Us Canada Tax Treaty Withholding Rates Interest

Can claim a reduced withholding rate from the United States on the dividend income 15 rather than 30 and Canada generally allows you to deduct the US. Reducing Amounts Withheld for US.

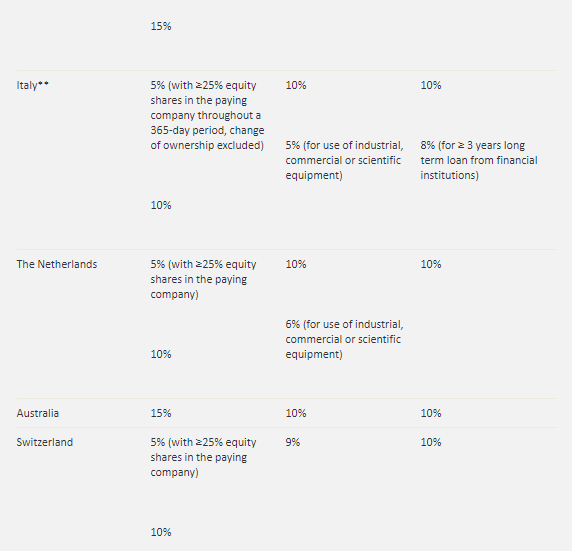

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

See the Part XIII tax calculator or the tax treaty for withholding rates on pensions and annuities see paragraph 70 for links.

Us canada tax treaty withholding rates interest. 3 Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax. Source income of a Withholding tax rates noted are those a pplied by Canada on certain. This is accomplished by providing a form called a W-8BEN to the income provider which you sign and in which you promise to declare the US.

Most interest payments made on or after January 1 2008 9 32. Pensions and annuities 61. Feb 2019 This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments.

Us canada tax treaty withholding rates interest. However you still need to file a US. 5 or 15 f.

Income tax return and report your worldwide income and pay any residual. Territory WHT rates. Taxes Paid in the United States.

Payments to residents of treaty countries 8 3. In that article states. Certain exceptions modify the tax rates.

Another way the United States-Canada Income Tax Treaty is beneficial to Canadians with income earned in the United States is to prevent amounts from being withheld for taxes. The Act provides for a withholding tax of 25 on Canadian pension benefits paid to nonresidents of Canada. Reverse hybrids - treaty benefits gen erally denied with respect to US.

The treaty requires 15 tax withholding on dividends and 10 tax withholding on interest. Specific exceptions are noted in paragraph 2121h of the Act. Income on your Canadian tax return.

Second the withholding tax is set at flat rate of 25 of the payment made to a non-resident. If all the income for a non-resident from Canadian sources is subject to withholding tax the non-resident is not required to file a tax return. This tax is commonly referred to as withholding tax.

4 Dividends subject to Canadian withholding tax include taxable dividends other than capital. The general rate for this tax is 25 of the gross amount of the payments received from the Canadian source. 98 Zeilen Withholding tax on certain interest payments to arms length foreign lenders.

Withholding tax from your Canadian tax on that income. Certain exceptions modify the tax withholding rates shown in the table. As a result Canada will impose a maximum WHT rate of 25 on dividends interest and royalties until a new treaty enters into force.

The rate is 5 for interest i beneficially owned by a bank or other financial institution including an insurance company or ii paid due to a sale on credit of any industrial commercial or scientific equipment or of any merchandise to an enterprise. Exemption under Doctrine of Sovereign Immunity 9 33. Exemptions from withholding tax 9 31.

Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev. A Canada shall allow a deduction from the Canadian tax in respect of income tax paid or accrued to the United States in respect of profits income or gains which arise within the meaning of paragraph 3 in the United States except that such deduction need not exceed the amount of the tax that would be paid to the United States if the resident were not a United States citizen. Accordingly an Irish domiciled ETF will pay 15 withholding tax on its US stocks.

Canada has also entered into tax treaties with many countries which may reduce the rate of withholding tax. So if you own a US. Rates of Canadian withholding tax applicable to interest dividend and trust income 8 241.

