Withholding Tax Rates Kenya 2021

The Act amends the Income Tax Act and the Value Added Tax VAT Act of Kenya. If yes then this informative article is for you.

Global Corporate And Withholding Tax Rates Tax Deloitte

Resident WHT is either a final tax or creditable against CIT.

Withholding tax rates kenya 2021. Withholding Tax is deducted at source from several income like. The directors and employees are not personally taxed on the benefit. Withholding tax rates kenya 2021.

What is withholding VAT. This marginal tax rate means that your immediate additional income will be taxed at this rate. What is exempt from Withholding Tax.

Any amount withheld should be remitted to KRA on or before the 20th day of the following month. One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. Either 5 of the tax payable or twenty thousand shillings whichever is higher.

What is withholding VAT. This is applicable for the months of April May and June 2021. Tax paid on imported services for use in the registered persons taxable business may be deducted as input tax in subsequent VAT returns.

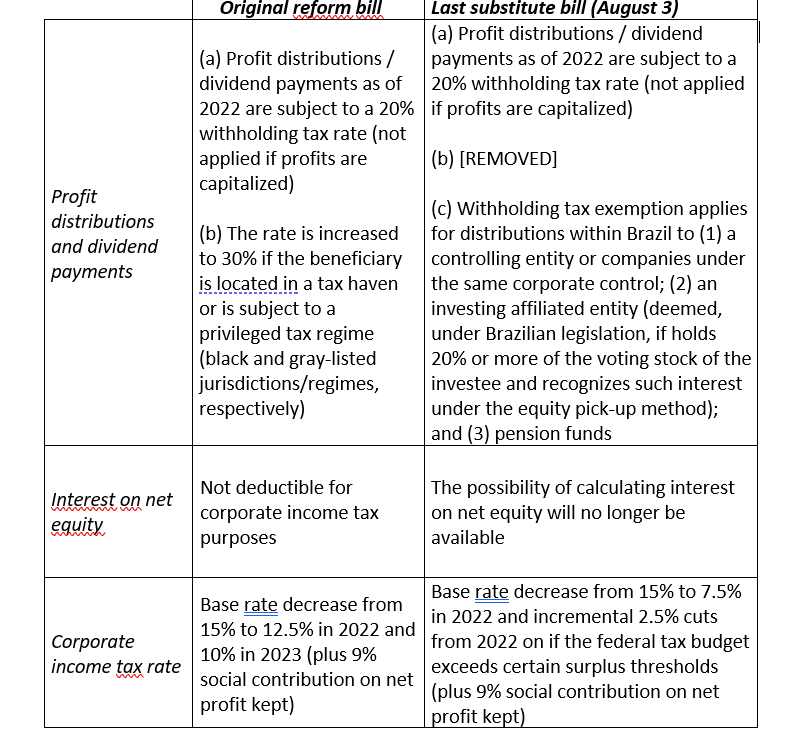

And ii the highest individual income tax band to 30 from the 25. That means that your net pay will be 757 KSh per year or 6308 KSh per month. Withholding Tax Rates 1 January 2021 Country Withholding Tax Country Withholding Tax Argentina1 7 Malta 0 Australia 30 Mauritius 0 Austria 275 Mexico 10 Bahrain 0 Mexico REITs4 30 Bangladesh 20 Montenegro 9 Belgium 30 Morocco 15 Bosnia 5 Namibia 20 Botswana 75 Netherlands 15 Brazil 0 New Zealand 30 Brazil Interest on Capital 15 Nigeria 10.

Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. Either 5 of the tax payable or twenty thousand shillings whichever is higher. These rate changes became effective on 1 January 2021.

25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. It can be pre-payment or a final tax. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125.

Corporate - Withholding taxes Last reviewed - 01 July 2021 WHT is levied at varying rates 3 to 25 on a range of payments to residents and non-residents. Your average tax rate is 2523 and your marginal tax rate is 145. In addition the Act has increased the withholding tax rate for dividends paid to a nonresident person from 10 to 15.

The key amendments made through the Act include the reinstatement of. The benefit is the difference between actual interest charged and the interest computed using the Commissioners prescribed rate published quarterly. The new definition also excludes certain activities which are preparatory and auxiliary in nature from creating a PE.

The withholding tax rate applicable for sales promotion advertising and transportation services is 20 on the gross fees while reinsurance premiums are to be taxed at 5. Deducted and remitted on or before the 20th of the following month. Withholding tax rate of 15 on the deemed interest shall be deducted and paid to the Commissioner by the 20th day of the month following the month of computation.

Withholding VAT is charged at a the rate of 2 of the value of taxable supplies with effect from 07112019. Additionally the VAT rate was reinstated to 16 from 14 through a legal notice in accordance with the law. Global tax rates 2021 is part of the suite of international tax resources provided by the Deloitte International Tax Source DITS.

