Withholding Tax Rates Jamaica

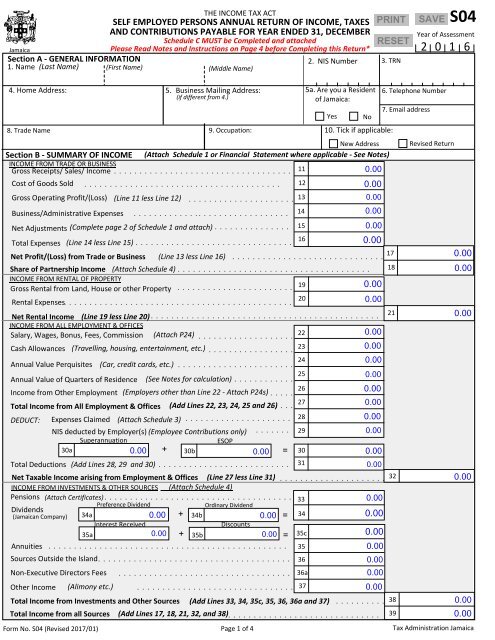

Payroll Taxes and Contribution Rates - EmployeeEmployer. I ncome Tax for Individuals Businesses Income Tax Rates Thresholds and Exemption 2003-2020 Notes and Instructions for completion of Returns of Income Tax Payable IT01 - IT05.

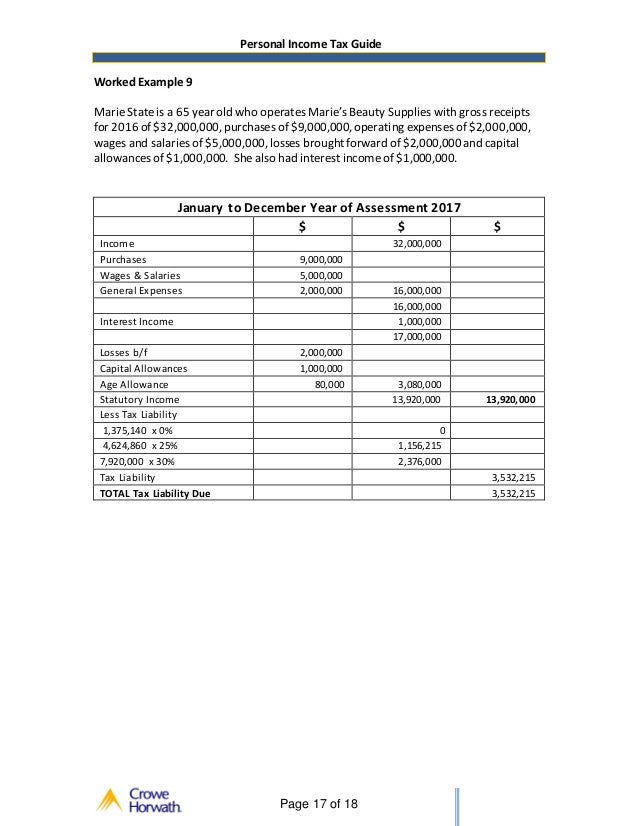

Jamaica Personal Income Tax Guide 2016 Edition 1

A 275 rate applies to companies with aggregate annual turnover of less than AUD50million for income years commencing on or after 1 July 2018.

Withholding tax rates jamaica. Income Tax and Pensioners. 132 Non-Resident Withholding Tax Rates for Treaty Countries1 Country2 Interest3 Dividends4 Royalties5 Pensions Annuities6 Algeria 15 15 015 1525 Argentina7 125 1015 351015 1525 Armenia 10 515 10 1525 Australia 10 515 10 1525 Austria 10 515 010 25 Azerbaijan 10 1015 510 25 Bangladesh 15 15 10 1525 Barbados 15 15 010 1525 Belgium8 10 515 010 25. Employers with part-time workers are reminded to withhold tax at 25 of the gross amount and to advise these workers with no other employment to contact the Tax Administration Jamaica TAJ.

Value added taxgoods and services tax. Corporate tax rates. Withholding Tax Certificate Upload Template - MS Excel File.

