Withholding Tax Rates Kenya

Withholding VAT is charged at a the rate of 2 of the value of taxable supplies with effect from 07112019. The dates of training for regions outside Nairobi will be confirmed in due course.

Panama Tax Treaties Tax Panama

The treaties will in most cases allow for the set-off of withholding tax against.

Withholding tax rates kenya. KRA will be carrying out sensitisation on the same at Times Tower 5th Floor on main hall on 22nd November 2019 at 900am. Kenya Last reviewed 01 July 2021. The withholding tax rate is 5 for residents and 20 for non-residents.

Corporate - Withholding taxes Last reviewed - 01 July 2021 WHT is levied at varying rates 3 to 25 on a range of payments to residents and non-residents. The various tax incentives for new listings or introductions on. Some of these treaties provide for preferential withholding tax rates.

In addition the Act has increased the withholding tax rate for dividends paid to a nonresident person from 10 to 15. Calculate withholding tax on invoice in Kenya When a taxpayer trader supplies and invoices an appointed withholding VAT Agent the payment for supply is made less VAT charged or that which ought to have been charged. The person making the payment is responsible for deducting and remitting the tax to Kenya Revenue Authority KRA.

25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021. In most cases however the standard tax rates set out above apply. 21 rows Payment of withholding tax is done online via iTax generate a payment slip and present it at any of the appointed KRA banks to pay the tax due.

7 Mauritius Possibly with effect from 1 January 2017. Withholding Tax Transactions in Kenya. In Kenya the agents deduct 2 of the VAT and remit it to KRA.

The remaining balance of 14 is paid to the supplier. Dividends received by a company resident in Kenya from a local subsidiary or associated company in which it controls directly or indirectly 125 or more of the voting power. What is exempt from Withholding Tax.

For resident suppliers of goods and services and commercial properties landlords the withholding VAT rate is 6. In Kenya 0 KRA Withholding Tax rates This is a method whereby the payer of certain incomes is responsible for deducting tax at source from payments made and remitting the deducted tax to KRA. Marketing commissions and residue audit fees paid to foreign agents in respect of export of flowers fruits and vegetables.

How do I pay for Withholding VAT. No VAT is withheld on exempt goods exempt services and Zero rated supplies. Any VAT withheld in exempt and Zero rated supplies is treated as tax paid in error and therefore refundable by the Commissioner.

The remaining balance of 14 is paid to the supplier. In Kenya the agents deduct 2 of the VAT and remit it to KRA. Calculate Withholding Tax On Invoice In Kenya When a taxpayer trader supplies and invoices an appointed withholding VAT Agent the payment for supply is made less VAT charged or that which ought to have been charged.

Interest when paid to both resident and non-resident persons is liable to withholding tax at 15 on the gross interest paid with the exception of interest from housing bonds to resident persons which is subject to withholding tax at the rate of 10 on the gross interest paid. However the Tax Laws Amendment No2 Act 2020 introduced the following additional exemptions from Minimum Tax. You can also pay via Mpesa.

Use the KRA Pay bill Number 572572. You can also pay via Mpesa. The rate of Minimum Tax is 1 of the gross turnover effective 1st January 2021.

In Kenya there are Withholding VAT under the Tax Procedures Act 2015. Payment of withholding tax is done online via iTax generate a payment slip and present it at any of the appointed KRA banks to pay the tax due. The tax is payable by the 20th of.

Interest from banks at 15 dividends at 5 and royalties at 5 insurance commission at 5 and consultancy fee 5 for residents. Withholding Tax is deducted at source from several income like. The Account Number is the Payment Registration number quoted at the top right corner of the generated payment slip.

However the withholding tax rate on dividend payments to non-residents has been increased from 10 to 15. Kenya has double tax avoidance treaties with the following countries. The withholding tax rate applicable for sales promotion advertising and transportation services is 20 on the gross fees while reinsurance premiums are to be taxed at 5.

The VAT is withheld by appointed agents only. Use the KRA Pay bill Number 572572. The percentage deducted varies between incomes and is dependent on whether you are a resident or non- resident.

Corporation tax rate reduced from 30 to 25 effective 1 st January 2020. Resident WHT is either a final tax or creditable against CIT. Consequently these expenses are not subject to withholding tax as they are not construed to be income earned in or derived from Kenya.

