Withholding Tax Rates Lebanon

75 for services and 225 for other than services. Lebanon has one of the most competitive corporate income tax rates regionally and internationally equal to 17 as per Latest regulations making Lebanons business environment one of the most attractive and competitive for foreign and national companies.

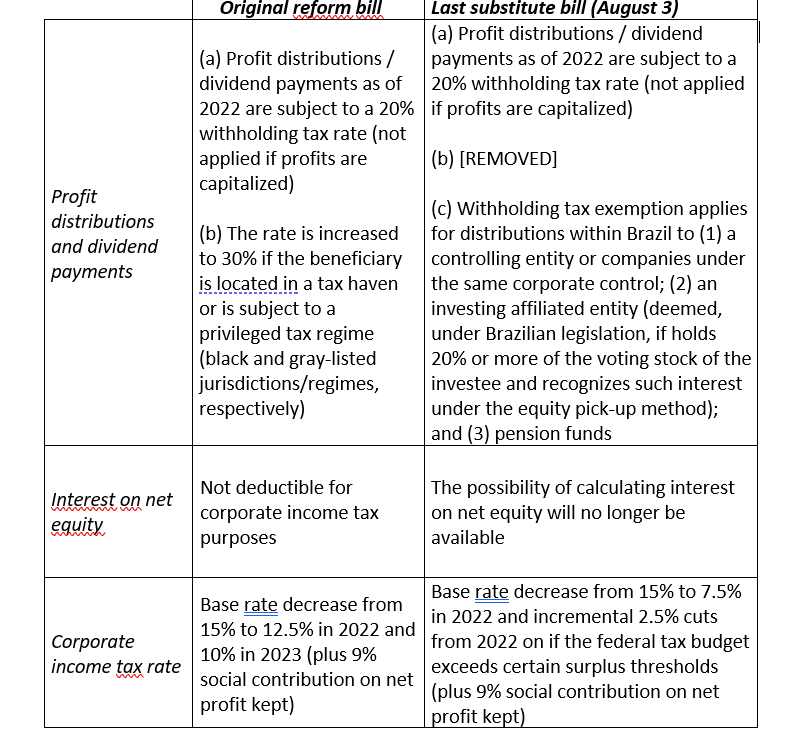

Brazil S Upcoming Tax Reform Will Impact Inbound Investors Mne Tax

With some variation the topics covered are taxes on corporate income and gains determination of trading income other significant taxes miscellaneous matters including foreign-exchange controls debt-to-equity rules transfer pricing controlled foreign companies and anti-avoidance legislation and treaty withholding tax rates.

Withholding tax rates lebanon. This Tax essentially concerns. The withholding tax rate varies depending on among other attributes whether the rret as e 3 216 Non-Resident Withholding Tax Rates. Income of individual persons.

Tax is withheld from dividends paid to resident and non-resident shareholderspartners at a rate of 10. Dividends received from a Lebanese entity are taxable at a rate of 10 although a reduced rate of 5 applies if certain conditions are satisfied. Income Payment made by NGAs LGU etc to its localresident suppliers of services other than those covered by other rates of withholding tax.

Subject to a 75 withholding tax. Individuals and partners in a private company are subject to tax on profits after deduction of family allowances on a progressive scale as follows. Inheritance and gift tax rates vary from 3 to 45 depending on the amount received and the affinity to the deceased or donor after deducting special exemptions applicable to estate beneficiaries.

A withholding tax at a rate of 10 on all proceeds derived from movable capital assets fixed assets generated in Lebanon. At the back of this Tax Guide you will find a list of the names and codes for all. Income Payment made by top withholding agents to their localresident suppliers of goods other than those covered by other rates of withholding tax.

Ministry of Finance Lebanon. The Personal Income Tax Rate in Lebanon stands at 25 percent. The rate has increased from 7 to 10 for 3 years from 1 August 2019.

10 10 NA. Distributed dividends interest and income from shares. From 2 to 25 instead of 2 to 20 starting 1 August 2019 based on article 23 of Budget Law 2019.

International conventions and avoidance of double taxation withholding taxes. Personal Income Tax Rate in Lebanon averaged 2056 percent from 2004 until 2021 reaching an all time high of 25 percent in 2020 and a record low of 20 percent in 2005. This rate is effective starting 1 August 2019 and applied over a period of three years until 31 July 2022.

Interest on bank deposits are subject to 10 and apply for residents and non-residents. Dividends received from a foreign entity are taxable at a rate. Lebanon at a flat rate of 15 of their business income.

Withholding tax WHT rates WHT rates DivIntRoy Resident. This page provides - Lebanon Personal Income Tax Rate - actual values historical. 15 for corporations and limited partnerships The tax rate for non-residents is.

Excise taxes are levied on certain beverages and spirits tobacco products gasoline and vehicles. Everything you need to know about taxes. 10 10 75.

