Punjab Sales Tax Withholding Rates

If taxable services are not covered under sub-rule 1 the withholding agent shall deposit the withheld amount of sales tax with the Government on the form PST-04 as prescribed in the Punjab Sales Tax and Services Filing of Returns Rules 2012 on due dates. For New Registration PKR WHT 2015 - 2016.

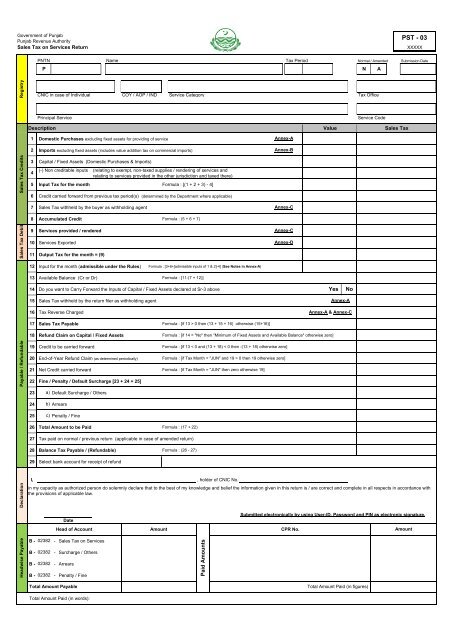

Sales Tax Return Form Pra Punjab

For Transfer Only PKR CC RANGE.

Punjab sales tax withholding rates. 6 - Chapter VI- RETURNS. Sales tax to be deducted by the withholding Agent. PUNJAB SALES TAX ON SERVICES WITHHOLDING RULES 2015 Gazette of Punjab Extraordinary 4th March 2015 No.

Telecommunication Banking Courier Insurance and. 2 They shall come into force at once. Of the Punjab Sales Tax on Services Act 2012 XLII of 2012 the Punjab Revenue Authority with the approval of the Government is pleased to make the following rules.

25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. Rate of tax 98011000 98013000 98014000 98015000 98016000 98300000 98370000 and 98620000 Services provided by hotels motels guest houses marriage halls and lawns by whatever name called including pandal and shamiana services clubs including race clubs and caterers. 98011000 98013000 98014000 98015000 98016000 98370000and 98620000 Six n er ent 2.

PUNJAB SALES TAX ON SERVICES ACT 2012 TARIFF HEADING DESCRIPTION RATE OF SALES TAX UNDER PSTSA 98025000 Advertisement on a cable television 98054000 98058000 and 98052000 Services provided by persons authorized to transact business on behalf of others- a customs agents. Prime Ministers package for construction sector. Updated up to June 30 2020.

And 100 of applicable rate of sales tax if services are obtained from unregistered vendor that is liable to be registered. PST on Services WHRules 2015. Restaurant Services Rules 09-10-2012.

170 5 Sales tax payable by the withholding agent to the supplier. 2 - Chapter II- SCOPE OF TAX. PRAOrders062012 dated 20-2-2015---In exercise of the powers conferred under section 76 of the Punjab Sales Tax on Services Act 2012 XLII of 2012 the Punjab Revenue Authority with the approval of the Government is pleased to make the following rules.

Enlisted below are the rate of With Holding Tax on vehicles. 0 0 10. Punjab Sales Tax on Services An Overview.

Short title and commencement I These rules may be cited as the Punjab Sales Tax on Services Withholding Rules 2015. 1 - Chapter I- PRELIMINARY. Service from unregistered service providerA withholding agent having free tax number FTN or national tax number NTN and falling under clauses a b c d or e of sub-rule2 of rule 1 shall on receipt of taxable services from an unregistered service provider deduct sales tax at the applicable rate of the value of taxable services provided to him from the payment due to the service.

It has been reported by several travel agentstour operators that most of the airlines have discontinued payment of fixed commission on the sale of air-tickets and have instead allowed them to charge commission and. Historically Vreplaced AT turnover taxes and also emerged as a precursor of income taxation. By the prescribed due date in the month following the tax period in which he claims input tax adjustment in his Punjab sales tax.

