Withholding Tax Rates Japan

Exemption from withholding taxes on interest subject to. The withholding tax rate is 1021 of sales consideration not a capital gain.

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

Where a seller of Japanese real estate is non-resident a buyer has to withhold Japanese income tax from the sales consideration.

Withholding tax rates japan. 15315 tax will be also imposed on redemption profits derived from discount bonds such as T-bills from 1 January 2016. In some cases withholding tax obligation of the buyer might be exempt under the Japanese tax law. The Protocol amends the existing income tax treaty 2003 and provides for.

Taxable Income Tax Rate less than 195 million yen 5 of taxable income 195 to 33 million yen 10 of taxable income minus 97500 yen 33 to 695 million yen 20 of taxable income minus 427500 yen 695 to 9 million yen 23 of taxable income minus 636000 yen 9. This table lists the income tax and withholding rates on income other than for personal service income including rates for interest dividends royalties pensions and annuities and social security payments. Surtax A 21 surtax applies on the withholding tax for certain Japanese-source income as discussed below.

In cases where the DTT rate is lower than 15315 rate the DTT rate will be applied. If the form is not submitted by the deadline the tax is withheld at a rate based on prevailing Japanese laws instead of the tax rate that is prescribed by the Income Tax Convention in Japan. For the purpose of claiming tax treaty benefits PDF207KB.

From United States tax to interest received by residents of Japan on debt obligations guaranteed or insured or indirectly financed by those Japanese banks or insured by the Government of Japan. Thus no liability is accepted. Outline of Japans Withholding Tax System Related to Salary The 2020 edition For Those Applying for an Exemption for Dependents etc.

However if the Japanese company paying the dividends to a non-resident shareholder is a listed company this withholding tax rate. The non-resident however may apply for a refund of the excess payment by submitting the Application Form for Refund of the Overpaid Withholding Tax. Application Form for Certificate of Residence in Japan.

Includes OTC shares and listed investment trusts ETF REIT and Nikkei 300. A non-resident taxpayer whose employment income has not been subject to a 2042 percent withholding tax must file a return by the day of their departure from Japan or by 15 March of the following year if a tax agent is appointed and pay the 2042 percent tax. Deloitte International Tax Source Online database providing tax rates including information on withholding tax tax treaties and transfer pricing.

Treasury Department reporting the entry into force of the Protocol to the Japan-United States income tax treaty. 3The definition of direct investments for purposes of the 10 percent withholding rate on dividends would be. Application Form for Income Tax Convention etc.