Income revenues and interest earned from accounts opened at Lebanese banks and from treasury bonds are now subject to a 10 withholding tax WHT instead of 7. Subject to Canadas 25 withholding tax on the income. Directors and shareholders fees.

Bethel Park Bethel Park S. A 10 WHT is levied on income derived from movable capital generated in Lebanon. Dividend distribution withholding tax WHT.

We have up-to-date key fact summaries as well as detailed analyses of the tax regime in jurisdictions around the world covering corporate taxation individual taxation and business and investment. Certain payments to nonresidents such as those made in consideration of projects performed in Lebanon or equipment installed in Lebanon are subject to a 225. Taxable income is comprised of the following.

Https Assets Ey Com Content Dam Ey Sites Ey Com En Us Topics Financial Services Ey Global Withholding Tax Reporter Pdf

Https Cthi Taxjustice Net Cthi2019 20 Double Tax Treaties Pdf

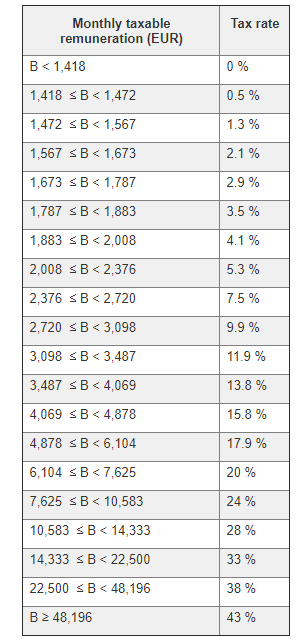

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

Mali Selected Issues In Imf Staff Country Reports Volume 2018 Issue 142 2018

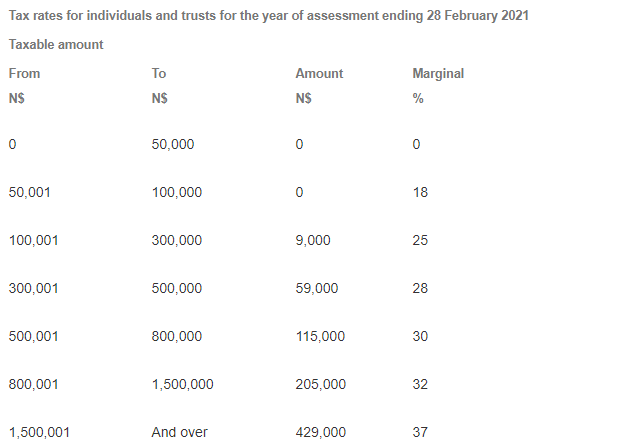

Namibia Issues 2020 Budget Ey Global

Doing Business In The United States Federal Tax Issues Pwc

Royalty Withholding Tax Rates In Different Countries In 2020 Royalty Tax Recovery Corp

Global Corporate And Withholding Tax Rates Tax Deloitte

The Withholding Tax Pas In France Welcome To France

Chapter 15 Resource Rich Developing Countries And International Tax Reforms In Corporate Income Taxes Under Pressure

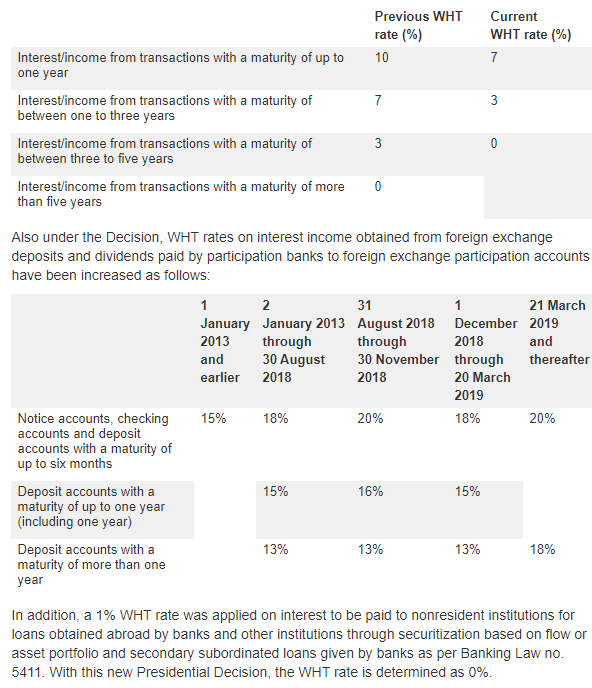

Turkey Announces Change In Withholding Tax Rates On Interest Obtained From Deposits Issued Abroad And Foreign Exchange Deposits Ey Global

Tax Treaties Database Global Tax Treaty Information Ibfd

Real Estate Taxation In Thailand Thai Property Group

Russia S Double Tax Treaty Agreements Russia Briefing News

Posting Komentar untuk "Withholding Tax Rates Lebanon"