4 - Chapter IV- REGISTRATION. Short title and. Sales tax withholding shall not apply to.

Punjab Sales Tax On Services Act 2012. 5 - Chapter V- BOOK KEEPING AND AUDIT PROCEEDINGS. Giving details of these dates the rules said in case the withholding agent is a registered person.

For services obtained in Punjab sales tax is withheld 100 of sales tax charged in the invoice by a registered vendor. All amounts of the Punjab sales tax on services deducted or withheld under these rules shall be paid to or deposited with the Government under head of account B-02382-Punjab Sales Tax on Services Withholding in the prescribed form and manner. Value added taxes or taxation VAT is one of the four marvelous innovations of the twentieth century the other three being atomic energy anti-biotics and computers or information technology.

Any person who fails to maintain records required under the Act or the rules. WHT 2015 - 2016. Definitions I In these rutes.

The services provided by tour operators and travel agents including all their allied services or facilities other than Hajj and Umrah are liable to Punjab sales tax at the rate of 16. 7 - Chapter VII- APPOINTMENT OF AUTHORITIES AND THEIR POWERS. Sales tax chargeable 17.

And c stevedores 16. Punjab Sales Tax Services All Rules 2012. 3 4 10 11 17 18 and 68.

Description Classification Rate of Tax 1 2 3 4 Se 1 r vi ces po d d by ho tl motels guest houses marriage halls and lawns by whatever name called including pandal and shamiana servicesclubs and caterers. ILLUSTRATION in case 15th of sales tax amount is to be deducted Value of taxable supplies excluding sales tax. Marriage hall- Marriage hall includes a marriage lawn or banquet.

3 - Chapter III- PAYMENT COLLECTION OF TAX ON TAXABLE SERVICES. Pakistan Last reviewed 15. Typically VATis charged on.

Such person shall pay a penalty of ten thousand rupees or five percent of the total tax payable for the tax period for which he has failed to maintain the required record whichever is higher. Oman Last reviewed 24 June 2021 Resident. Applicable Withholding Tax Rates.

153 1b Withholding Tax On Services How To Deduct Tax On Payment Of Services In Pakistan Fbr 2021 Youtube

