How Much Is Withholding Tax In Nigeria

It is direct because it is deducted from your earnings. Some companies are 31 December due to.

Tax Business Matters Nigeria May 2020

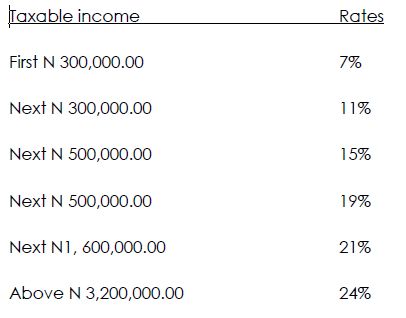

Nigerian tax rates vary according to the amount of income you earn and you pay different rates on different portions of your income.

How much is withholding tax in nigeria. The rates of withholding tax in Nigeria varies among individuals companies and corporate bodies. Note that companies are required to submit in electronic form a schedule of all their suppliers for the month showing the tax identification number TIN address of the suppliers the nature of the transaction WHT deducted and invoice number. Airland transport service using its own equipmentfacilities the.

Social security contributions in Nigeria cover benefits for retirement disability sickness and maternity. Where a person rents or hires propertyservices from another WHT at the rate of 10 will apply. Income tax rates range from 7 to 24.

Nigeria is liable to tax in Nigeria the place of payment not withstanding. It has been 6 months of demanding work for most Auditors and Accountants. Where a person rents or hires propertyservices from another withholding tax at the rate of 10 will apply.

But where a person provides services to another for eg. In conclusion returns for WHT are filed 21 days after the duty to deduct must have arisen from companies. As a general rule income on a property rent hire or lease payments or rights royalties situated in Nigeria is liable to tax in Nigeria the place of payment notwithstanding.

As a general rule income on a property rent hire or lease payments or rights royalties situated in Nigeria is liable to tax in Nigeria. What rate should be applied for WHT. 5 5 or 10 depending on the the type of transaction and the tax authority responsible for the collection of the tax Federal Inland Revenue.

WITHHOLDING TAX COLLECTING AGENTS IN NIGERIA Withholding tax is been collected by all organisations or bodies making payments to. Please not that people earning the same salary of N12m can actually pay different amount of taxes depending on how well the accounts. The indirect taxes are taxes like VAT Value Added Tax and WHT Withholding Taxes.

The prevalent tax rate on commission is 10 WHT but if the principal is a non-resident any sales proceed from the arrangement will attract 50 Wht All types of contract activities and arrangements other than. Employees contribute a minimum of 8 of their salary while employers must contribute around 10 to the various benefit schemes. Desire to be aligned to Government fiscal year or personal decisions.

As a general rule income on a property rent hire or lease payments or rights royalties situated in Nigeria is liable to tax in Nigeria the place of payment not withstanding. Most Companies in Nigeria are 31 December financial year-end. Based on the above your total tax is N1084812522000 130 48125 per annum.

For those that are mandated to have their financial year-end as 31. What is the contractual value for. Where a Where a person rents or hires propertyservices from another WHT at the rate of 10 will.

The educational charge is pegged at 2 percent of the assessable profit while a 10 percent withholding tax. The indirect taxes are not deducted from your earnings rather you pay them when you purchase goods and services like shopping at shoprite or paying for the services of a Lawyer. It should not be believed that withholding tax is an additional cost of the contract but an advancement of tax.

The penalty for failure to deduct or remit tax is 10 of the amount not deductedremitted. Commission is subjected to withholding tax in Nigeria. Bringing some practicality to withholding tax in Nigeria.

