Is There Withholding Tax In Saudi Arabia

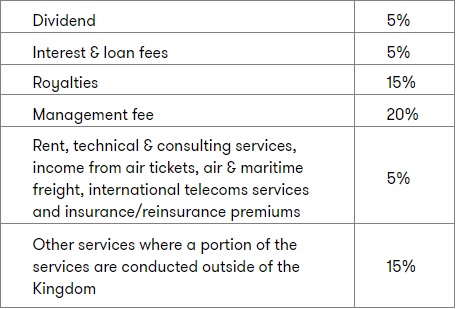

If tax is withheld for an amount paid to a taxpayer who is included in its tax base the tax withheld shall be deducted from the tax due on the taxpayer against the tax base. The withholding tax rate is.

Understanding withholding tax in the Kingdom of Saudi Arabia KSA By Simon Dawson on 26 Feb 2018 Under the law and tax regulations of the Kingdom of Saudi Arabia KSA there is an obligation for all clients to pay withholding tax WHT on all out of kingdom international payments to non-Saudi residentregistered partiescompanies direct to the General Authority of Zakat and Tax.

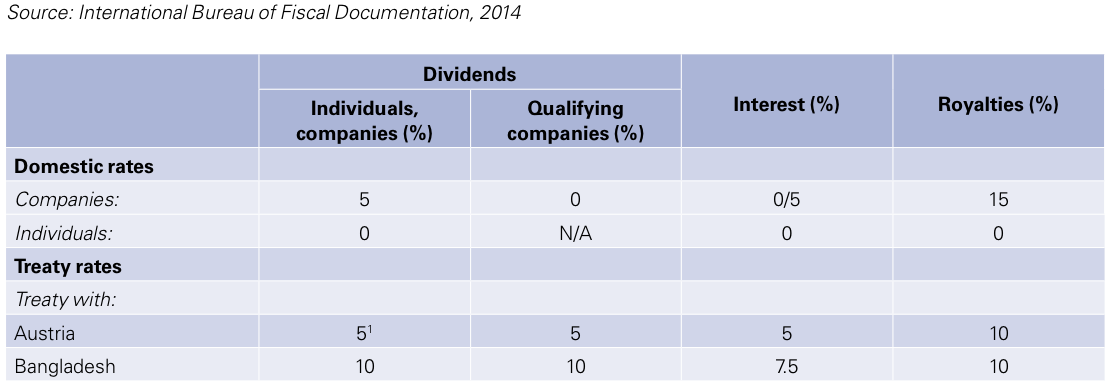

Is there withholding tax in saudi arabia. However there is white land tax WLT. Saudi Arabia Highlights 2020. A 20 tax rate applies to foreign companies which are paid by the non-Saudi owner or liable shareholders.

A Real Estate Transaction Tax RETT applies on the disposal of real estate at a rate of 5. Updated January 2020. 377 dated 13 June 2016 the White Land Tax L aw and its implementing regulations the WLT law were issued.

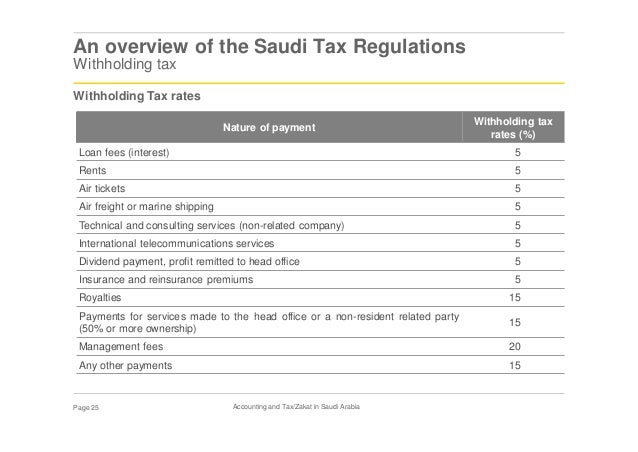

Depending on the type of business tax rates may differ across sectors. 8- If tax is not withheld the beneficiary remains indebted to GAZT for the amount of tax and GAZT may recover it from him his agent or sponsor. The withholding tax rates are.

Kingdom of Saudi Arabia KSA. Non resients receiving income from Saudi source may be subject to withholding tax at rates ranging from 5 to 20 depending on the nature of the service. White land tax WLT Pursuant to Royal Decree No.

