Employment Tax Rates Arizona

Return to UI Tax Home Page. This is of course separate from and additional to whatever they pay in income tax.

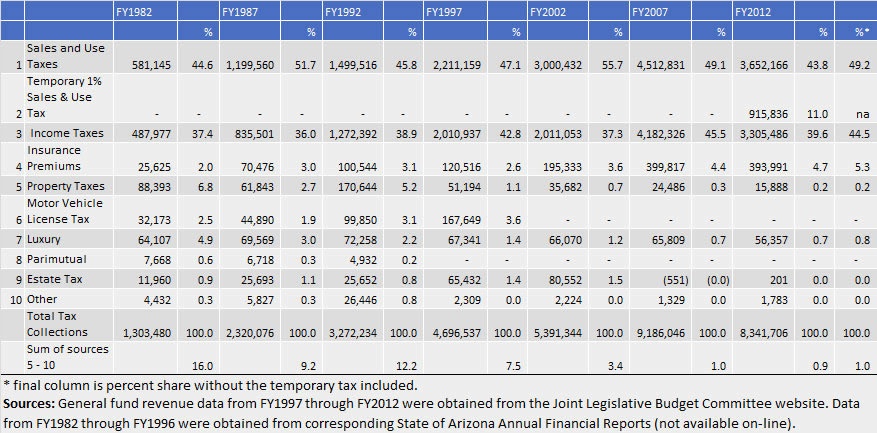

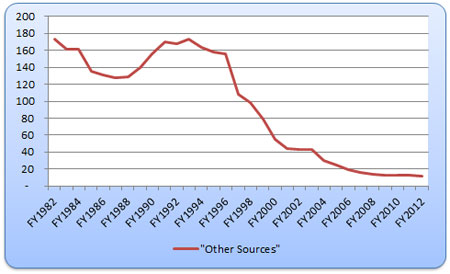

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

Each marginal rate only applies to earnings within the applicable marginal tax bracket.

Employment tax rates arizona. See Experience Rating Method. Employers and other entities that pay Arizona income tax withheld on an annual basis must File Arizona Form A1-APR to pay the income tax withheld and to reconcile their payments for the year. Employer Account Number - Password Password ChangeProblem.

The Arizona Department of Economic Security announced that employers should expect unemployment tax rates to be higher in 2021 than in 2020. If the new employee fails to complete Arizona Form A-4 within 5 days of hire the employer must withhold Arizona income tax at the rate of 27 until the. Arizona State Tax Commission 411 US.

Adobe Acrobat Reader 10 or later is recommended. In Arizona different tax brackets are applicable to different filing types. Web site for detailed information.

Our calculator has recently been updated in order to include both the latest Federal Tax Rates along with the latest State Tax Rates. Of course youll have federal taxes deducted from each paycheck along with your state taxes. In Phoenix Arizona self-employed business owners pay a self-employment tax rate of 153.

The self-employment tax rate of 153 plus your ordinary income tax rate which depends on your taxable income and filing status. Arizona Unemployment Tax and Wage System. The FUTA tax rate was 62 until July 1 2011 when it decreased to 60.

Visit the Arizona Department of Revenue. The rates range from 259 to 450 with higher brackets paying higher rates. The 153 self employed SE Tax is to pay both the employer part and employee part of Social Security and Medicare.

Each state sets its own withholding tax rates such as Arizona which withholds between 008 and 51 depending on the number of deductions an employee is eligible for. Arizona has a progressive tax system with varying rates depending on your income level. There are no local income taxes.

The Arizona anti-SUTA dumping law mirrors the federal SUTA Dumping Prevention Act. Self Employment tax Scheduled SE is generated if a person has 400 or more of net profit from self-employment on Schedule C. The annual total SUI tax rate is based on a range of rates.

Like the federal income tax Arizonas state income tax has rates based on income brackets. Submit federal Forms W-2 and W-2c reporting Arizona wages andor Arizona income tax. So you get social security.

Most states have an income tax. Arizona Form A1-APR is due January 31 of the year following the calendar year for which Arizona income tax was withheld. Employment Taxes - Arizona Withholding Tax.

They tax a portion of an employees income based on withholding tables. The annual FUTA tax you pay is used to fund the administrative costs of the Unemployment Insurance program while your Arizona state unemployment tax is used solely for the payment of benefits to unemployed workers. You are able to use our Arizona State Tax Calculator in to calculate your total tax costs in the tax year 202122.

Click here to install or upgrade. Arizona has four marginal tax brackets ranging from 259 the lowest Arizona tax bracket to 45 the highest Arizona tax bracket. See SUI Taxable Wages.

