amount of tax so you do not get a bill at the end of the year.

New Zealands tax and PAYE system is designed so that employees are taxed at the correct rate. The Inland Revenue Department IRD is responsible for collecting taxes in New Zealand. 14001 - 48000 175.

For example if you earn 75000 and your wages went up for every additional 1 you earn the tax rate of 33 is applied. As a working holidaymaker isnt likely to have a New Zealand student loan these are the likely secondary income tax codes. You will pay 105 tax on your income to 14000 then 175 on your income from 14001 to.

More than 70000 your secondary tax code is ST and your NZ Super will be taxed at 33. If you choose to or must have tax deducted from your pay fill out the IR330C and give it to your payer. You do not pay any ACC earners levy on the lump sum.

Following steps one to five Jays employer can. Calculate your take home pay from hourly wage or salary. Your secondary income tax code is determined by how much your combined annual income is and whether you are paying off a student loan.

We are delivering on that promise says Revenue Minister Stuart Nash. By doing so your tax bracket will be confirmed.

The World S Most Competitive Tax Systems Infographic Infographic Economic Trends Tax

Net Household Savings Rate In Selected Countries 2019 Saving Rates Savings Household

5 Amazing Features You Should Enjoy With A Study Loan In India Post Secondary Education Study Education

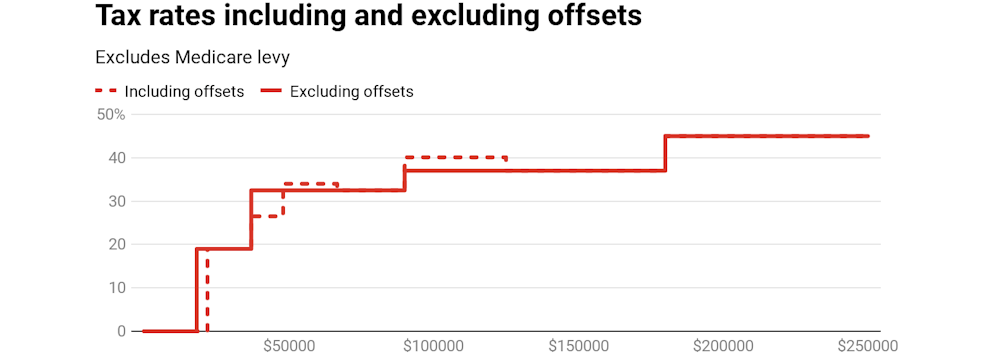

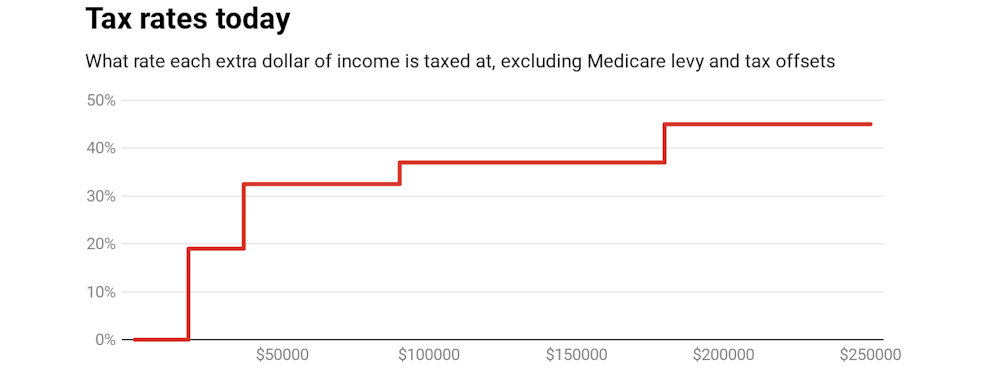

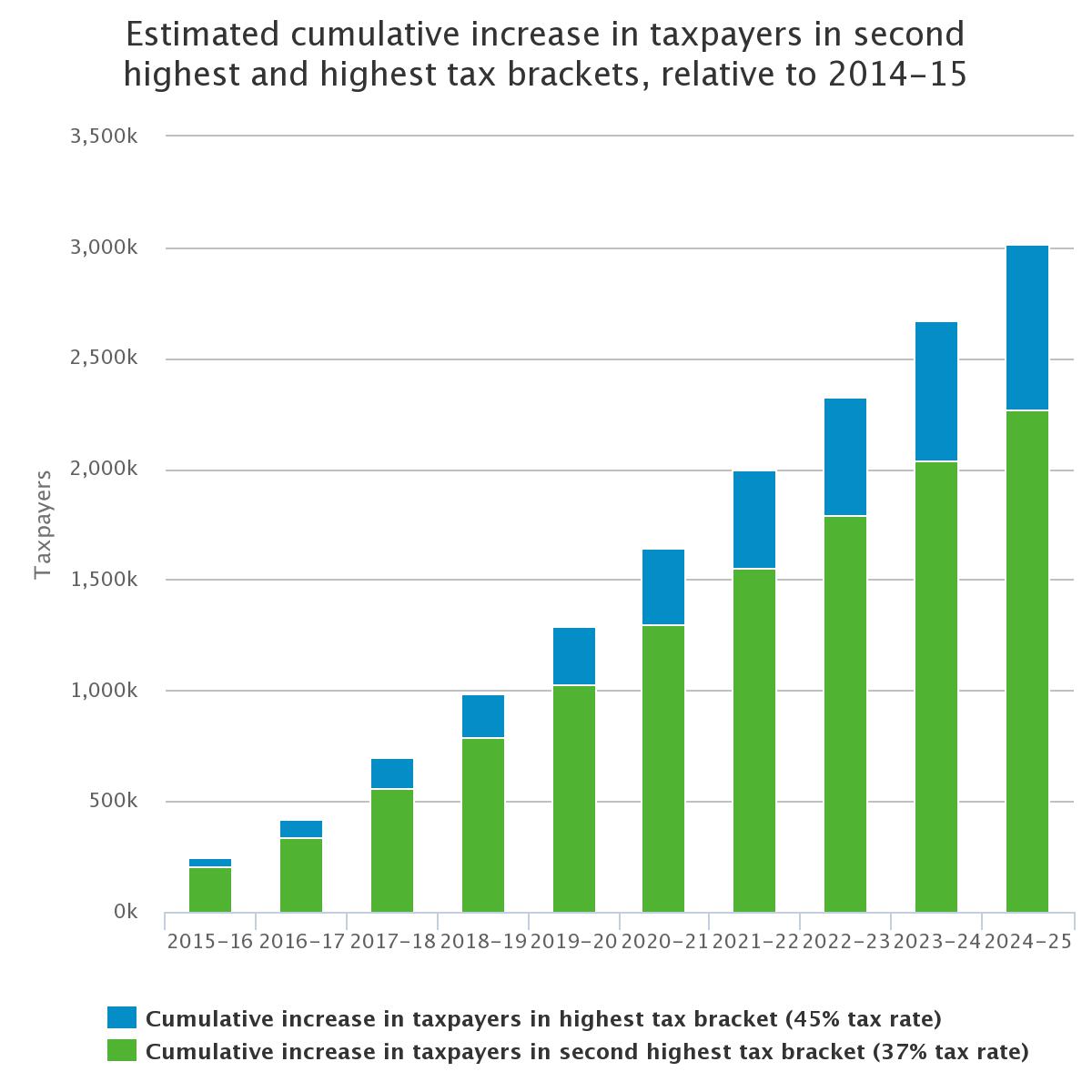

The Budget S Dirty Secret Is The Hikes In Tax Rates You Re Not Meant To Know About

How Much Tax Do I Pay On My Cryptocurrency Profits Cryptocurrency Tax Nz

New Zealand Tax Codes And Rates Your Refund Nz

Pdf Does Australia Have A Good Income Tax System

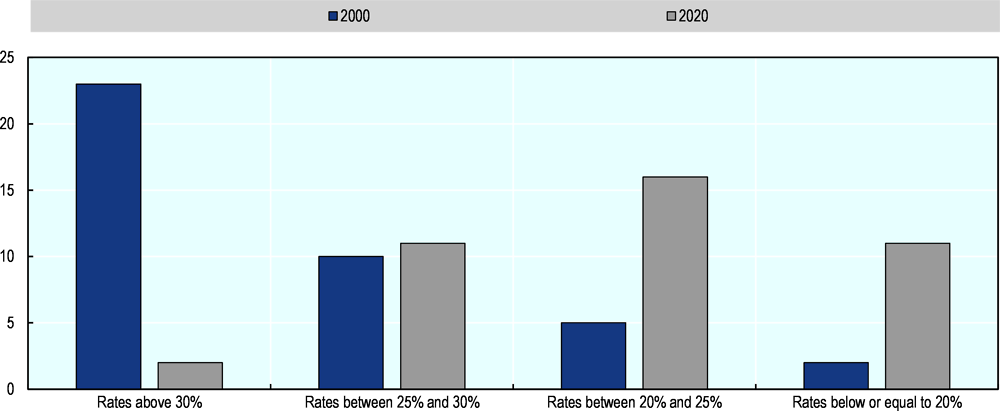

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Tax Reforms Before The Covid 19 Crisis Tax Policy Reforms 2020 Oecd And Selected Partner Economies Oecd Ilibrary

Funding Program Requirements Ssn Personal Credit Requirements Personal Credit Is Recommended Because This Guarantee Public Records Financial Services Person

The Budget S Dirty Secret Is The Hikes In Tax Rates You Re Not Meant To Know About

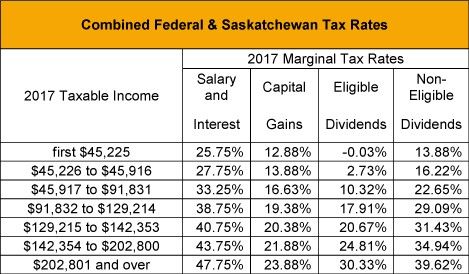

Saskatchewan 2017 Budget Tax Canada

How To Calculate Foreigner S Income Tax In China China Admissions

Posting Komentar untuk "What Is Secondary Tax Rate Nz"