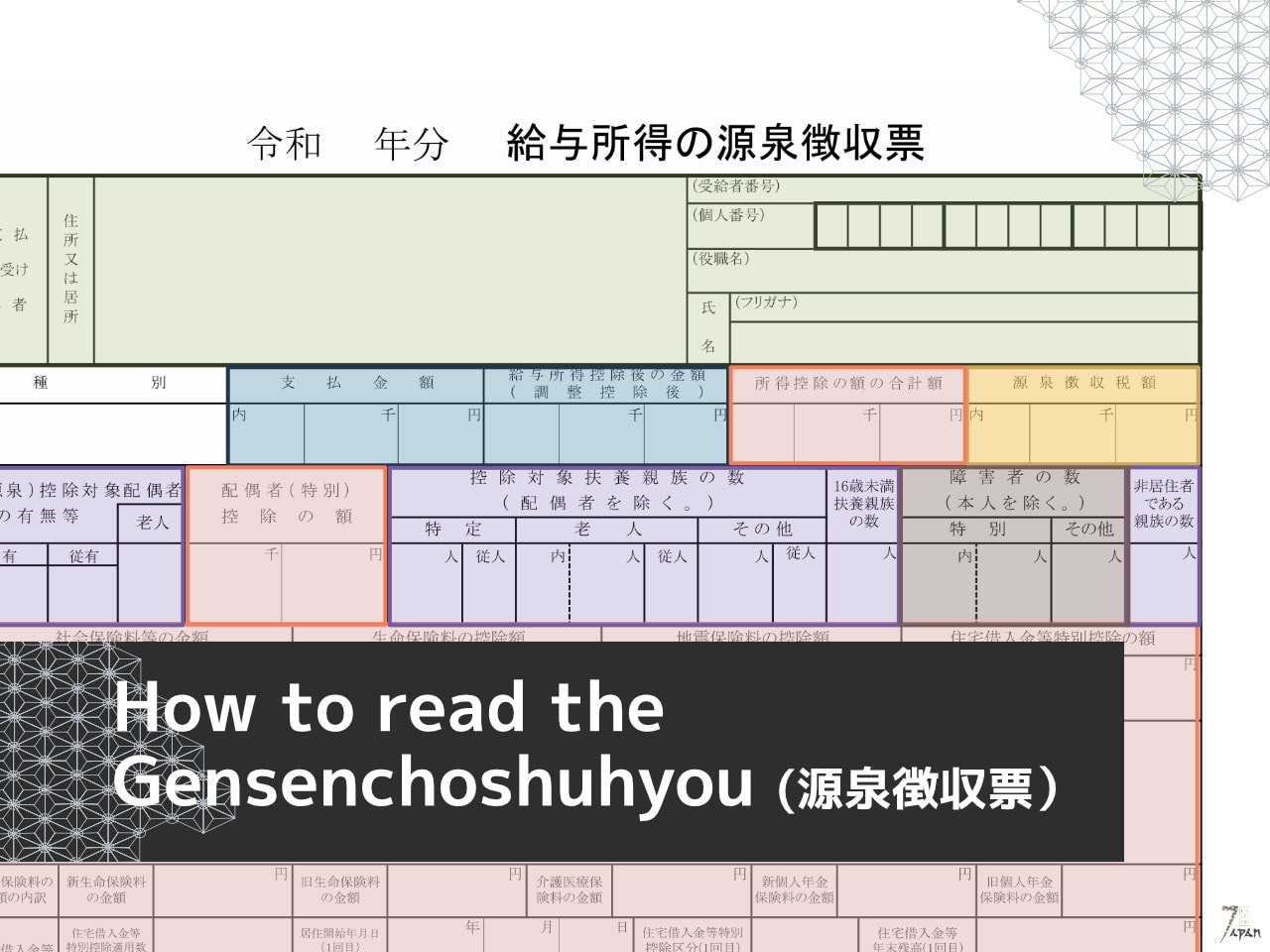

1 Withholding Tax Guide This Withholding Tax Guide is a translation of the 2019 edition of Gensen Choushu no Shikata. 72 rows However the WHT rate cannot exceed 2042 including the income surtax of 21 on any royalties. Tax Rates on Income Other Than Personal Service Income Under Chapter 3 Internal Revenue Code and Income Tax Treaties Rev.

Read todays release from the US. Global tax rates 2017 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS. 25 0 0 The Parliament has adopted a 15 withholding tax.

Global tax rates 2017 provides corporate income tax historic corporate income tax and domestic withholding tax rates for more than 170 countries. The corporate tax rate for a branch is the same as for a subsidiary. National Income Tax Rates.

Tax Rates Online An online rates tool produced by KPMG that compares corporate indirect individual income and social security tax rates within a country or across multiple countries. Under Japanese domestic tax law generally a non-resident shareholder either a non-resident company or a non-resident individual of a Japanese company is subject to Japanese withholding tax with respect to dividends it receives from such Japanese company at the rate of 2042. With Regard to Non-resident Relatives.

The contents reflect the information available up to. The effective tax rate for corporations inclusive of the local inhabitants and enterprise taxes based on the maximum rates applicable in Tokyo to a company whose paid-in capital is over JPY 100 million is approximately 30. This is an unofficial translation and reference material designed to help you understand the Japanese withholding tax system.

Taxation in Japan Preface This booklet is intended to provide a general overview of the taxation system in Japan.

Step By Step Document For Withholding Tax Configuration Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax Images Stock Photos Vectors Shutterstock

Step By Step Document For Withholding Tax Configuration Sap Blogs

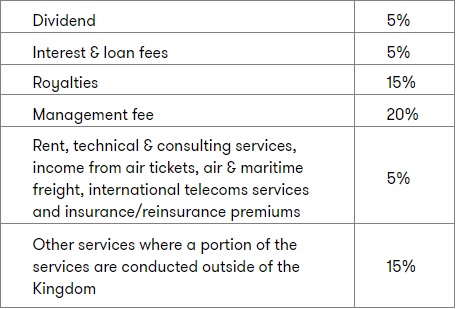

Panama Tax Treaties Tax Panama

Real Estate Related Taxes And Fees In Japan

Withholding Tax Images Stock Photos Vectors Shutterstock

Foreign Dividend Withholding Tax Guide Intelligent Income By Simply Safe Dividends

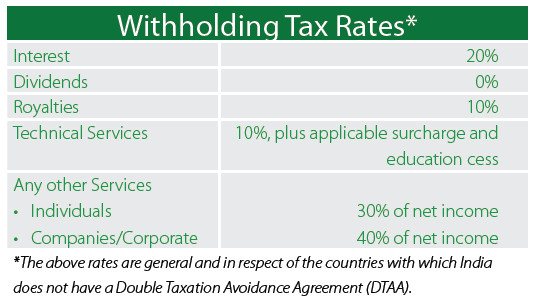

Asiapedia Withholding Tax Rates In India Dezan Shira Associates

Step By Step Document For Withholding Tax Configuration Sap Blogs

Gensenchoshuhyou How To Read Japanese Withholding Tax Slip Practical Japan

Practical Example On How To Use Corporate Investment Income Case Study Ibfd

Global Corporate And Withholding Tax Rates Tax Deloitte

Step By Step Document For Withholding Tax Configuration Sap Blogs

Global Corporate And Withholding Tax Rates Tax Deloitte

Real Estate Related Taxes And Fees In Japan

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Withholding Tax Stock Illustrations 213 Withholding Tax Stock Illustrations Vectors Clipart Dreamstime

Posting Komentar untuk "Withholding Tax Rates Japan"