You pay 153 for SE tax on 9235 of your Net Profit greater than 400. All new employees subject to Arizona income tax withholding must complete Arizona Form A-4 within five days of employment. There are four tax brackets that range from 259 and 450.

A tribal enrolled Native American employee who lives and is employed within an Indian reservation established for that tribe and thereby claims that no Arizona state income tax liabilities exist based on the decision by the Supreme Court of the United States in McClanahan vs. Internet Explorer 7 or later is recommended. All wages salaries bonuses or other compensation paid for services performed in Arizona are subject to state income tax withholding with exceptions.

Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a. Effective January 1 2021 unemployment tax rates will range from 008 to 1030 for positive-rated employers and from 1087 to 2060 for negative-rated employers. Under state law employers that knowingly attempt to manipulate businesses to.

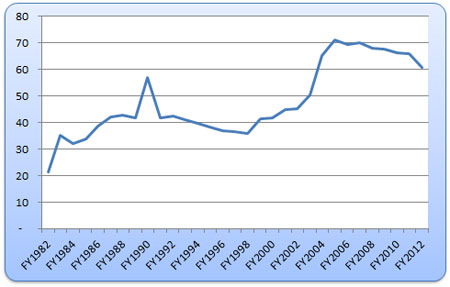

Contribution rates in Arizona are determined based on the reserve ratio method of experience rating. Wage Upload File Format Instructions. 1257 1973 may use this form to claim exemption from withholding.

How Much Should I Set Aside For Taxes 1099

Arizona Tax Forms 2020 Printable State Az Form 140 And Az Form 140 Instructions

Pros And Cons Of Moving From California To Arizona

What S The Arizona Tax Rate Credit Karma Tax

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

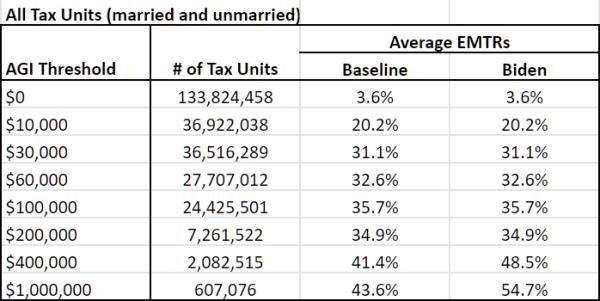

National And State By State Estimates Of President Biden S Campaign Proposals For Revenue Itep

Arizona Sales And Use Tax Rates Lookup By City Zip2tax Llc

States With Highest And Lowest Sales Tax Rates

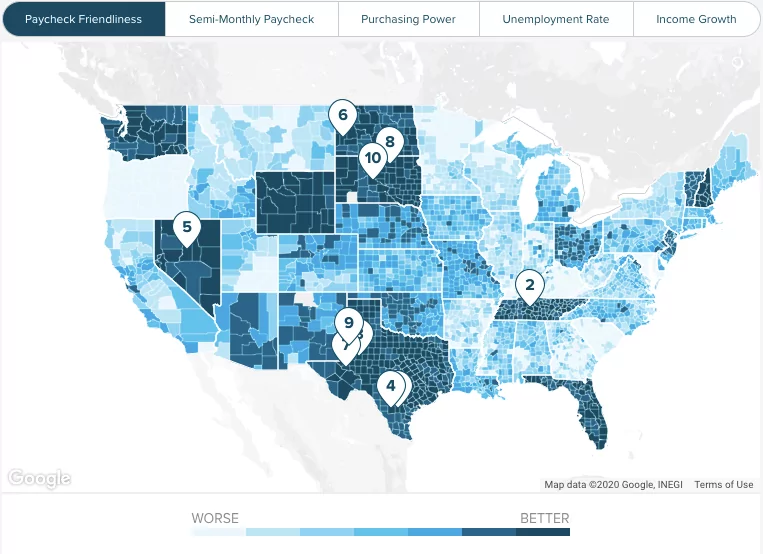

Paycheck Calculator Take Home Pay Calculator

Https Www Dcms Uscg Mil Portals 10 Cg 1 Ppc Guides Gp Spo Deductions State Tax Withholding Exceptions Pdf

Arizona General Fund Tax Revenues An Historical Perspective Arizona S Economy

State W 4 Form Detailed Withholding Forms By State Chart

2021 Federal State Payroll Tax Rates For Employers

Arizona Paycheck Calculator Smartasset

Joe Biden Tax Calculator How Democrat Candidate S Plan Will Affect You

Posting Komentar untuk "Employment Tax Rates Arizona"