Withholding Tax Rates In Pakistan 2018-19 Pdf

The period ICMA Pakistan has actively participated in arranging several pre-budget. The original Statue Income Tax Ordinance 2001 as.

Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan.

Withholding tax rates in pakistan 2018-19 pdf. Where the taxable salary income does not exceed Rs. For contracts the rate of tax. It is a specific amount that both the buyer and seller have to pay when a property is sold.

As per Finance Supplementary Amendment Bill 2018 passed by Government of Pakistan in September 2018 following slabs and income tax rates will be applicable for salaried persons for the year 2018-2019 who meet the following income condition. Withdrawal payment on cash exceeding at rate of Rs 50000 per day. The main residence nil-rate band albeit the main residence nil-rate is subject to the taper withdrawal below.

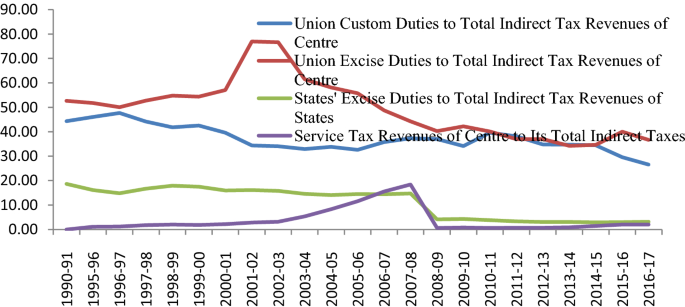

Income Tax Ordinance 2001 Income Tax Rules 2002 Appellate Tribunal Rules 2010 Appointment of ITAT Members Rules 1998 Voluntary Declaration of Domestic Assets Act 2018 Foreign Assets Declaration and Repatriation Act 2018 Procedure for Deposit of Tax. During FY 2018-19 the share of customs duty and FED has increased whereas the share of direct taxes. For estates worth in excess of 2m a 50 taper withdrawal applies.

Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Register for Income Tax. Other than stock fund was liable to tax and withholding tax 25.

Files 03 Non files 06. According to the withholding tax rates in Pakistan 2018-19 the buyer of the home who is also an income tax filer has to pay a 2 withholding tax whereas a buyer who is a non-filer has to pay 45 tax. 400000 the rate of income tax is 0.

In general payments made on account of dividend interest royalty and fee for technical services income derived from Pakistan sources are subject to a 15 withholding tax WHT which tax has to be withhelddeducted from the gross amount paid to the recipient. NAME HUZAIMA IKRAM Federal Direct Taxes of Pakistan Vol 1 2nd Edition 2018-19 With legislative history and footnotes as amended up to October 10 2018 DIRECT TAXES. The Finance has reduced this rate to 15.

Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021. As per income tax exemption bill passed by Government of Pakistan following slabs and income tax rates will be applicable for salaried persons for the year 2018-2019. The majority of these payments do not attract enhancement of 100 even if the recipients are not appearing on the ATL.

Payment for advertisement services to a non- resident person relaying from outside Pakistan Any Other payment except payment to foreign news agencies syndicate services non-resident contribution having no permanent establishment in Pakistan PAYMENT TO NON-RESIDENTS 151 Nature of payment Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART. Paragraph 1A Where the income of an individual chargeable under the head salary exceeds fifty per cent 50 of his taxable income the rates of. Tax and withholding tax on dividend received by a person from a Developmental REIT Scheme setup by 30 June 2018 was eligible for reduction by 50.

Tax Withdrawal From The Bank. 5 As per Tenth schedule tax rate will be increased by 100 in case the person not appearing in Active Tax Payer List A mutual fund or a collective investment scheme or a REIT scheme shall deduct Capital Gains Tax and on. Redemption of securities capital gain tax shall be deducted as specified below-.

Pakistan Mercantile Exchange 5. The government has to put in place concrete measures to bring in the. The withholding tax rate on dividend is 125 percent where the recipient is a filer of Pakistan tax return and 20 percent where the recipient is a non-filer.

As per the collection FY 2018-19 the sales tax is the top revenue generator with 381 share followed by direct taxes with 378 customs 179 and FED 62 Graph 1. In case of a stock fund if dividend receipts of the fund are less than capital gains the rate of tax deduction shall be 125 instead of 10. PAKISTAN BUDGET DIGEST 2018-19 Income Tax Rationalization of withholding tax rates for non-filers For salessupplies the rate of tax for non-filers has been increased from 7 to 8 in the case of companies and from 775 to 9 in the case of persons not being companies.

Change your personal details. Tax rates 201819 201718 Main rate 40 40 Chargeable on lifetime transfers 20 20 Transfers on or within 7 years of death 40 40 Reduced rate 36 36. In case of a stock fund if dividend receipts of the fund are less than capital gains the rate of tax deduction shall be 125 instead of 10 httptagmcopdfWithHoldingRatesTaxYear2019pdf Tariq Abdul Ghani Maqbool Co.

In case of federal provincial government on the day tax is deducted. Royalties and fees for technical service paid to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 15 percent. Thus played a vital role by highlighting improvements in the existing taxation laws and suggesting concrete measures for generating tax revenues.

Pakistan S Tax Reforms A Critique

Pakistan Salary And Income Tax Calculator For Year 2018 2019

Pakistan S Top Tax Payers Pakistan Dawn Com

Https Www Eadvisors In Authorised Capital Vs Paid Up Capital Share Capital Meaning Of Authorised Share Capital Meaning Of Paid In 2020 Capitals Paying Shared

Property Tax In Pakistan 2019 2021 Graana Com Blog

Income Tax What The Salaried Class Will Pay Now Pakistan Defence

Agriculture Income Tax In Pakistan Mohsin Tax Consultants

Pakistan Staff Report For The 2015 Article Iv Consultation Ninth Review Under The Extended Arrangement Request For Waivers Of Nonobservance Of Performance Criteria And Request For Modification Of A Performance Criterion In

Pakistan Fourth And Fifth Reviews Under The Extended Arrangement And Request For Waivers Of Nonobservance Of Performance Criteria In Imf Staff Country Reports Volume 2014 Issue 357 2014

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Do Governance Quality And Ict Infrastructure Influence The Tax Revenue Mobilisation An Empirical Analysis For India Springerlink

How To Calculate Income Tax In Excel

The Kingdom Of The Netherlands Aruba In Imf Staff Country Reports Volume 2018 Issue 363 2018

Full Article Pakistan S Search For A Successful Model Of National Political Economy

Https Www Accaglobal Com Content Dam Acca Global Pdf Students Acca F6 Examdocs Pakistan Tx Pkn F6 Examdocs 2018 Pdf

Posting Komentar untuk "Withholding Tax Rates In Pakistan 2018-19 Pdf"