Withholding Tax Rates By Country 2019

The RD deduction in the amount of 150 percent is available already for the calendar year 2019 or a tax year which began after 1 January 2019 and the final increase of RD deduction to 200 percent will be applicable for 2020 or a tax year beginning after 1 January 2020. This page displays a table with actual values consensus figures forecasts statistics and historical data charts for - List of Countries by Personal Income Tax Rate.

Panama Tax Treaties Tax Panama

Comparative information on a range of tax rates and statistics in the OECD member countries and corporate tax statistics and effective tax rates for inclusive framework countries covering personal income tax rates and social security contributions applying to labour income.

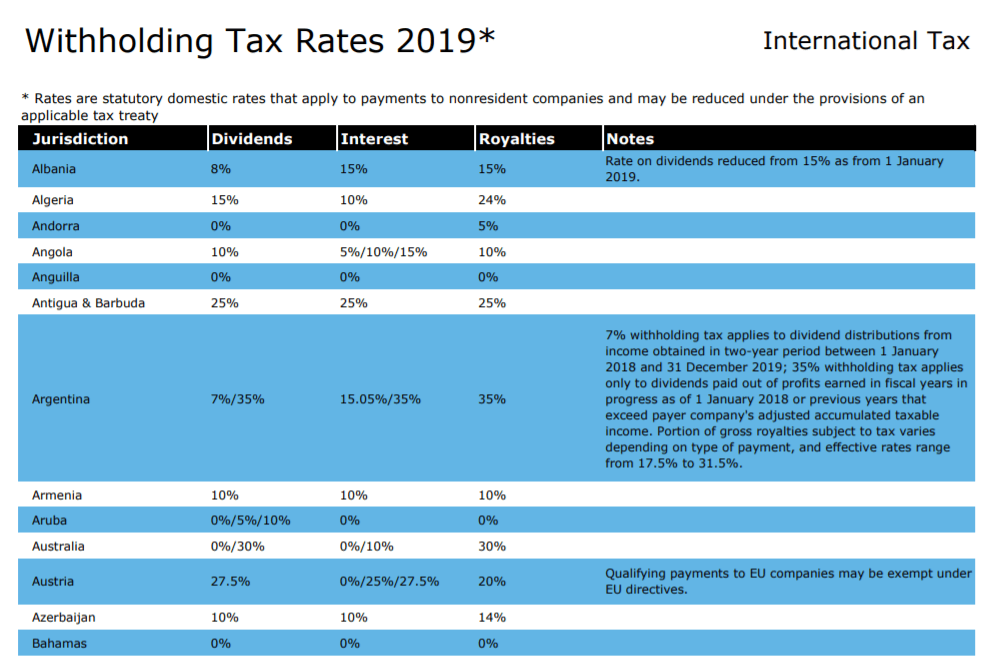

Withholding tax rates by country 2019. This table lists income paid by US. The withholding tax rate is based on the US. In order to benefit from a reduced rate or full tax exemption in accordance with the new regulations regardless of the value of payments made payers are required to exercise due diligence.

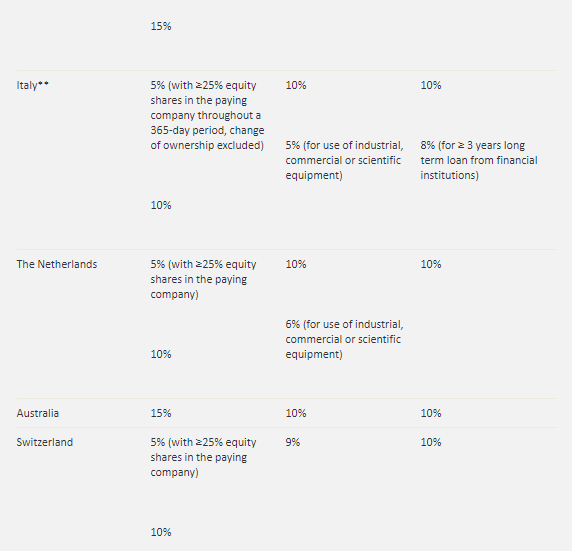

Feb 2019 This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. This guide presents tables that summarize the taxation of income and gains derived from listed securities from 123 countries as of December 31 2020. Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income.