Tax Treaty Table 1 lists the income tax and withholding rates on income other than personal service income including rates for interest dividends royalties pensions and annuities and social security payments. International tax treaty rates 1 1 Withholding tax rates applied by Canada to certain payments to residents of selected countries with which it has signed international tax treaties. For other republics that comprise the former USSR the status of the former treaty with the USSR is uncertain.

Updated to December 31 2018 Country Interest. Updated to August 1 2015 Country Interest. A foreign athlete or entertainer working in the Unites States will incur a withholding tax at 30 of the gross compensation.

Withholding tax rates noted are those applied by Canada on certain payments to residents of selected countries with which it has signed international tax treaties. Stock as a Canadian resident there. Payments to residents of non-treaty countries 8 242.

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

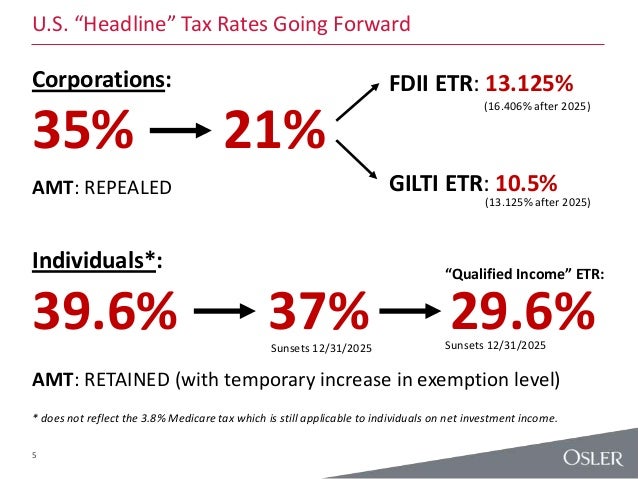

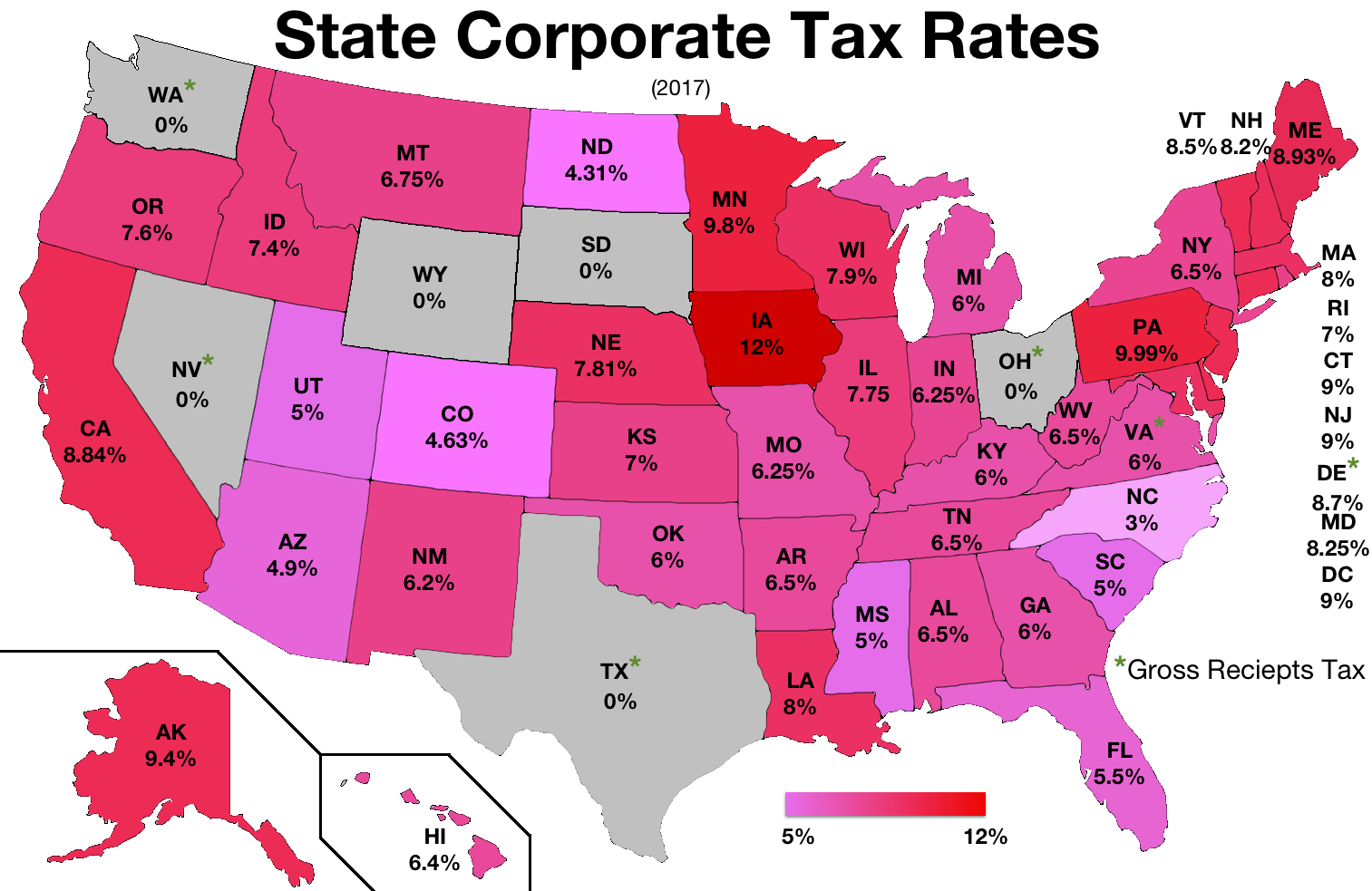

Corporate Tax In The United States Wikiwand

Corporate Tax In The United States Wikiwand

Global Corporate And Withholding Tax Rates Tax Deloitte

Is The U S The Highest Taxed Nation In The World Committee For A Responsible Federal Budget

Your Bullsh T Free Guide To Taxes In Germany

Corporate Tax In The United States Wikiwand

Pdf Taxation And Investment In Colombia

Corporation Tax In The Republic Of Ireland Wikiwand

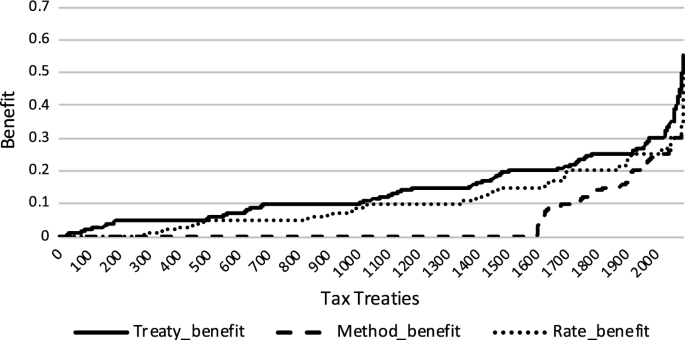

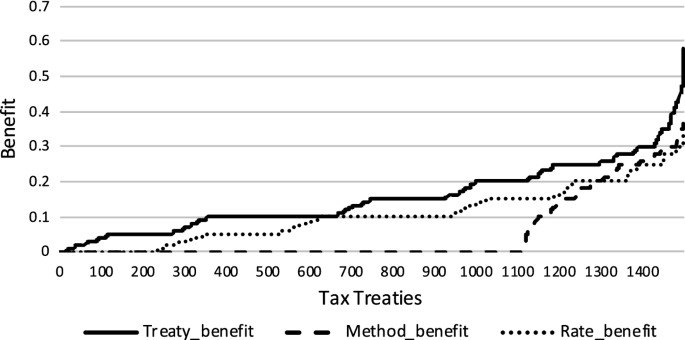

On The Relevance Of Double Tax Treaties Springerlink

On The Relevance Of Double Tax Treaties Springerlink

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Fin 440 International Finance Ppt Download

Corporate Tax In The United States Wikiwand

Doing Business In The United States Federal Tax Issues Pwc

Taxes In Switzerland Income Tax For Foreigners Academics Com

Posting Komentar untuk "Us Canada Tax Treaty Withholding Rates Interest"