Withholding Tax Rates In Liberia

Determination of taxable income foreign tax relief withholding tax rates and other issues. Get Tax Clearance.

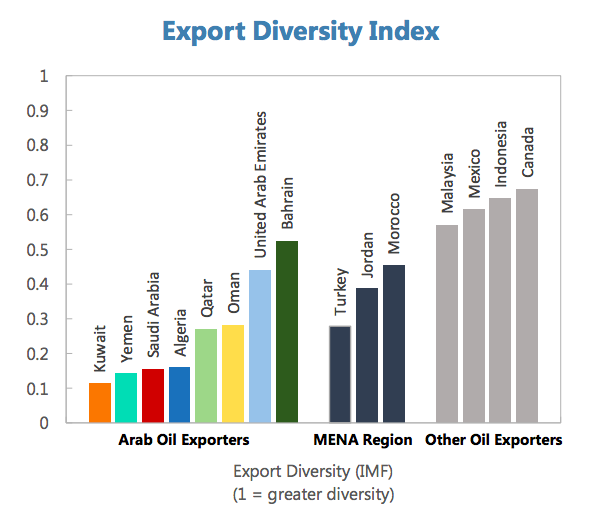

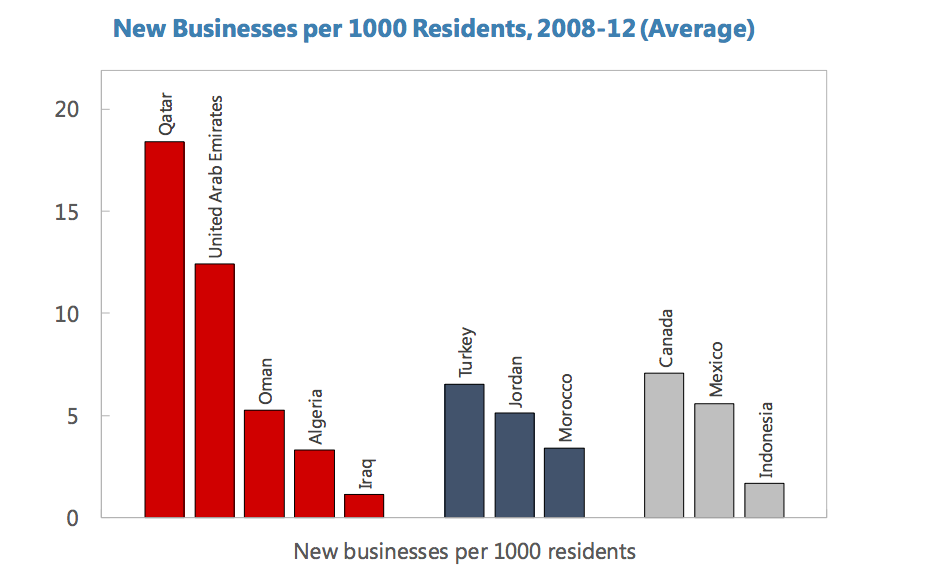

Taxation In The Mena Region Exploring Economics

In this case the withholding tax of 5 percent on N100000 is N5000.

Withholding tax rates in liberia. Payments to non-resident sportsmen or sports associations. 8 Charting tax trends Annual tax rates Resident Individuals The annual personal income tax of every resident individual in Liberia is determined in accordance with the following schedule. Tax news and developments.

When you add this VAT to the net amount of N95000 you will be paid N100000. Personal Annual Income Tax Rates Bands From LIB To LIB Tax rate 1 - 70000 0 of Gross Taxable Income 2 70001 200000 5 of Excess over. You are not currently subscribed to this product.

Royalties dividends interest fees. Make An Online Payment. Non-resident companies are exempt from withholding tax.

Does Liberia have these characteristics to be called a tax haven. Published by PKF in May 2018. Sign up for a free trial to preview this article or shop subscriptions like this.

Income by way of interest from infrastructure debt fund. Oman Last reviewed 24 June 2021 Resident. Libera imposes withholding taxes WHT on payments made to both resident.

Non-residents are subject to tax on income having a source in Liberia. The withholding tax is usually charged on the invoice amount excluding VAT. Given the importance of the question it is best that I provide a clearer definition of tax haven from the Economic Cooperation and Development OECD perspective.

The Corporation tax rate is 25 and 30 for general companies and miningpetroleum companies respectively. 10 R 15 NR. Non-residents are subject to tax on income having a source in Liberia.

0 0 10. The withholding of tax on payments in the course of business as provided in Section 905e is effective on January 1 2002 and the Section 905g credit for tax withheld on. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments.

Certificate for deduction at lower rate. Pakistan Last reviewed 15 July 2021. The Corporation tax rate is 25 and 30 for general companies and miningpetroleum companies respectively.

Liberia fiscal guide 201718 Summary of the tax regime published by KPMG. Income in respect of units of non-residents. Withholding Tax Rates for In-Force Liberia Income Tax Treaties.

The penalty for failure to deduct or remit tax is 10 of the amount not deductedremitted. The standard rate is 15. Some miningpetroleum companies have concessionary tax rates with the government.

2000 AS AMENDED1. Withholding taxes also apply to certain types of income for both residents and non-residents. EFiling and Filing Due Dates.

Some miningpetroleum companies have concessionary tax rates with the government. A selection of articles reporting on tax news and developments. Non-residents are subject to tax on income having a source in Liberia.

