Withholding Tax Rates Nigeria

Dividends interest and rates. Employees who earn not more than the National Minimum Wage currently N30000 are no longer liable to tax or deduction of monthly PAYE.

Global Corporate And Withholding Tax Rates Tax Deloitte

As an advanced tax payment it is used later to reduce the amount of tax payable by such tax payer.

.webp)

Withholding tax rates nigeria. Withholding Tax WHT is a method used to collect Income Tax in advance. Commission is subjected to withholding tax in Nigeria. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments.

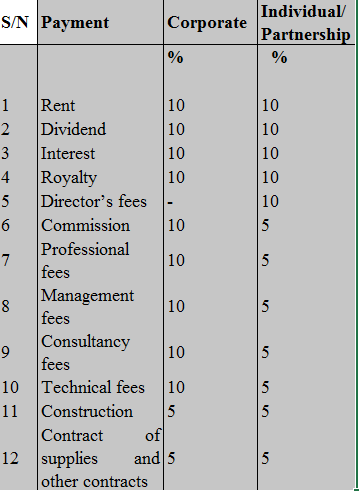

Tax Deduction in percentage. The Withholding Tax Rates in Nigeria WHT varies among individuals and companies corporate bodies. The Federal Inland Revenue Service.

It is an advanced payment of tax due on the transaction being done at the time of its deduction. WHT is deducted at varying rates ranging from 5 to 10 depending on the transaction. These also vary amongst either the individuals or companies involved.

WITHHOLDING TAX RATE TABLE - NIGERIA Companies Individuals Divident Interest Rent 10 10 Royalties 15 15 Commissions Consultancy Professional Technical Management Fees 10 5 Building Construction related activities 5 5 Contract of Supplies Agency arrangements 5 5 Director Fees 10 5. The application rates and provision of the Withholding Tax in Nigeria covers transactions of resident companies or individuals and non-resident companies or non-resident individuals. The rate of withholding tax on dividend interest and royalty is reduced to 75 when paid to a recipient resident in a country with which Nigeria has a double taxation treaty.

9 rows Nigeria has treaty agreements with about eight 8 countries and these countries are granted a. Rates Resident companies Companies income tax CIT. A withholding tax of 10 is deducted from the dividend paid by a Nigerian company to a non-resident company.

Because it is deducted at source the tax payer has no option but to pay it. Shareholders that are resident in a country that has signed a double tax treaty with Nigeria will however enjoy the reduced rate of 75. 9 rows Withholding Tax In Nigeria.

What is the withholding tax rate in Nigeria. WITHHOLDING TAX RATES IN NIGERIA. Dividends paid out of profits that have been subjected to petroleum profits tax will now suffer withholding tax of 10.

The prevalent tax rate on commission is 10 WHT but if the principal is a non-resident any sales proceed from the arrangement will attract 50 Wht All types of contract activities and arrangements other than. Large Companies over 100 million turnover Medium Companies 25 million to 100 million turnover Small Companies less than 25 million turnover 30 20 0 Tertiary education tax TET 2 Petroleum profits tax for petroleum companies 851 standard rate. COMPANIES INCOME TAX RATES ETC OFTAX DEDUCTED ATSOURCE WITHHOLDING TAX AMENDMENT REGULATIONS 2015.

Rate of Withholding Tax in Nigeria The rates of withholding tax in Nigeria varies among individuals companies and corporate bodies. B21-24 Printed andPublished byTheFederal Government Printer LagosNigeria FGP09220 15300 Annual Subscription from 1stJanuary 2015 isLocal. Withholding Tax in Nigeria as the name implies is a tax with-held at source.

Changes to the PITA Tax Identification Number to Open or Maintain a Bank Account. In most cases however the Withholding Tax rates for individuals is anythin g from 5 percent to 10 percent while for companies it is between 25 percent to 10 percent. Penalty for late filing of returns is N25 000 for the first month it occurs and N5 000 for each subsequent month the failure continues.

Rates And Its Application. 5 5 or 10 depending on the the type of transaction and the tax authority responsible for the collection of the tax Federal Inland Revenue Service or State Inland Revenue Service. These countries include the UK Northern Ireland Canada France Belgium the.

Nigeria has treaty agreements with about eight 8 countries and these countries are granted a reduced rate of WHT deduction usually at 75 of the generally applicable WHT rate. However the rate is 75 for a non-resident company located in a country that has entered into a DTT with Nigeria. Senate Queries FIRS For Unremitted N14bn Withholding Tax and VAT.

Withholding TaxAmendment Regulations 2015. Where a taxpayer has no taxable income because of personal reliefs and allowances or total income produces a tax lower than the minimum tax a minimum tax rate of 1 of the total income is payable. The due date for filing WHT returns is 21st day of every succeeding month.

Detailed description of corporate withholding taxes in Nigeria The period for filing WHT is 21 days after the duty to deduct arose for deductions from companies. N2L50000 Surface Mail.

How To Calculate Income Tax In Excel

Understanding Withholding Tax Regulations In Nigeria Oando Plc

Dividend Withholding Tax Rates In South Africa S Tax Treaties With Download Table

Pin By Sab Auditing Of Accounts On Vat In Uae Digital Tax Accounting Firms Vat In Uae

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Calculate Income Tax In Excel

Laos To Implement New Income Tax Rates Tax Lao Peoples Democratic Republic

Global Corporate And Withholding Tax Rates Tax Deloitte

How To Calculate Foreigner S Income Tax In China China Admissions

Overview Of Withholding Tax In Nigeria

Understanding Tax Rates In Nigeria Robert Inoma And Co

Global Corporate And Withholding Tax Rates Tax Deloitte

Firs S Vat Of N29 2 Million Imposed On Bank Reversed By Tribunal Revenue Capital Market Accounting

Nigerian Tax Sound Bites Withholding Tax 2 By Chidi U Medium

How To Calculate Income Tax In Excel

.webp)

Tax Regulations For Dutch Companies

Tax Treaties Database Global Tax Treaty Information Ibfd

Dividend Withholding Tax Rates In South Africa S Tax Treaties With Download Table

Posting Komentar untuk "Withholding Tax Rates Nigeria"