How To Pay Withholding Tax Tanzania

That is what the law provides. Tanzania Individual Income Tax rates are progressive to 30.

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

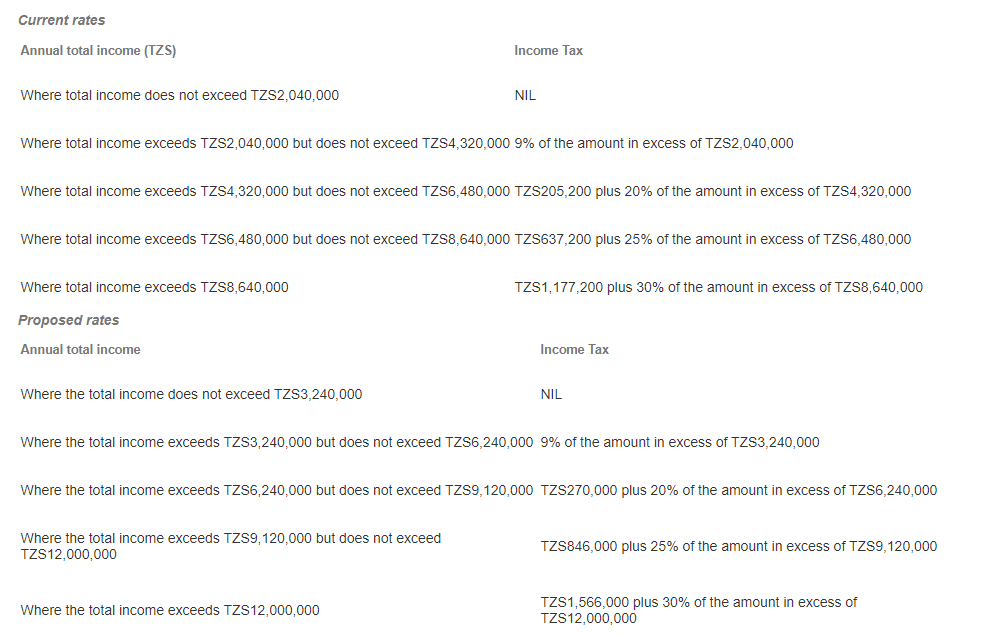

50 Resident Individual Income Tax Tanzania Mainland Monthly Income Tax Rate.

How to pay withholding tax tanzania. If the recipient is non-resident the tax is final. Withholding tax rates on payments made by resident persons to resident and non-resident companies. The paying entity subsequently pays the withheld amount to the tax authorities.

The reviews focus on areas of high risk and also identification of tax opportunities. Shield GEO becomes the Employer of Record and employs the staff on behalf of the client. Paying company is listed on the.

Payments which are liable to Withholding Tax WHT include but are. Subject to tax when sourced from Tanzania. Annual income of TZS 2040000 is not taxable.

Certificates are obtained in the Revenue Gateway System and can be printed by Withholder or withholder as the case may be after making payment. The Act offers guidance with regards to what is sourced from Tanzania and section 69i provides. Categories of withholding taxes.

- Final withholding taxes. However they are some exception to the rule. Tax Health checks provide an independent review of tax compliance.

Non final withholding taxes. Where Total Income exceeds Tshs. However the total income of a non-resident individual is charged at the rate of 20.

For non-resident employees of a resident employer the income is subject to withholding tax at the rate of 15. A Withholdee is a person liable to pay tax from the total income or final withholding payment. Shield GEO will invoice the client monthly in advance of the.

Withholding Tax Statement-a payments made by the withholding. The withholdee of a payment that is not a final withholding payment shall be entitled to a tax credit in an amount equal to the tax treated as paid for the year of income in which the payment is derived. If it pays interest to any other recipient it must withhold tax at a rate of 10.

Kenya Uganda Tanzania Rwanda and Burundi require that anyone making payments to suppliers for the provision of goods and services whether resident or non-resident should withhold tax at the appropriate rates see Annex 1 and remit this tax to the respective Revenue Authority. Total income TZS Rate payable up to 2 040 000 0 2 040 001 4 320 000 9 4 320 001 6 480 000 20 6 480 001 8 640 000 25 over 8 640 000 30 Residents Non-residents Employment payments 0 30 15 Directors fees other than full time service 15 15 Dividend. The normal rate of WHT on dividends is 10.

Obligation to withhold tax. The withheld tax is to be declared and repaid by the paying entity each month before the 28th day of the following month. Non-residents are taxable on income with a source in Tanzania.