Tax is withheld at the rate of 15 where a dividend is paid by a company resident in Jamaica to a resident individual shareholder regardless of shareholding. 15 10 30 unless rates. The withholding tax will be phased in.

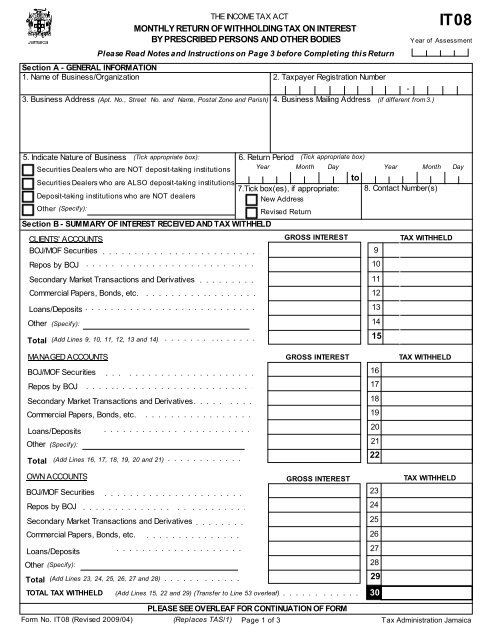

One of a suite of free online calculators provided by the team at iCalculator. You are viewing the income tax rates thresholds and allowances for the 2019 Tax Year in Jamaica. IT08 - Prescribes Persons and other Bodies.

Individuals and companies by a prescribed person. 71 rijen Rates Fees. Prescribed persons include commercial banks and other financial institutions.

Tax is deducted from interest paid to Jamaican residents if payment is made by a prescribed person. 2020 Tax Rates Thresholds and Allowance for Individuals Companies Trusts and Small Business Corporations SBC in Jamaica. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax.

You are viewing the income tax rates thresholds and allowances for the 2020 Tax Year in Jamaica. INTRODUCTION tax but does not do so can face a penalty of as much as fifty percent of the tax that should. See how we can help improve your knowledge of Math Physics Tax Engineering and more.

IT10 - This form is to be completed and submitted with supporting documents by any person designated under the Income Tax Act as a Tax Withholding Agent for Specified Sevices. IT13 - This form is to be completed by any person who is. The Deloitte International Tax Source DITS is an online database featuring tax rates and information for more than 60 jurisdictions worldwide and country tax highlights for more than 130 jurisdictions.

On 14 May 2015 the Jamaican tax authorities announced that a 3 withholding tax on certain service payments will be introduced from 1 June 2015. 15 10 0 but VAT 19 unless exempted. Jamaica Introduces Withholding Tax Requirements for Certain Service Payments.

