How Much Is Paye Tax Nz

We have a progressive tax system so that individuals pay a higher rate of tax as they earn more. This rate applies for each boarder or home-stay student you have up to a maximum of 4.

How Wealthy Countries Tax Their Citizens Social Media Business Infographic Managing Finances

Create budgets savings goals and plan for retirement.

How much is paye tax nz. From 1 April 2021. All of New Zealand is at Alert Level 4 from 1159pm on Tuesday 17 August 2021. For each dollar of income Tax rate.

The taxes are collected at a national level by the Inland Revenue Department IRD on. 1050 1750 30 33 and 39. If youre earning any sort of income you have to pay tax.

Our PAYE calculator shows you in seconds. Its your responsibility to pay tax on. Contract work or casual work including cash jobs or under the table payments.

Self-employment and tax external site link In some cases your employer deducts tax from your contract or casual income payments. Extra pays like redundancy or special bonuses. Our current tax rates for individuals are as follows.

Calculate your take-home pay KiwiSaver Secondary Income Tax Tax Code net worth. Its useful for weekly fortnightly four weekly or monthly pays but it will not allow for. These are the rates for taxes due in April 2022.

0 - 14000 105. The results presented here are the work of the Treasury not Stats NZ. All New Zealanders should stay home to save lives.

It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC. Your tax bracket depends on your total taxable income. Employers and employees can use this calculator to work out how much PAYE should be withheld from wages.

To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. All Income tax dates. New Zealands Best PAYE Calculator.

Income from being self-employed. Work out PAYE deductions from salary or wages. They help your employer or payer work out how much tax to deduct before they pay you.

Over 14000 and up to 48000. New Zealand has progressive or gradual tax rates. How to use the New Zealand Income Tax Calculator.

Tax codes are different from tax rates. Tax relief and income assistance is available to people affected by the downturn in business due to the COVID-19. Tax codes only apply to individuals.

Tax codes and tax rates for individuals. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. The income tax rates for PAYE earners and self-employed individuals are exactly the same.

KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE. Tax rates are used to work out how much tax you need to pay. Income Tax is a gradual tax that has four brackets.

Personal income tax scale 105c per 1 on annual taxable income up to 14000. For the year ending 31st March 2018 if you have one or two boarders the standard cost is 266 each week for each boarder. If you have three or four boarders the standard cost remains the same for the first two and 218 each for the third and fourth boarders.

Calculate your take home pay from hourly wage or salary. Just enter your gross annual salary into the box and click Calculate - then well show you a breakdown of how much PAYE tax youll pay and what your kiwisaver and student loan contributions will be. Figures may not sum to totals due to rounding.

How to pay tax. The amount of tax you pay depends on your total income for the tax year. The rate for the 2020-2021 income year is 194.

To work out how much money to deduct Inland Revenue has a calculator to help. Important - the calculator below uses the 2021-22 rates which is what you need to understand your tax obligations. IRD calculate your income tax rate by summing the total of all your sources of income including PAYESalary jobs together with self-employed income investment income etc and then applying their standard tax rates.

You can vary the kiwisaver contribution rate to see the effect on your net pay. We usually set the rate in May for the tax year that ended on 31 March. Wondering how much difference that pay rise or new job would make.

The rates increase as your income increases. If you have 5 or more boarders or home-stay students you cannot use the standard cost method. The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 39 for wages greater than 180000 NZD.

Holiday pay that is paid as a lump sum. GST - If you earn over 60000 per. PAYE calculator external link Inland Revenue.

Generally if you provide accommodation or an accommodation allowance to an employee its taxable via PAYE but tax isnt paid on all accommodation allowances. If you pay out holiday pay at 8 of annual income use Inland Revenues tax on holiday pay calculator external link. New Zealands tax and PAYE system is designed so that employees are taxed at the correct rate.

COVID-19 Inland Revenue. The amount of PAYE you deduct depends on the employees tax code and how much they earn. These payments are called schedular payments.

It also will not include any tax youve already paid through your salary or wages or any ACC earners levy you may need to pay. The table below will automatically display your gross pay. Make sure youre paying the right amount so you do not end up with a large bill.

There are five PAYE tax brackets for the 2021-2022 tax year.

Without Hiring A Trustworthy Company That Offers Accountancy Services In Auckland It Is Very Difficult To Run A Com Tax Accountant Tax Refund Tax Preparation

Hmrc P60 Digital Copy National Insurance Number Number Words Tax Credits

Get Ready For Health And Safety Law Changes Business Plan Template Free Business Plan Template Health And Safety

New Zealand Invoice Template Excel With Plus Together As Well And With Invoice Template New Zealand Invoice Template Invoice Template Word Printable Invoice

Pin On Tips For British Expats

The Government Wants To Tax You For Items You Sell On Ebay Ebay Government How To Plan

Contacts Cash4u Fast Cash Loans Fast Cash Cash Loans

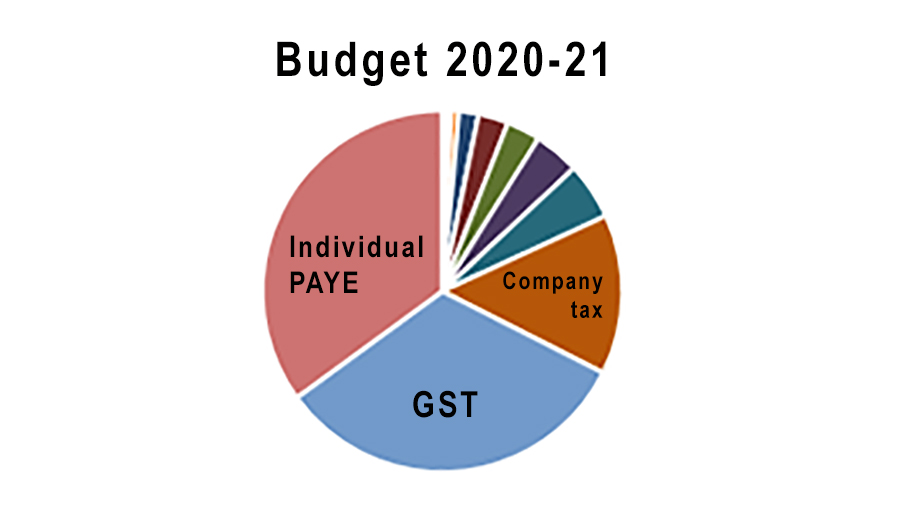

Budget 2020 Summary Of All Tax Collections Interest Co Nz

A Retirement Blog Tax Return Deadline Blog Taxes Tax Return Deadline Tax Return

Autumn Statement From Inland Revenue Means More Austerity And Higher Taxes On Middle Class And Wealthy Pensions Uk Pension Financial Advice

Nz Tax Return Preparation Bookkeeping Outsourcing Tax Return

Pin On Murray Sharma Associates Limited Tax Agent Nz

Tax Havens Tax Evasion Cayman Islands Bahamas Gibraltar Biggest Bank Fraud Case Cayman Islands Flag New Zealand Flag Cayman Islands

Qrops Nz Changes 2016 17 For Brits Moving To Nz Uk Pension Pensions New Zealand

Pin On Tips For British Expats

Shelf Pty Available For Sale 0723711083 Stanger Gumtree South Africa 145755324 Income Tax Return Income Tax Tax

South Africa Tax Calculator 2021 2022 How To Use Our Free Tax Calculator To Determine Take Home Pay Youtube

Posting Komentar untuk "How Much Is Paye Tax Nz"