Where Total Income exceeds Tshs 9120000 but does not exceed Tshs 12000000. Shield GEO manages all aspects of payroll for workers in Tanzania including taxes withholding social security payments and other statutory requirements. Filing of Withholding tax statements Every withholding agent shall file with the Commissioner General within 30 days after the end of each 6-month calendar period a statement of any income tax withheld during the month by filling the prescribed form ITX 23001E.

We will also keep you abreast of new developments in Tanzania as well as. Section 81 of the Income Tax Act requires an employer to withhold tax from the payments made to an employee. The domestic WHT rate applies unless the DTT rate is lower in which case the lower DTT rate applies.

If these are sourced from Tanzania the withholding tax mechanism then kicks in to require the person making payment to collect tax at the point of payment. The rates of the WHT differ according to the nature of the goodsservices and the rates applicable within the framework of the DTTs. Tax Credit for non-final withholding tax Section 87 of ITA.

I Payment of withholding taxes should be within 7 days after the month of deduction. Staff are paid monthly with tax and social security deducted at source and paid to local authorities. Businesses in Tanzania are required to withhold tax on various payments including payments for service fees to nonresident service providers.

Companies listed in the Dar-es-salaam Stock Exchange are required to pay only 25 income tax on their first three years of business. If your business pays interest to a resident financial institution there is no withholding tax. The lower rate applies if the beneficial owner is a company that controls directly or indirectly at least 15 of the voting power in the company paying.

Where a dividend is paid by a resident corporation to another resident corporation holding 25 or more of shares and voting rights in the corporation paying the dividend the WHT. Every withholding agent shall pay to the Commissioner within seven days after the end of each calendar month any income tax that has been withheld. Ii Computation and payment of withholding taxes is done online through wwwtragotz iii The submission of statement is within 30 days after each 6- month period.

The law has divided withholding taxes in to two major categories namely. Prior to July 2016 withholding tax WHT only applied to such payments either where services were rendered in Tanzania or where the payer for the services was the Government of Tanzania then irrespective of place of performance. In Tanzania Withholding tax applies mostly to employment income.

846000 plus 25 of the amount in excess of Tshs. So where the payer was not the Government the question was whether services had been rendered in Tanzania. Tax Technical courses are designed to equip taxpayers with a working knowledge of taxation in Tanzania.

An example of Withholding tax is tax on salary income of an employee PAYE. Income tax is charged at a rate of 30 on income of a resident corporation and of a permanent establishment PE of a non-resident corporation or 5 of turnover for technical and management service providers to mining oil and gas entities deducted by way of WHT. Dividend payments are taxed by way of WHT and this is a final tax.

Corporate entities in Tanzania are required to pay a fixed 30 rate on their net profit as income tax from their first year of operation. If the recipient is resident the tax is non-final. 6240000 but does not exceed Tshs.

270000 plus 20 of the amount in excess of Tshs.

Final Report Sara Value Added Tax Withholding Tax

Tanzania Vs African Barrick Gold Plc August 2020 Court Of Appeal Case No 144 Of 2018 2020 Tzca 1754 Tpcases Com

Understanding And Calculating Paye In Tanzania Seifi Accountants Consultants

Tanzania S Parliament Passes Finance Bill 2020 Ey Global

Tanzania Revenue Authority Ppt Download

Claritas International On Twitter Press Release Issued By Commissioner General From Tanzania Revenue Authority Tra As At 6th August 2021 Tax Auditing Claritasinternational Tanzania Https T Co Ivaekr9ezs

Tanzania Revenue Authority Ppt Download

Https Abgpersonas Com Wp Content Uploads 2021 03 Tanzania Ias Pholio Pwc Pdf

Tanzania Revenue Authority Ppt Download

Tanzania Revenue Authority Ppt Download

In Review Direct Taxation Of Businesses In Tanzania Lexology

Tax Dispute Settlement Procedures In Tanzania Grin

Taxation In Tanzania Cdr Tanzania Investment Forum

Pdf Factors Influencing Tax Compliance In Tanzania A Case Of Tanzania Revenue Authority Located In Mbeya Region Benson James Lyimo Academia Edu

The Income Tax Act Tanzania Investment Centre

Tanzania Revenue Authority Paye Slab Tra Paye Lenvica Hrms

Assad Associates Live Tra E Filing Seminar Facebook

C A June 2019 Tanzania Tax Update By Bcassian Issuu

Tanzania In Imf Staff Country Reports Volume 2003 Issue 002 2003

Posting Komentar untuk "How To Pay Withholding Tax Tanzania"