Withholding Tax Table Vendor

15 10 0 but VAT 19 unless exempted. Enter the Vendor ID Withholding Tax Enabled of the Vendor to be Invoiced.

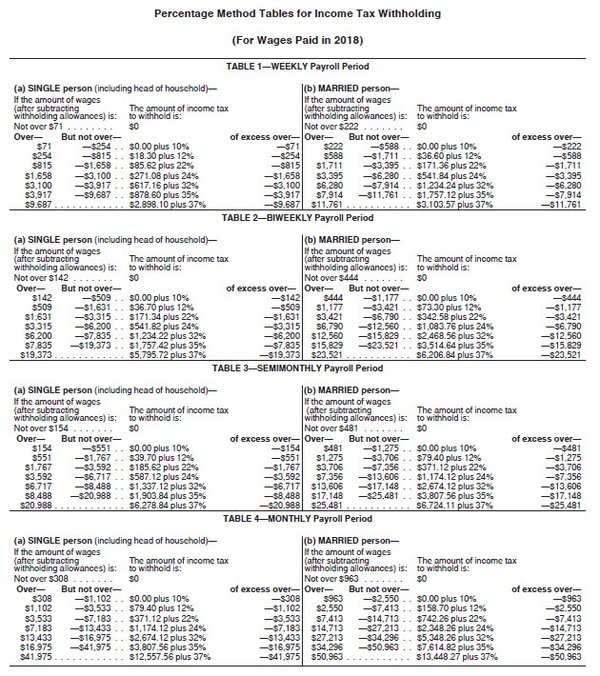

Irs Releases New Withholding Tax Tables For 2018 Insightfulaccountant Com

The part of the vendor master record where you record information about which taxes you have to withhold from payments to a vendor.

Withholding tax table vendor. Withholding agents are permitted to reduce the rate of withholding if the beneficial owner properly certifies their eligibility for a lower rate either based on operation of the US tax code or based on a tax. Angola Last reviewed 24 June 2021 Dividends and royalties are taxed at 10 and the tax is withheld at source by the paying entity in Angola. Vendor master record withholding tax types X.

LFBW Vendor master record withholding tax types X T059Z. The withholding tax Q is calculated now as follows. To resolve this problem change the code in the CreateVendBillWithhTax function in the Vendor Bill Line table 12182 as follows.

Select Tax Code for the Tax Applicable. Effective January 1 2018 to December 31 2022. Purchase Account and Amount for the Invoice.

To access the vendor master on the SAP Easy Access screen choose Accounting. 000 20 over P685. Withholding Tax Amount.

End of the deleted line. Enter Amount for Invoice. Interest on loans granted by third parties or shareholders is liable to investment income tax at 15 and 10 respectively.

REVISED WITHHOLDING TAX TABLE. In which sap transactional table vendor witholding master data fk01- withholding tax data. All persons withholding agents making US-source fixed or determinable annual or periodical FDAP payments to foreign persons generally must report and withhold 30 of the gross US-source FDAP payments such as dividends interest royalties etc.

Select Tax Indicator Calculate Tax. Not available The vendor. Check Document Type as Vendor Invoice.

15 10 30 unless rates provided by Double tax treaties. While recording outgoing payment transaction FK53 or vendor invoice FB60. P35616 30 over P2192.

82 Zeilen SAP Withholding Tax Tables. In S4HC if you dont maintain the vendor master data the Withholding Tax Tab will not appear which is one of the reasons why the customer dont know how to post the withholding tax simply because the tab is not there. For generic information about withholding tax data in the vendor master see Defining Liability to Tax and Authorization to Deduct Tax.

On the Tax information FastTab in the Status field select the status of the Permanent Account Number PAN for the vendor. Vendor Master Bank Details LFBK. Withholding Tax Table Fields.

Vendor master dunning data LFB5. The withholding tax reason code total amount base excluded amount not taxable amount by treaty not taxable amount taxable base and withholding tax amount. The following options are available.

View the full list of Tables for Vendor Master. Define the following in the vendor. Delete the following line.