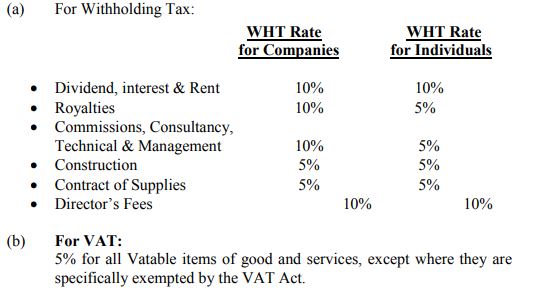

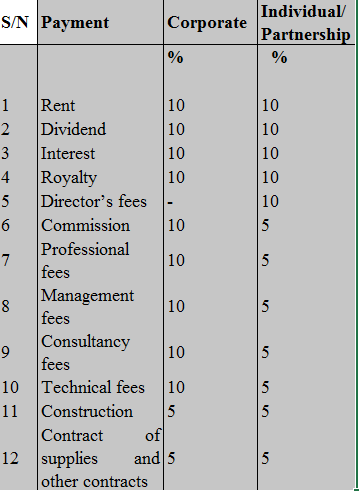

WITHHOLDING TAX RATE TABLE - NIGERIA Companies Individuals Divident Interest Rent 10 10 Royalties 15 15 Commissions Consultancy Professional Technical Management Fees 10 5 Building Construction related activities 5 5 Contract of Supplies Agency arrangements 5 5 Director Fees 10 5. Where a person rents or hires propertyservices from another WHT at the rate of 10 will apply. What to Should be deducted.

Regulatory requirements eg Banks Insurers Stockbrokers etc. In most cases however the Withholding Tax rates for individuals is anythin g from 5 percent to 10 percent while for companies it is between 25 percent to 10 percent. Per Month it is N1087343.

Direct taxes are basically under what is called Personal Income Tax. Withholding tax is an advance payment of tax deductible at the point of payment or when credit is effected whichever comes before the other for the activities or services effected. Interest is income from investments of every kind.

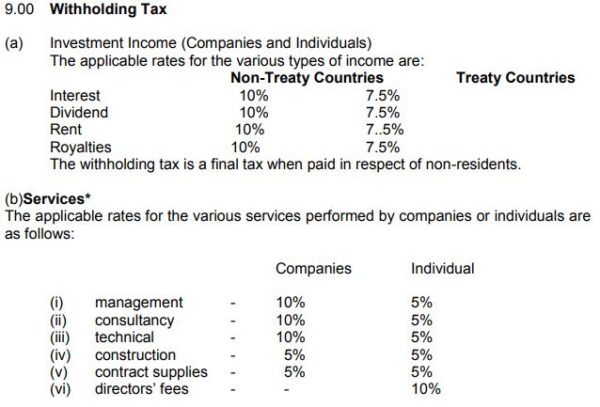

Nigerian Companies pay 30 percent of their worldwide profit while foreign companies pay 30 percent of only the profit made in Nigeria. However failure to deduct or remit WHT attracts 10 of the amount not deducted or remitted. Nigeria has double taxation treaty agreements on withholding tax with a few countries with the under listed applicable rates.

Understanding Vat Amp Withholding Tax In Nigeria

Firs Says Wht And Vat Are Due On All Payments In Cash Or Kind To Agents Dealers Distributors And Retailers By Principal Companies Tax Nigeria

Withholding Tax In Nigeria Rates And Its Application

Withhoding Tax Wht And Value Added Tax Vat Collection Aziza Goodnews

Tax System In Nigeria For The Purpose Of This By Accounteer Accounteer

Transaction Taxes In Nigeria Key Issues Ppt Download

Overview Of Withholding Tax In Nigeria

What You Need To Know About Witholding Tax Ince Consulting Ltd

The Taxation Of Non Residents In Nigeria Aziza Nigeria

Withholding Tax Beginners Guide For Small Businesses In Nigeria Nairametrics

Pdf Withholding Tax And Corporate Financial Performance Evidence From The Construction Industry In Nigeria

The Remittance Of Witholding And Pas As You Earn Tax In Nigeria

Types Of Taxes Paid In Nigeria And How They Are Administered

Who Pays For Value Added Tax And Withholding Tax Nairametrics

Nigerian Tax Sound Bites Withholding Tax 2 By Chidi U Medium

What You Need To Know About Tax In Nigeria Taxes In Lagos Nigeria Sow

Transaction Taxes In Nigeria Key Issues 2011 Content

Understanding The Tax Regime Business Names Tax Nigeria

Withholding Tax Beginners Guide For Small Businesses In Nigeria Nairametrics

Posting Komentar untuk "How Much Is Withholding Tax In Nigeria"