Withholding Tax Rates Applicable Withholding Tax Rates. 2020 Global Withholding Taxes. Rates for Withholding Income Tax Updated to the Effect of Proposed Changes vide the Finance Bill 2018 APPLICABLE FOR TAX YEAR 2019 Nature of Payment Tax Rate Nature of Tax Filer Non-filer Advance Final Minimum Tax Page 2 SHIPPING OR AIR TRANSPORT INCOME OF NON-RESIDENTS Section 7 Division V Part I First Schedule Shipping income 8.

Updated up to June 30 2021. For example in developed Europe Switzerland has a very high 35 withholding tax rate for non-residents while the UK charges 0 for stocks only for Americans. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US-source.

15 10 0 but VAT 19 unless exempted. Income tax is levied on income earned by resident individuals in Argentina and abroad. 226 rader A comparison of tax rates by countries is difficult and somewhat subjective as tax laws in.

As you can see some nations are far friendlier to foreign dividend investors than others. Tax rates on consumption. Tax treaty with the country of the investors residence.

Corporate tax rates and statistics effective tax rates. Principal International Tax KPMG US. Selected country list withholding rates as of February 2019.

You can view the complete list of withholding tax rates for every country here. 15 10 30 unless rates provided by Double tax treaties. From 2019 the requirements to apply the withholding tax exemptions and reduced withholding tax rates based on EU law or the applicable double tax treaties have been extended and more formalized.

Without the tax treaties US investors will pay higher taxesThe Netherlands has a statutory tax rate of 25. This difference is due to tax treaties between these countries and the US. The withholding tax rate would be 15 of the gross amount of the payment unless an applicable income tax treaty provides a lower rate of withholding.

Corporate Tax Rates 2021 includes information on statutory national and local corporate income tax rates applicable to companies and branches as well as any applicable branch tax imposed in addition to the corporate income tax eg branch profits tax or branch remittance tax. However for each activity the law establishes a percentage of presumptive net income on which 35 withholding tax is applicable thereby reducing the effective tax rate. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Dividend Withholding Tax Rates by Country for 2020. Last reviewed - 06 February 2021. Subject to 35 withholding tax.

The withholding tax will be levied on interest payments made to related parties that are residents of low-tax jurisdictions. 2019 Global Withholding Taxes. Corporate - Withholding taxes.

Companies and such income is not effectively connected with the conduct of a US. List of Countries by Personal Income Tax Rate - provides a table with the latest tax rate figures for several countries including actual values forecasts statistics and historical data. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15.

Angola Last reviewed 24 June 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. Meanwhile some of the most popular foreign dividend companies including those in Australia Canada and Europe can have very high withholding rates between 25 and 35.

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Tax Changes 2019 Withholding Tax Vgd

Global Corporate And Withholding Tax Rates Tax Deloitte

Is Dividend Withholding Tax Important In Investing Investment Moats

Corporate Tax Rate And Withholding Tax Rates In The The Black Download Table

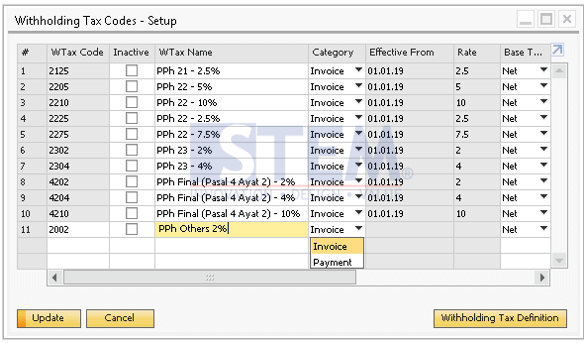

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Global Corporate And Withholding Tax Rates Tax Deloitte

