Withholding Tax Rates For Non Residents Of Canada

If all the income for a non-resident from Canadian sources is subject to withholding tax the non-resident is not required to file a tax return. 46 lignes The standard non-resident tax rate is 25.

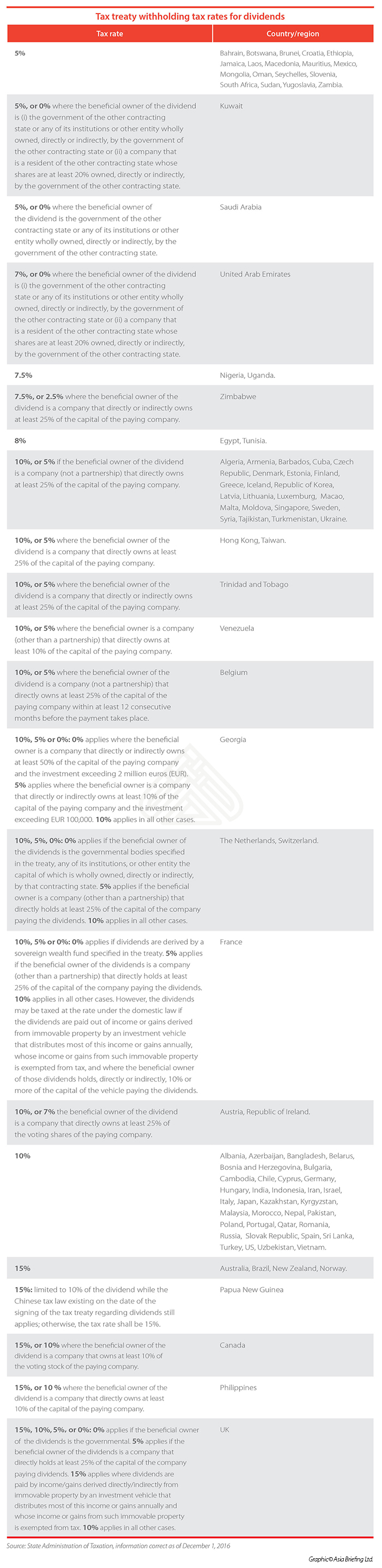

Withholding Tax In China China Briefing News

Instead of the various withholding tax rates shown in the table on page 1 non-resident withholding tax is applied at a flat rate of 25 unless the amount is reduced by an Income Tax Treaty between Canada and the.

Withholding tax rates for non residents of canada. Pursuant to paragraph 153 1 g of the Act and Regulation 105 a withholding of 15 is required from the payment of fees commissions or other amounts paid or allocated to a non-resident person in respect of services provided in Canada. The usual Part XIII tax rate is 25 unless a tax treaty between Canada and your home country reduces the rate Part XIII tax is not refundable. 10 10 10.

10 10 10. Second the withholding tax is set at flat rate of 25 of the payment made to a non-resident. However tax treaties and provisions within the Income Tax Act may allow lower rates.

For non-residents the WHT rate will be reduced to 75 through the use of a DTT. For more information go to Non-Resident Tax Calculator. Inform the payer of your Canadian income that you are a non-resident of Canada for tax purposes as well as your country of residence so that the correct amount is deducted for your income.

This calculator provides calculations based on the information you provide. Non-residents are also subject to a Canadian withholding tax which must be deducted and remitted to the CRA by the purchaser whether a resident or a non-resident of Canada equal to either 25 percent or 50 percent depending whether income or a capital gain was realized on the sale of the gross sales proceeds within 30 days from the end of the month in which the disposition is closed unless the non. However Canada has tax treaties with some countries that affect the amount of non-resident tax withheld.

You can also get the current tax rates and effective dates by contacting the CRA for Part XIII tax and non-resident withholding accounts or visit the Department of Finance Canada. The most common types of income that could be subject to non-resident withholding tax include. The 25 Part XIII tax will apply to any taxable amounts you paid or credited to persons in non-treaty.

This table shows the tax rate that applies to your country of residence as well as any applicable exemption. Where Canadian non-resident withholding tax applies to a payment to the partnership the rate would generally be 25. Non-residents usually pay 25 percent on amounts subject to Part XIII tax.

The type of payment eg interest dividends or trust income the rate of tax applicable to that type of payment under Canadian domestic law. This results in an effective 2442 tax rate on capital gains in 2018. The rates of the online calculator apply only if you are a non-resident of Canada who is entitled to benefits under a treaty.

Dividends subject to Canadian withholding tax include taxable dividends other than capital gains. 3 Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax. 4 Dividends subject to Canadian withholding tax include taxable dividends other than capital.

Canadian financial institutions and other payers have to withhold non-resident tax at a rate of 25 on certain types of Canadian-source income they pay or credit you as a non-resident of Canada. Therefore do not file a Canadian tax return to report the income unless you elect to file a return because you receive either. The withholding tax would apply to the partnership as a whole where there is even one non-resident partner.

Canadian non-resident withholding tax. The rate of Canadian tax applicable to payments made to non-residents of Canada can vary depending upon factors such as. Further a refund is almost always necessary given that the withholding is 25 of the capital gain and the top tax rate applied to non-residents of Canada selling Canadian real estate is 4884.

For questions about your taxes contact the Canada Revenue Agency. This arises from the wording of subparagraph 212 1 d i of the Act. Elective Filing for Non-Residents.