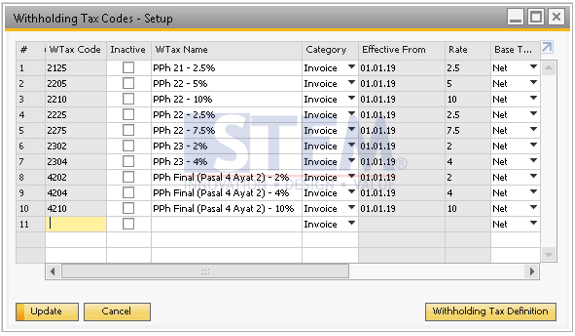

Code and name of the withholding tax codes defined as defaults for the business partner. After completing the above fields click Withholding tax. P134247 32 over P5479.

LFA1 Vendor Master General Section LFB1 Vendor Master Company Code LFBK Vendor Master Bank Details LFM1 Vendor master record purchasing organization data LFC1 Vendor master transaction figures LFBW Vendor master record withholding tax types X and more. In the Withholding tax group field enter the default withholding tax group to use in vendor transaction payment journals. P8219 25 over P1096.

The application of the percentage rate or formula The accumulation table contains a base amount WT_BSaa increased by b and a withholding tax amount WT_WTaa increased by q after document posting for posting month aa. You specify whether and for how long the company code is authorized to deduct withholding tax for the specified withholding tax type. Step 2 In the Next Screen Enter Company Code you want to post invoice to.

77 Zeilen SAP Vendor Master Tables. If the user selects to print details in the dialog box the report. Step 3 In the next screen Enter the Following.

You can change these codes and choose any code that appears in the income tax withholding codes and in the VAT withholding codes. On the Invoice and delivery FastTab select the Calculate withholding tax check box to calculate withholding tax for the vendor. Vendor master record purchasing organization data.

Vendor ID of the Vendor to be Invoice and Invoice Date. In order to be able to post withholding tax in vendor business transactions for each withholding tax type the company code must be authorized to deduct withholding tax and the vendor must be subject to withholding tax. Withholding tax - monthly - This report is used to print for each vendor account details of the withholding tax amounts for all invoices that were paid during a month.

Q WT Bb - Q where WT is the calculation rule for withholding tax ie. As we know it is being mainly used. 7 Zeilen Here we would like to draw your attention to LFBW table in SAP.

Step 1 Enter transaction FB60 in SAP Command Field. Vendor master withholding tax accounting table is LFBW. Displays whether the WT code is an income tax withholding or VAT withholding.

Vendor withholding tax master data in Transactional data.

Extended Withholding Tax Sap Simple Docs

Solved Determining Federal Income Tax Withholding Data About The Chegg Com

How To Post Withholding Tax In S 4hana Cloud Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Extended Withholding Tax Sap Simple Docs