You will be given detailed information on How To File Withholding Tax Returns In Kenya Requirements Rates. The first return under the new rate is due by 20th February 2021. Tax paid on imported services for use in the registered persons taxable business may be deducted as input tax in subsequent VAT returns.

FBT is due whether the employer is exempted from tax or not at the resident CIT rate of 30 with effect from January 2021. I the resident corporate income tax rate to 30 from 25. In addition the new definition of the fixed place of business PE lacks a threshold as to how long a business must be operating in Kenya to create a PE.

The rate of Value Added Tax is 16 with effect from 1st January 2021. Withholding Tax Rates 2021 includes information on statutory domestic rates that apply to payments from a source jurisdiction to nonresident companies without a permanent establishment in that source jurisdiction. If you make 757 KSh a year living in Kenya you will be taxed 0.

One is required to declare the income and the withholding tax certificates upon filing individual tax returns and pay any tax due What is the penalty for late filing. The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA. Deducted and remitted on or before the 20th of the following month.

There is a proposal in the Finance Bill 2021 to expand the definition of PE to include a service PE concept. How To File Withholding Tax Returns In Kenya 2021 Are you looking for a way on How To File Withholding Tax Returns In Kenya. The following are aspects of federal income tax withholding that are unchanged in 2021.

Germany Taxing Wages 2021 Oecd Ilibrary

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

Corporate Income Dividend Withholding Tax Outline

Internet Consultation On Conditional Withholding Tax On Dividends Launched Pwc Tax News

Update Withholding Tax On Interest And Royalty Payments To Low Tax Countries

.webp)

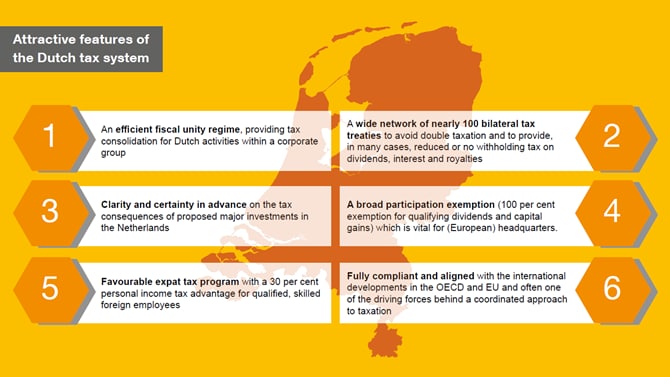

Tax Regulations For Dutch Companies

.jpg)

Tax Accounting Impact Tax Plan 2019 Pwc Insights And Publications

Corporate Income Dividend Withholding Tax Outline

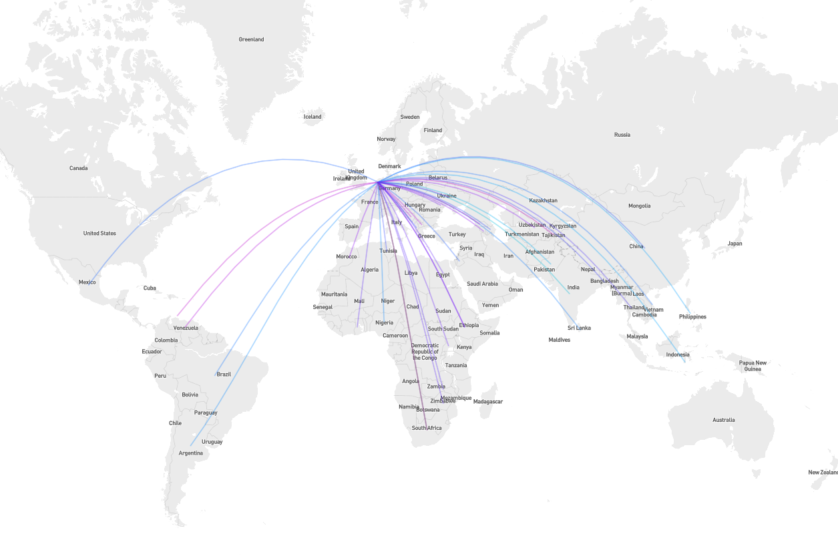

Have The Netherlands Tax Treaties With Developing Countries Become Fairer Ictd

Tax Treaties Database Global Tax Treaty Information Ibfd

Global Corporate And Withholding Tax Rates Tax Deloitte

Agreements On Beps 2 0 Provides Needed Breakthrough On The Future Of International Tax International Tax Review

How To Calculate Income Tax In Excel

Conditional Withholding Tax On Dividend Payments Proposed Deloitte Netherlands

Tax Treaties Database Global Tax Treaty Information Ibfd

Taxation In The Netherlands Doing Business In The Netherlands 2021 Pwc Netherlands

Posting Komentar untuk "Withholding Tax Rates Kenya 2021"