Withholding Tax Rate Between Singapore And Australia

0 after tax treaty 15. This is not the final tax.

5 Ways You Can Acquire Status Of Assessee In Default Why It Is So Dangerous Http Taxworry Com 5 Ways Can Acqu Capital Gains Tax Taxact Transfer Pricing

The principal factor considered in relation to the taxation of business profits is the presence of a permanent establishment.

Withholding tax rate between singapore and australia. 15 after tax treaty 15. Under the DTA the reduced tax rate of 10 for. 52 Singapore NIL 10 8 5 53 South Africa NIL 10 5 5 54 South Korea NIL 15 10 10.

Australian tax rates used are for the income year ended 30 June 2015. When is Singapores tax year. When a person makes a payment to a non-resident company for technical or management services rendered in Singapore a withholding tax at the prevailing corporate tax rate of 17 is chargeable on that payment.

You may also have to withhold tax if any of the above payment types have been dealt with for example reinvested or capitalised on behalf of the non-resident. Royalty payments are subject to WHT at the rate of 10. Interest Without the treaty the withholding tax rate in Singapore for any interest paid to non-residents is 15 whereas in Australia the withholding tax rate for interest paid to non-residents is 10.

The withholding tax rate on interest royalties and fees for technical services is as provided in the ITA 1967. Similarly Singapore residents who derive income from Australia will be subject to tax in Australia at the rate of 10 on the gross amount of interest. Australian residents who derive interest income from Singapore will be liable to Singapore tax at a reduced rate of 10 on the gross amount of interest.

The income tax and the petroleum resource rent tax in respect of offshore projects imposed under the federal law of the Commonwealth of Australia. The tax withheld represents a final tax and applies only to non-residents who are not carrying on any business in Singapore and who have no PE in Singapore. The Agreement applies also to any identical or substantially similar taxes which are.

The withholding tax rates are reduced under the double tax treaty between Singapore and China. The dividend rate is reduced to 5 from the applicable rate for those companies owning at least 25 of the share capital of the company making the dividend payment. Singapore tax rates used are for the income year ended 2014.

Payment for services rendered by a company. Unless a lower treaty rate applies interest on loans and rentals from movable property are subject to WHT at the rate of 15. O Rate applies to payments for the use of or the right to use any patent design or model plan secret formula or process or for the use of or the right to use industrial commercial or scientific equipment or for information concerning industrial commercial or scientific experience.

Any tax resident person who is liable to make certain specified types of payments to a non-resident is required to deduct withholding tax at a prescribed rate applicable to the gross payment and remit it to the Malaysian IRB within one month of paying or crediting. Yes it can be viewed here. The withholding tax on royalties is also reduced from 10 to 6.

The tax year in Singapore runs from 1 Jan 31 Dec of the previous year. Non-resident employment income is taxed at a flat rate of 15 or the progressive resident tax rates whichever results in a higher amount of tax. As an Australian resident you generally withhold tax from the following types of payments you make to someone who is not an Australian resident.

Exchange rate of AU100 108 SGD. Therefore the withholding tax rate of 15 under the Income Tax Act applies. Country Fees for Technical Services 1 Albania NIL 10 10 10.

Is there an Australia-Singapore tax treaty. Tax returns are. DOUBLE TAXATION AGREEMENTS WITHHOLDING TAX RATES No.

Withholding tax rate on dividends. 77 sor Withholding tax is a method of collecting taxes from non-residents who have derived income which is subject to Malaysian tax. Withholding tax if held via Irish-domiciled ETF.

For services performed in Singapore withholding tax is to be imposed at the prevailing corporate tax rate of 17 on the gross payment and paid to IRAS. No withholding is required in relation to franked dividends. Where the jurisdiction of source imposes a limited rate of tax on selected types of income profits or gains for example a withholding tax this is usually expressed as may be taxed in that other state.

This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Where the recipient does not quote a Tax File Number or Australian Business Number the payer is obligated to withhold tax at the rate of 47 under the Pay-As-You-Go PAYG withholding regime. Singapores withholding tax ranges from 10 to 17.

Dividends and interests paid by Australian resident companies to non-residents are subjected to a 10 to 30 withholding tax.

The Cares Act The Tax Provisions And What S Next

Singapore Corporate Tax Rikvin

Singapore Corporate Tax Rikvin

Https Ink Library Smu Edu Sg Cgi Viewcontent Cgi Article 5161 Context Sol Research

Taxes Vpns And Office Hours The Ultimate Forbes Guide To Working From Home

The Cares Act The Tax Provisions And What S Next

Singapore Corporate Tax Rikvin

Taxes Vpns And Office Hours The Ultimate Forbes Guide To Working From Home

Social Security Contributions In China A Guide For Overseas Employers

Bangladesh Ranked Least Innovative Country In Asia Innovation Country Asia

Austal Delivers Ninth Guardian Class Vessel To Australian Dod

Section 100a Why So Much Attention

Https Www Jstor Org Stable 24864650

Singapore Corporate Tax Rikvin

Https Www Bakermckenzie Com En Insight Publications 2017 10 Media Files Insight Publications 2017 10 Belt Road Doing Business In Singapore 2017 Pdf La En

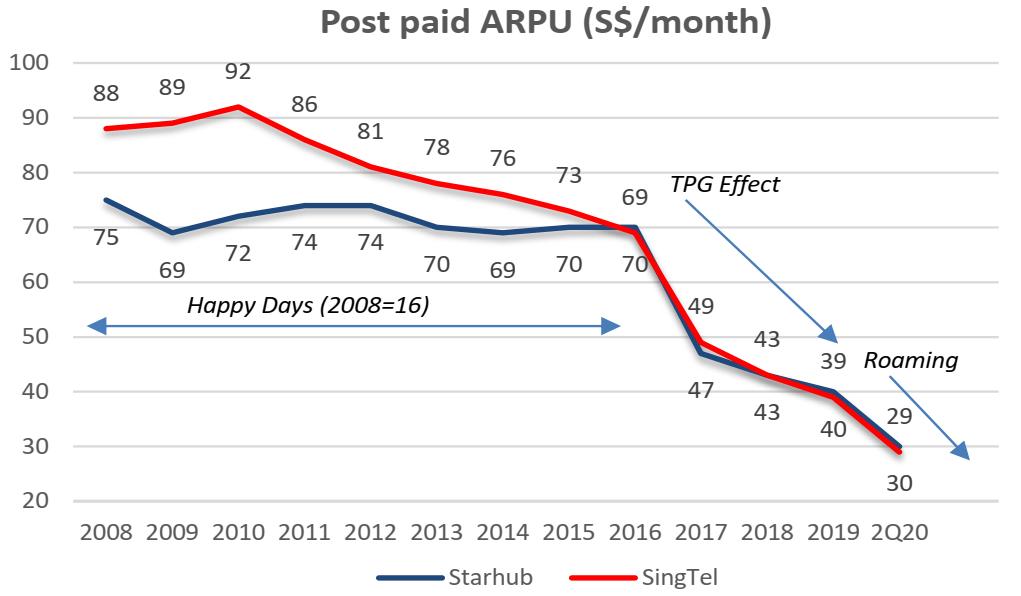

Singapore Telecommunications A Mixed Picture Otcmkts Sgapy Seeking Alpha

Https Assets Kpmg Com Content Dam Kpmg Pdf 2016 07 Mt Malta Double Tax Treaties Pdf

Posting Komentar untuk "Withholding Tax Rate Between Singapore And Australia"