In the absence of a tax treaty applying this tax will be at a rate of 25. As a general rule royalties paid to non-residents of Canada for the use of property in Canada would be subject to non-resident withholding tax under Part XIII of the Income Tax Act the Act. To determine if a treaty applies to you go to Status of Tax Treaty Negotiations.

Non-residents Non-residents of Canada have different rules for withholding tax on amounts paid to them from RRSPs and RRIFs. There are administrative requirements to claim. To continue select I accept at the bottom of the page.

Canada imposes no domestic withholding tax on certain arms length interest payments however non-arms length payments are subject to a 25 withholding tax. Canada has also entered into tax treaties with many countries which may reduce the rate of withholding tax on certain payments. Non-resident agents or nominees who are holding securities on behalf of other non-residents must fill out and send an agent or nominee certificate as described in the current version of Information Circular IC76-12R Applicable rate of Part XIII tax on amounts paid or credited to persons in countries with which Canada has a tax convention to the payer or another upstream agent or nominee.

Your portion of the Canadian sourced income as well as your portion of the non-.

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

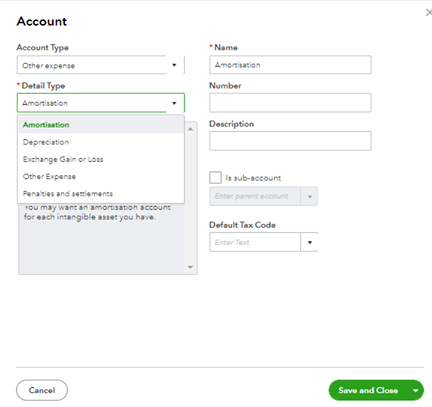

Solved How To Record And Pay Withholding Tax On Supplier

Global Corporate And Withholding Tax Rates Tax Deloitte

How Is My Canadian Rrsp Taxed In The U S

Exempt From Backup Withholding What Is Backup Withholding Tax Community Tax

Hong Kong Withholding Tax What You Need To Know

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

Solved How To Record And Pay Withholding Tax On Supplier

How To Read Japanese Tax Statement Gensen Choshu Hyo Tax Questionnaire Tq Help

Understanding Us Dividend Withholding Tax In Tfsa Rrsp Youtube

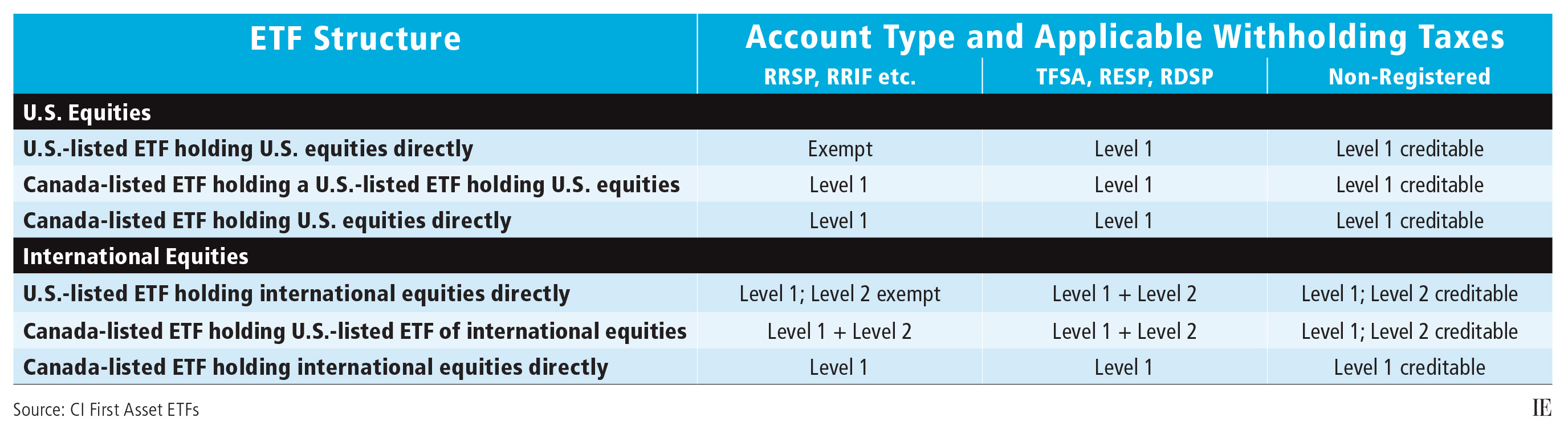

Etfs And Foreign Withholding Taxes Investment Executive

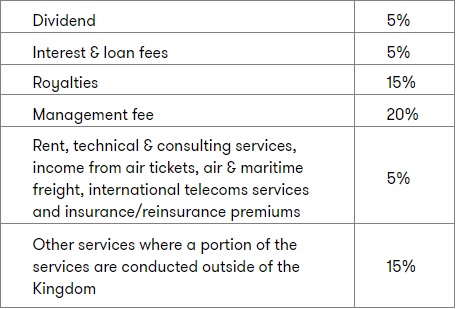

Understanding Withholding Tax In The Kingdom Of Saudi Arabia Ksa Faithful Gould Middle East

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Posting Komentar untuk "Withholding Tax Rates For Non Residents Of Canada"