What Is Withholding Tax On Bank Transaction

This is known as Backup Withholding BWH and may be required. The tax so deductedcollected shall be adjustable.

How To File Your Monthly Taxes Taxtime Income Tax Tips Tax Return Tips Bookkeeping Business Small Business Bookkeeping Business Tax

Wages paid along with any amounts withheld are reflected on the Form W-2 Wage and Tax Statement the employee receives at the end of the year.

What is withholding tax on bank transaction. Finance Minister Asad Umar said that currently the advance income tax is withheld on cash withdrawal where the aggregate of cash withdrawal from all bank accounts of the person exceeds Rs50000 in a day. In the existing mechanism a person withdrawing more than Rs 50000 is charged with Withholding Tax which is 03 percent for filers and o6 percent for non-filers. Under the BWH-B program because you failed to provide a correct taxpayer identification number TIN to the payer for reporting on the required information return.

The Government receives the amount immediately or as when any such transaction is incurred. Making the payment to deduct withholding tax of 3 on the sum of the service fee and the stamp duty regardless of whether they are paid separately or together. It is an advance payment to be applied as tax credit to settle the income tax liability of the years of assessments to which the income that suffered the deduction relates.

Tax returns filers got relief in the mini-budget announced on Tuesday. It said that every banking company shall collect withholding tax from persons not on the ATL at the time of sale of such instruments. Person deducting collecting withholding tax shall provide a Certificate of Deduction of Tax to the person from whom deduction is made.

It is for the guidance that it is a kind of income tax that is applicable by using various types of bank services. Withholding tax may be a form of advance payment of income taxes value added taxes goods and service taxes or some combination of these and other types of tax. This 24 percent tax is taken from any future payments to ensure the IRS receives the tax due on this income.

Tax deducted or collected is required to be deposited into Government Treasury within seven days from end of each week ending on Sunday. Usually this money goes to the government from the customer side. Withholding tax on bank transactions waived off for filers ISLAMABAD.

The sources explained that under Section 151 1 b withholding tax is collected on profit on debt paid by banking companies or financial institutions on account or deposit maintained. Finance Minister Asad Umar said that currently the advance income tax is withheld on cash withdrawal where the aggregate of cash withdrawal from all bank accounts of the person exceeds Rs50000 in a day. 03 tax on bank transactions is only an advance tax on non-filers of Income Tax Returns.

Non-filers can become filer at any time by submitting his Income Tax Return. An employer generally withholds income tax from their employees paycheck and pays it to the IRS on their behalf. Withholding tax is a tax levied by an overseas government on dividends or income received by non-residents.

Another example is when a bank issued a bank guarantee for a company and in return charged the company a service fee and the stamp duty for which the bank is. The FBR said that 06 percent withholding tax rate is applicable on non-cash banking transactions under Section 236P of Income Tax Ordinance 2001. How withholding is determined The amount withheld depends on.

Withholding Tax is not a. Withholding tax is levied on a transaction the payee deducts the amount of the tax while making payment and deposits the same amount with the government. Remember tax rules can change and depend on your personal circumstances.

Tax returns filers got relief in the mini-budget announced on Tuesday. The government imposed 06 percent withholding tax on banking transactions on withdrawal of more than Rs 50000 in the budget for FY16 which was reduced subsequently to 03 percent due to protests. He said that this tax was burden for those people who are regularly filing tax returns and following the tax laws of the country.

The seller reduces subsequent payments of its tax liabilities by amounts already paid on its behalf by buyers. The minister said the rate of tax to be deducted is 03 percent of the cash amount withdrawn for filers and. It is different for filers and non-filers.

The National Tax Service Of South Korea Nts Has Decided To Withhold Income Tax From Bithumb S Foreign Customers The To Tax Services Expert Quote South Korea

Obww Sap Tcode For C Fi Withholding Tax

Brazilian Withholding Taxes Bpc Partners

Step By Step Document For Withholding Tax Configuration Sap Blogs

Hansaworld Integrated Erp And Crm

End To End Withholding Tax Cpb Software Ag

Step By Step Document For Withholding Tax Configuration Sap Blogs

Brazilian Withholding Taxes Bpc Partners

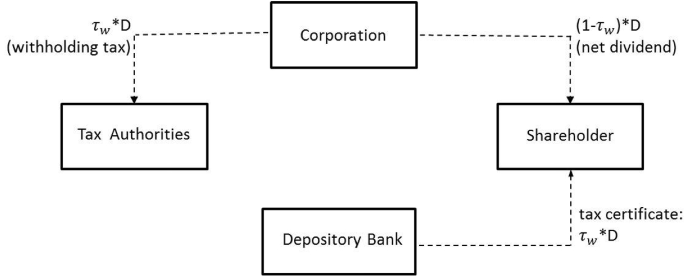

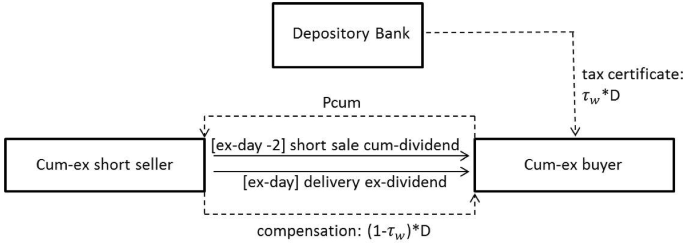

Withholding Tax Non Compliance The Case Of Cum Ex Stock Market Transactions Springerlink

Hansaworld Integrated Erp And Crm

Understanding Withholding Tax Microsoft Dynamics 365 Enterprise Edition Financial Management Third Edition

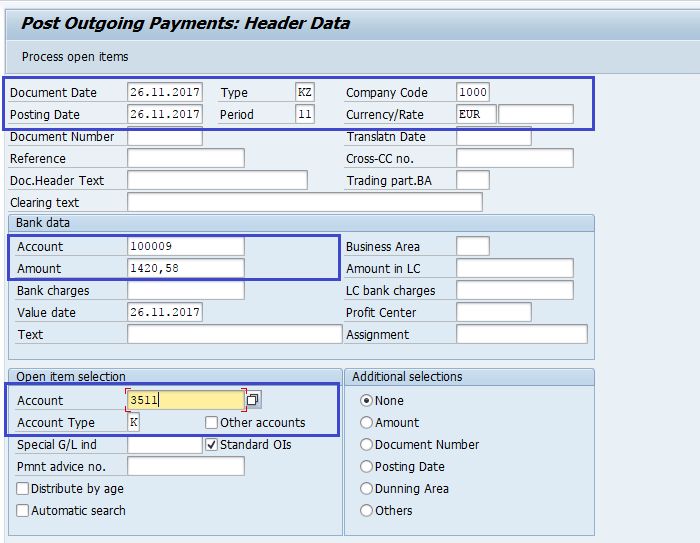

Sap Fi Withholding Tax During Payment Posting

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax For Sales Sap Blogs

Withholding Tax Non Compliance The Case Of Cum Ex Stock Market Transactions Springerlink

Step By Step Document For Withholding Tax Configuration Sap Blogs

Gotovi Fotografiyi Zobrazhennya Video Grafichni Ta Vektorni Ob Yekti Bez Splati Royalti Money Transfer Banking Know Your Customer

Firs S Vat Of N29 2 Million Imposed On Bank Reversed By Tribunal Revenue Capital Market Accounting

Ax 2012 Withholding Sales Tax Microsoft Dynamics Ax Community

Posting Komentar untuk "What Is Withholding Tax On Bank Transaction"