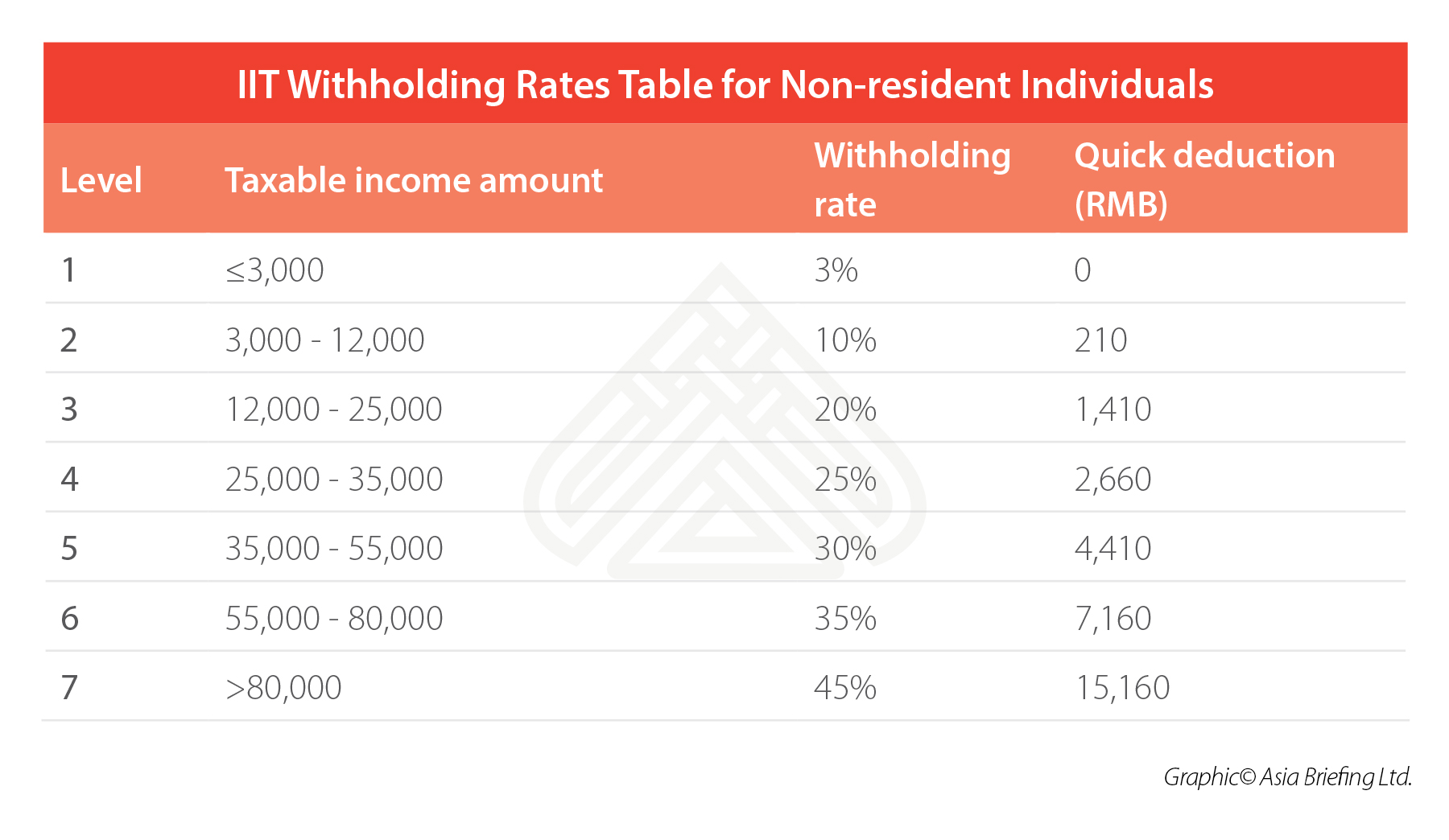

How To Calculate And Withhold Iit For Your Employees In China

Doing Business In Thailand Withholding Tax Jarrett Lloyd

Global Corporate And Withholding Tax Rates Tax Deloitte

Countrywise Withholding Tax Rates Chart As Per Dtaa

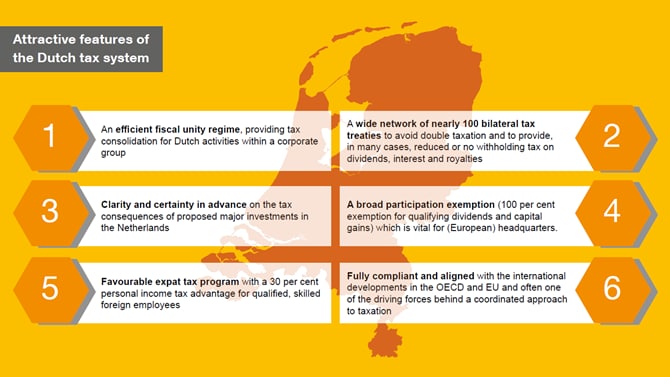

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Global Corporate And Withholding Tax Rates Tax Deloitte

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

Posting Komentar untuk "Withholding Tax Rates By Country 2019"