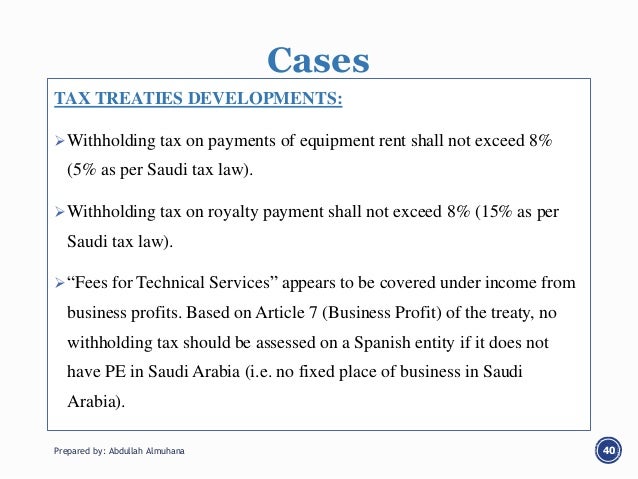

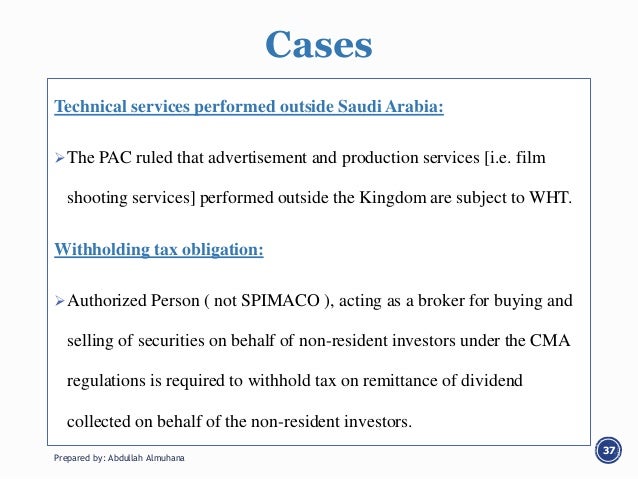

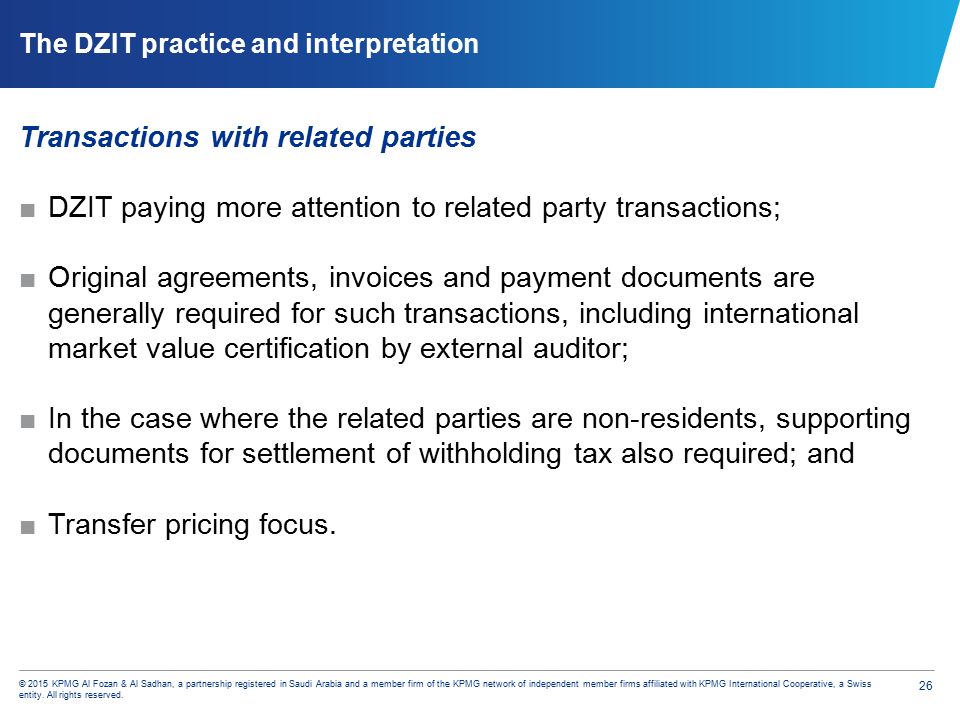

Regarding withholding tax article 68 of the Tax Law states that any resident which includes corporate entities regardless of whether it is a taxpayer and whether such payments are considered tax deductible for the payer of Saudi Arabia making a payment to a non-resident person or entity must withhold taxes ranging from 5-20 per cent of the payment. Non-residents that provide services in Saudi Arabia without having a PE or branch are subject to withholding tax ranging from 5 to 20 depending on the nature of services. The rates vary between 5 15 and 20 based on the type of service and whether the beneficiary is a related party.

This rule applies regardless of whether the Saudi entity is a taxpayer. The taxpayer is required to file online a monthly Withholding Tax Return WTR within 10 days at the end of the month in. The UKSaudi Arabia DTA does not.

Currency Saudi Riyal SAR Foreign exchange control There is no foreign exchange control. Payments made from a resident party or a PE to a non-resident party for services performed are subject to WHT. This approach carries significant cost and requires some knowledge of local employment and payroll regulations.

M4 dated 24 November 2015 and to Council of Ministers Decision No. A copy of the withholding tax form used to pay the Saudi tax together with the bank receipt confirming settlement of the withholding tax with the DZIT. There are no property taxes in Saudi Arabia.

A Saudi resident entity must withhold tax from payments made to such non-residents with respect to income derived from Saudi Arabia. Withholding tax is applicable when payments are made from a permanent establishment or a resident party or to a non-resident party for services performed. The WHT should be paid within the first ten days of the month following the month during which the payment was made.

There is no capital duty stamp duty or payroll tax in Saudi Arabia. 15 on Commissions attendance fees and other services in case of Saudi-sourced income. Withholding agent also has do annual filling within the.

You are required to settle these tax fees within 10 days following receipt of the company tax. There will be a need for in country human resources personnel who possess the relevant background necessary to manage a Saudi Arabian payroll and can also fulfill all tax withholding and payroll requirements. The withholding tax is applicable in the Kingdom of Saudi Arabia on the full amount paid to the non-resident as of 30072004.