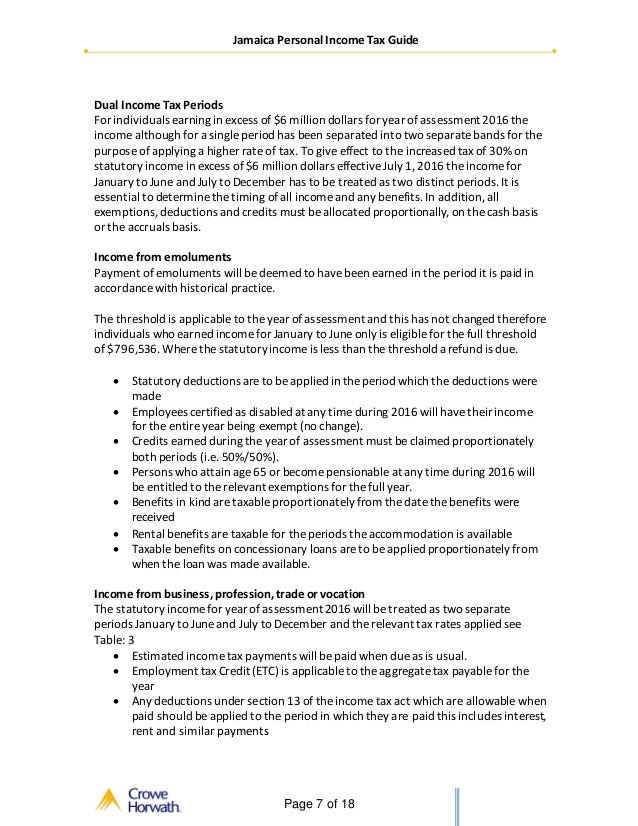

This information is only a Guide and is not a substitute for the Income Tax Act and other relevant Legislation. Review the 2020 Jamaica income tax rates and thresholds to allow calculation of salary after tax in 2020 when factoring in health insurance contributions pension contributions and other salary taxes in Jamaica. An annual tax-free threshold of JMD 15 million is available to Jamaican.

Jamaica 3333 Tunisia 10 Japan 2042 Turkey 15 Jordan 0 Turkey REITs 0. See also note 4. Provided the income is not effectively connected with a PE in Jamaica.

DITS includes current rates for corporate income tax. 6Johannesburg Stock Exchange listings of UK-domiciled companies have a 20 withholding tax rate applied unless otherwise announced by the companies. If you are looking for an alternative tax.

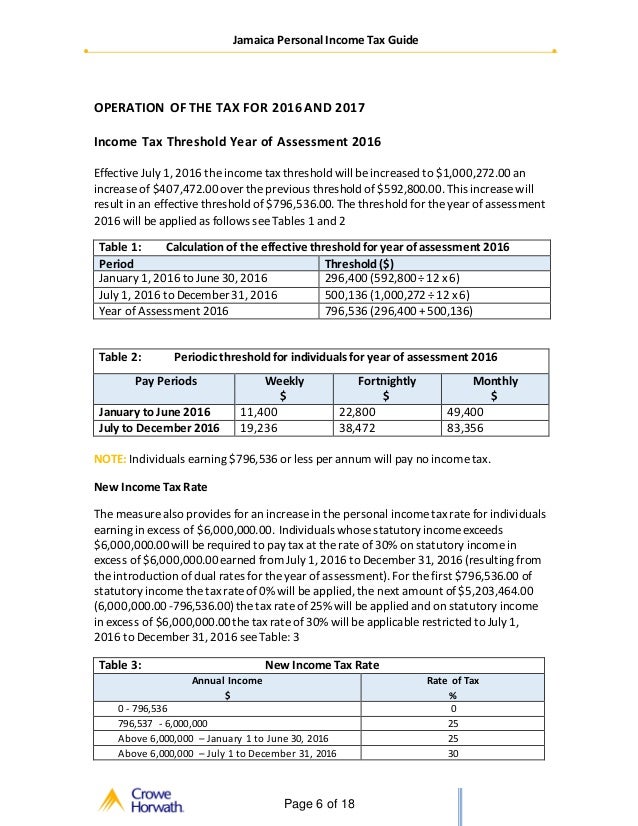

Income Tax and Non Residents. Withholding tax on dividends interest and royalties under tax treaties. Chargeable income derived in excess of JMD 6 million per annum is subject to income tax at a rate of 30.

Capital Allowances Electrical Hotel Income Tax Rates Thresholds and. The lower rate is subject to a passive income test. The corporate tax rate is 30.

If you are looking for an alternative tax year please select one below. Income Tax and School Leavers. The protocol introduces an exemption from withholding tax for certain dividends received by organizations that operate exclusively to administer benefits under recognized pension plans.

Tive in mind Tax Administration Jamaica TAJ and the Ministry of Finance have introduced a Withholding Tax on Specified Services which took effect on May 1 2015. The corporate income tax rate applies to both resident and non-resident companies. DividendsThe 5 withholding tax rate applies if the recipient of the dividend is a company that controls directly or indirectly at least 10 of the voting power of the payer.

The interest is taxable at applicable rates 2530 with a credit for withholding tax WHT borne. Income tax at the rate of 25 is deducted at source from gross interest paid to Jamaican residents ie. 2017 - 2018 Tax Tables 2018 - 2019 Tax Tables 2020 - 2021 Tax Tables 2021 - 2022 Tax Tables.