7 rows Withholding Tax. Liberia Seeks Tax Treaty With Qatar. Libera imposes withholding taxes WHT on payments made to both resident R and non-resident NR companies on certain classes of income earned.

The Government of Liberia with assistance from its partners developed and endorsed a Domestic Resource Mobilization. Daily Tax Payment Rate. 0 R 15 NR Contract services.

Some miningpetroleum companies have concessionary tax rates with the government. Withholding taxes also apply to certain types of income for both residents and non-residents. Income tax corporate tax information and tax implications for non-residents.

Then the customer will still need to pay you the VAT of N5000. Real Property Tax Estimator. Countries tax laws may include a low corporate tax rate and bank secrecy laws as elements of attract foreign investments.

Income by way of interest from Indian Company. This gives us the net amount of N95000. Get Tax payment Receipt.

10 R 15 NR Management and consultancy fees. 5 5 or 10 depending on the the type of transaction and the tax authority responsible for the collection of the tax Federal Inland Revenue Service or State Inland Revenue Service. The Corporation tax rate is 25 and 30 for general companies and miningpetroleum companies respectively.

Withholding taxes also apply to certain types of income for both residents and non. THE REVENUE CODE OF LIBERIA PHASE ONE OF THE REFORM TAX CODE OF LIBERIA A. For example permitting the reduction of tax rates or release from the obligation to pay tax aside from.

Withholding tax is levied on certain payments of an income nature to non-residents eg. Note that companies are required to submit in electronic form a schedule of all their suppliers for the month showing the tax identification number TIN address of the suppliers the nature of the transaction WHT deducted and invoice number. The rates of withholding tax in Nigeria varies among individuals companies and corporate bodies.

Withholding tax levied on i interest paid to non-residents at the rate of 15 ii royalties paid to non-residents at the rate of 15 and royalties paid to mining companies at the rate of 5 iii dividends paid to non-residents at the rate of 15 iv rental income paid to non-residents at the rate of 15 and v management and technical services fees paid to non-residents at the rate of 15. Tax Notes Today International and Worldwide Tax Treaties and Tax Notes Today Global.

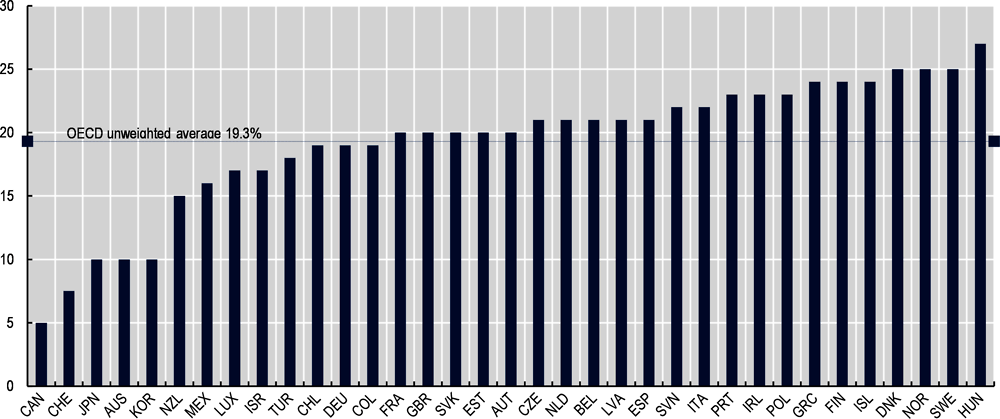

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Taxation In The Mena Region Exploring Economics

Liberia Lr Total Tax Rate Of Profit Economic Indicators Ceic

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Taxation In The Mena Region Exploring Economics

Germany Taxing Wages 2021 Oecd Ilibrary

Global Corporate And Withholding Tax Rates Tax Deloitte

Taxation In The Mena Region Exploring Economics

Global Corporate And Withholding Tax Rates Tax Deloitte

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

Doing Business In The United States Federal Tax Issues Pwc

Israel Corporate Tax Rate 2000 2021 Data 2022 2023 Forecast Historical Chart

Taxation In The Mena Region Exploring Economics

Taxation In The Mena Region Exploring Economics

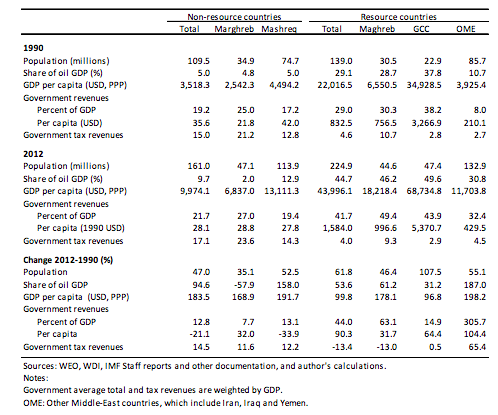

Chapter 15 Resource Rich Developing Countries And International Tax Reforms In Corporate Income Taxes Under Pressure

Enhancing The Efficiency And Equity Of The Tax System In Israel Oecd Economic Surveys Israel 2020 Oecd Ilibrary

2 Value Added Taxes Main Features And Implementation Issues Consumption Tax Trends 2020 Vat Gst And Excise Rates Trends And Policy Issues Oecd Ilibrary

Posting Komentar untuk "Withholding Tax Rates In Liberia"