How To Post Withholding Tax In S 4hana Cloud Sap Blogs

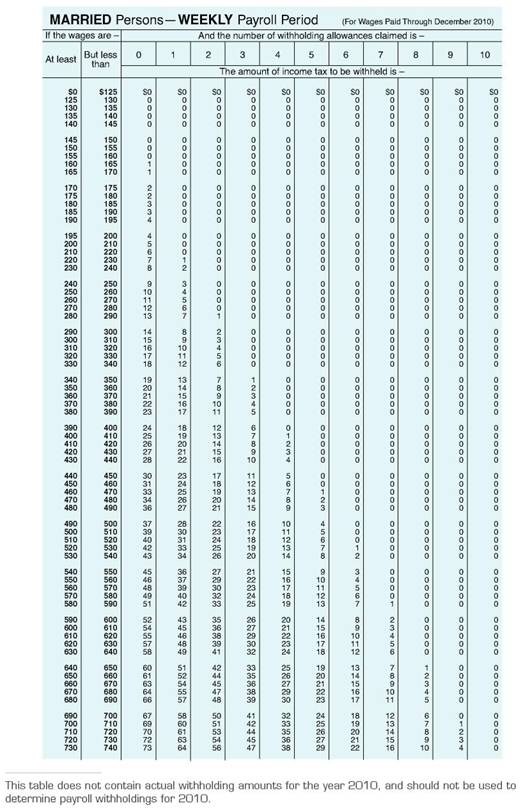

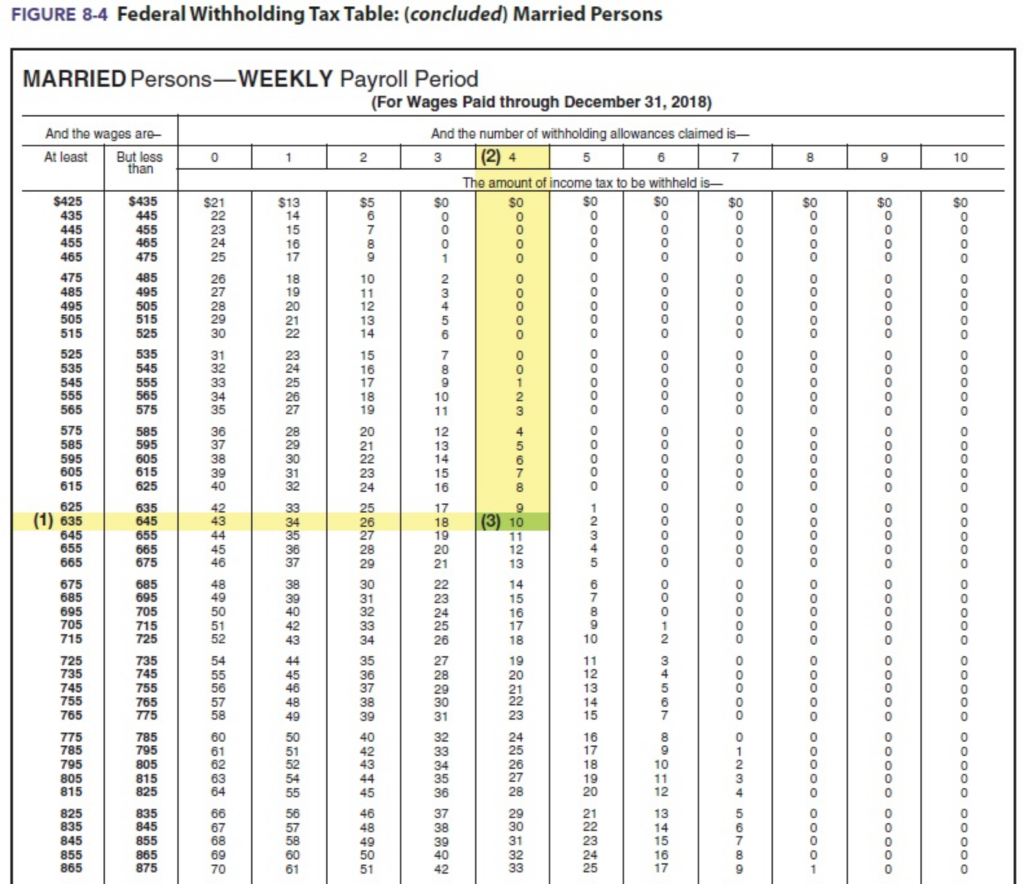

Computing Federal Income Tax Using The Table Chegg Com

Down Payment With Withholding Tax Process Sapspot Down Payment Tax Payment

Withholding Tax Gross Up On Fixed Interest Rate On Borrowing Calculation In Sap Treasury Sap Blogs

Step By Step Document For Withholding Tax Configuration Sap Blogs

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

How To Calculate Payroll Taxes For Your Small Business The Blueprint

All About Sap Assign Withholding Tax Type To Company Code

Lfbw Sap Table For Vendor Master Record Withholding Tax Types X

Massive Changes To Withholding Tax Code Using Cmd Ei Api Class Sap Blogs

Withholding Tax In Purchase Transactions Finance Dynamics 365 Microsoft Docs

Posting Komentar untuk "Withholding Tax Table Vendor"