Where such expenses are deductible under the provisions of a Double Tax Treaty such amounts will now be construed as accruing or derived from Kenya and therefore subject to non-resident rates of withholding tax. The tax shall be payable by the 20th day of the 4th 6th 9th and 12th month of the accounting period.

Tax Training Taxation Of Government Ministries 26 May

Global Corporate And Withholding Tax Rates Tax Deloitte

How Compounding Can Grow Tiny Amounts Into Millions Money Market Fund Management Money Market Account

Withholding Tax Rates To Non Residents Download Table

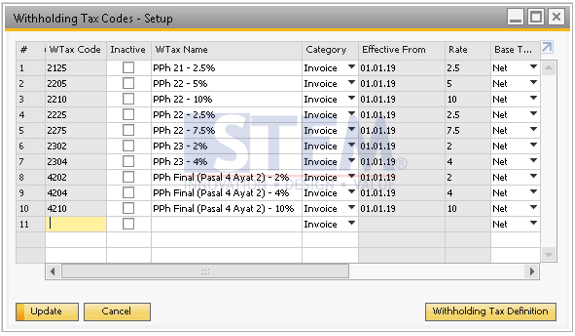

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

Hf Group Forecasts Fy Decline In Profits Profit Forecast Previous Year

Pdf Tax Systems And Tax Harmonisation In The East African Community Eac

Tax Formula Tax Tax Deductions Adjusted Gross Income

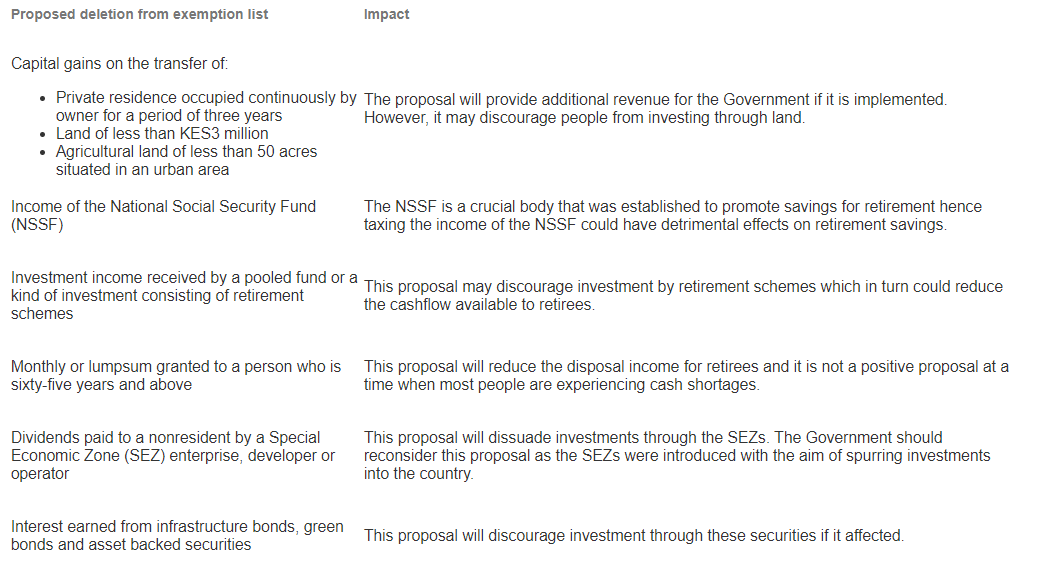

Kenya Proposes Tax Laws Amendments Bill 2020 Ey Global

Pin On Teaching Social Studies

Tax Training Taxation Of Government Ministries 26 May

Royalty Withholding Tax Rates In Different Countries In 2020 Royalty Tax Recovery Corp

How To Pay Presumptive Tax In Kenya Winstar Technologies Business Tax Community Business Paying Taxes

Irs Webinar For Small Business Tax Changes 2018 Tax Reform Basics For Small Businesses And Pass Through Entities Thursday N Irs Taxes Income Tax Filing Taxes

Tax Training Taxation Of Government Ministries 26 May

Posting Komentar untuk "Withholding Tax Rates Kenya"