Accounting principlesfinancial statements IFRS. Due to this no withholding tax would apply to interest payments between the USA and KSA residents. Corporate tax in Saudi Arabia.

Also if there is no WHT deducted in particular month then there is no requirement to make a filling declaration. The rates may vary between 5 15 and 20 based on the type of. Posted on August 5 2021 - Blog Tax.

The withholding tax in Saudi Arabia on interest is 5 and in the UAE is 0. For the latest tax developments relating to Saudi Arabia see. What are the current income tax rates for residents and non-residents in Saudi Arabia.

WITHHOLDING TAX IN SAUDI ARABIA. Income Subject to Tax Income subject to tax is gross income and includes income profits gains of any type and any form of payment arising from carrying out activity. Withholding Tax in Saudi Arabia Withholding tax is applicable when payments is made from a permeant establishment PE or a resident party or to a non-resident party for services performed.

Management fees are taxed at 20. While there is no real estate tax Zakat religious tax may be payable on real estate if held for speculation. 5 on Technical fees Interest and Dividends and.

Withholding Tax Return Consultant In Saudi Arabia Withholding Tax Agents In Ksa

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Withholding Tax In Saudi Arabia Services For Incorporate The Company In Saudi Arabia Neom Sagia Qiddiya

New Year New Tax Saudi S Evolving Taxation System Proven

Https Leadtc Com Wp Content Uploads 2019 03 Slides Vat Withholding Tax Pdf

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Saudi Tax Zakat Update List Of Topics Ppt Download

Accounting And Tax Zakat In Saudi Arabia By Ernst Young

Withholding Tax Not Calculated For Saudi Arabia Microsoft Dynamics Ax Forum Community Forum

Saudi Tax Zakat Update List Of Topics Ppt Download

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Saudi Tax Zakat Update List Of Topics Ppt Download

Saudi Tax Zakat Update List Of Topics Ppt Download

Overview Of Wht In Saudi Arabia Youtube

Taxation Of Cross Border Mergers And Acquisitions Saudi Arabia 2014 Institute For Mergers Acquisitions And Alliances Imaa

Posting Komentar untuk "Is There Withholding Tax In Saudi Arabia"