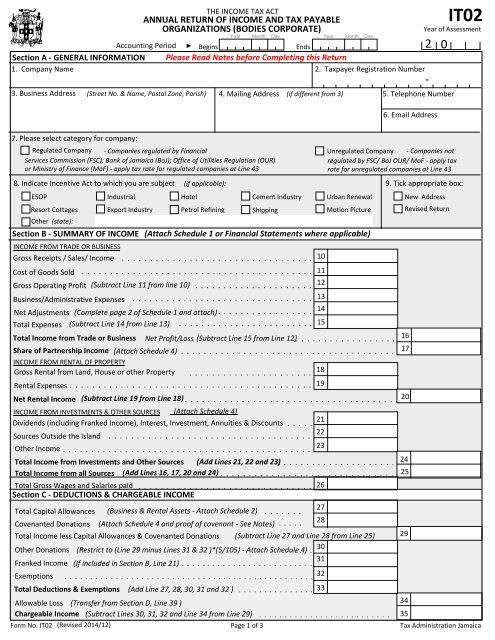

Form It02 Tax Administration Jamaica

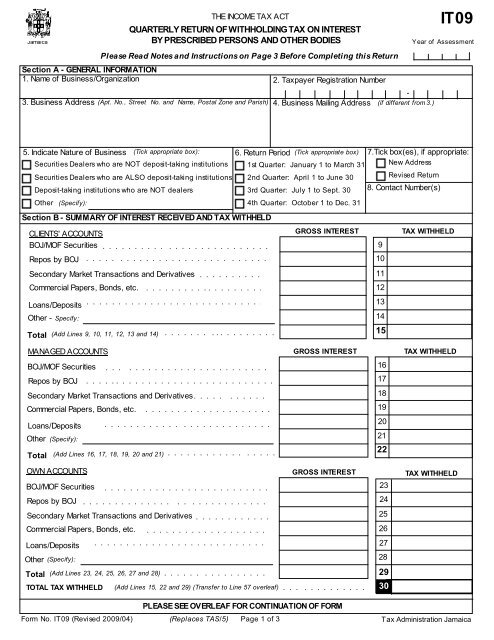

It09 Tax Administration Jamaica Taj

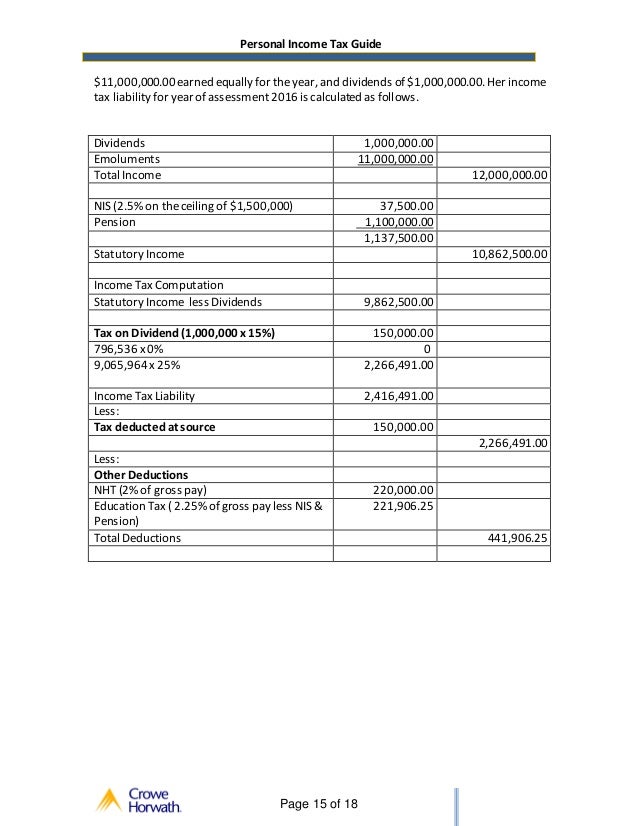

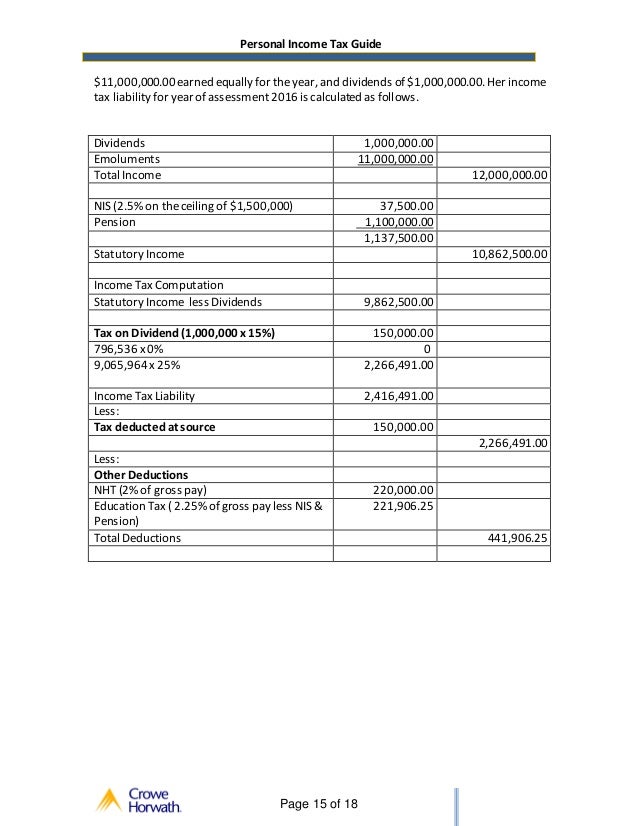

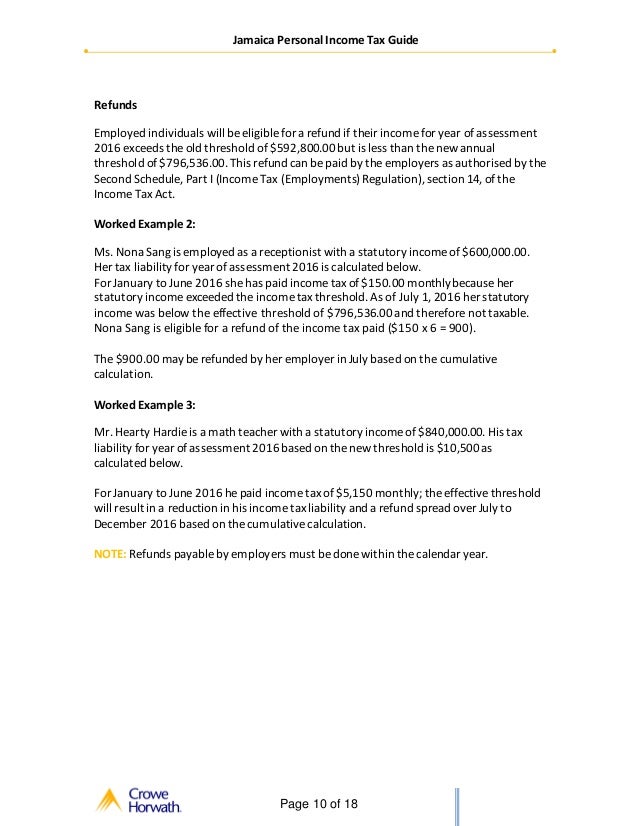

Jamaica Personal Income Tax Guide 2016 Edition 1

Jamaica Personal Income Tax Guide 2016 Edition 1

Jamaica International Tax Treaties Compliance Freeman Law

Jamaica Personal Income Tax Guide 2016 Edition 1

Jamaica Personal Income Tax Guide 2016 Edition 1

Forms It01 Tax Administration Jamaica Taj

Https Www Jstor Org Stable 4191696

Pdf Payroll Taxes And Contributions

It08 Tax Administration Jamaica Taj

Jamaica Personal Income Tax Guide 2016 Edition 1

Germany Taxing Wages 2021 Oecd Ilibrary

Https Docsonline Wto Org Dol2fe Pages Ss Directdoc Aspx Filename Q Wt Tpr S42 4 Pdf

Posting Komentar untuk "Withholding Tax Rates Jamaica"