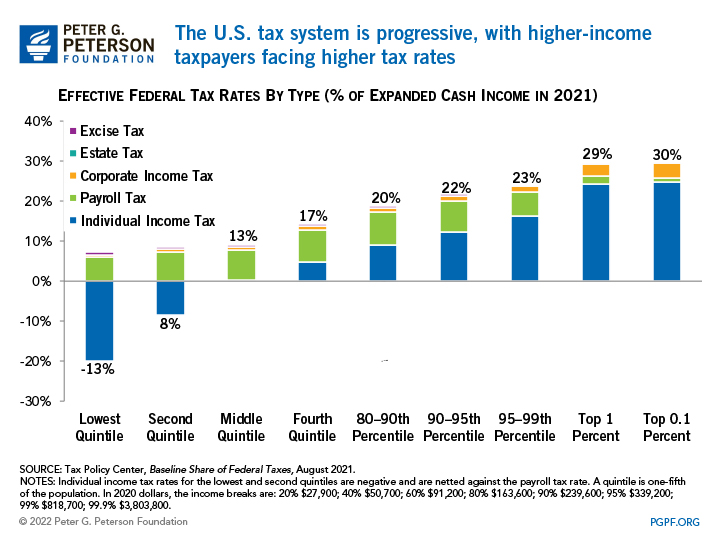

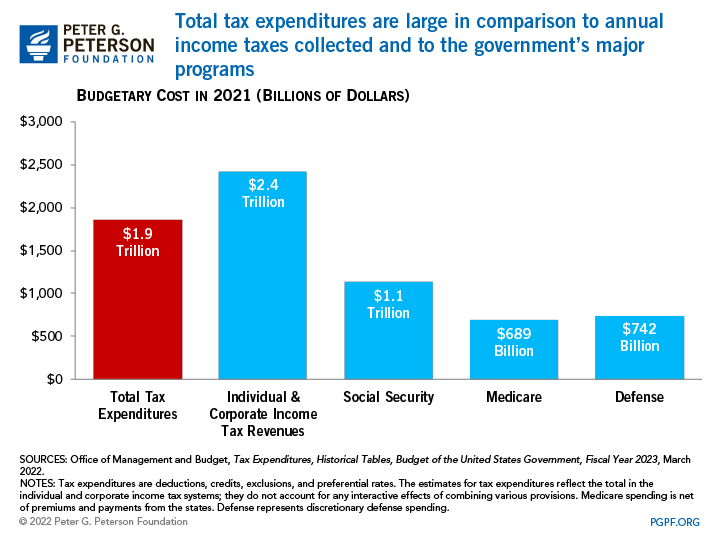

Understanding The Budget Revenues

Understanding The Budget Revenues

Workshop On Sales Tax Laws On Services Part

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

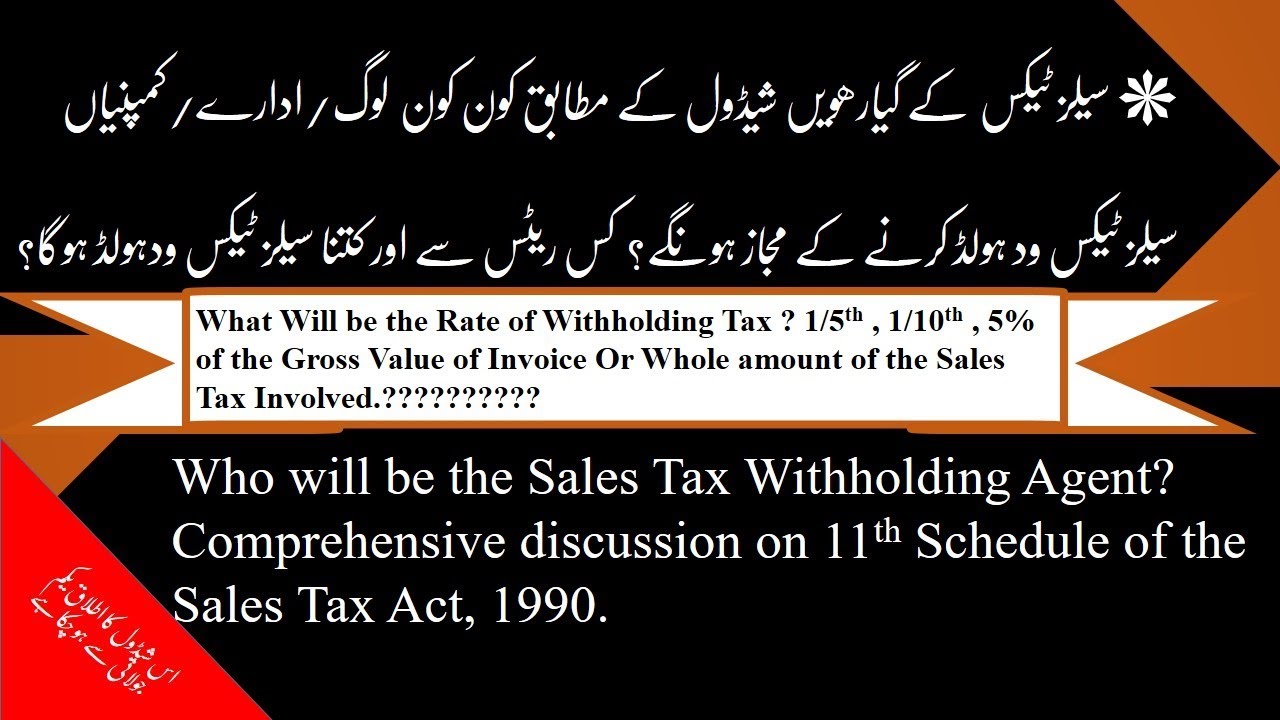

Sales Tax Withholding Agents 11th Schedule Youtube

Wht Rate Card 2021 Pdf Withholding Tax Taxation In The United States

Income Tax Treaty Tax Treaties Database Tax Notes

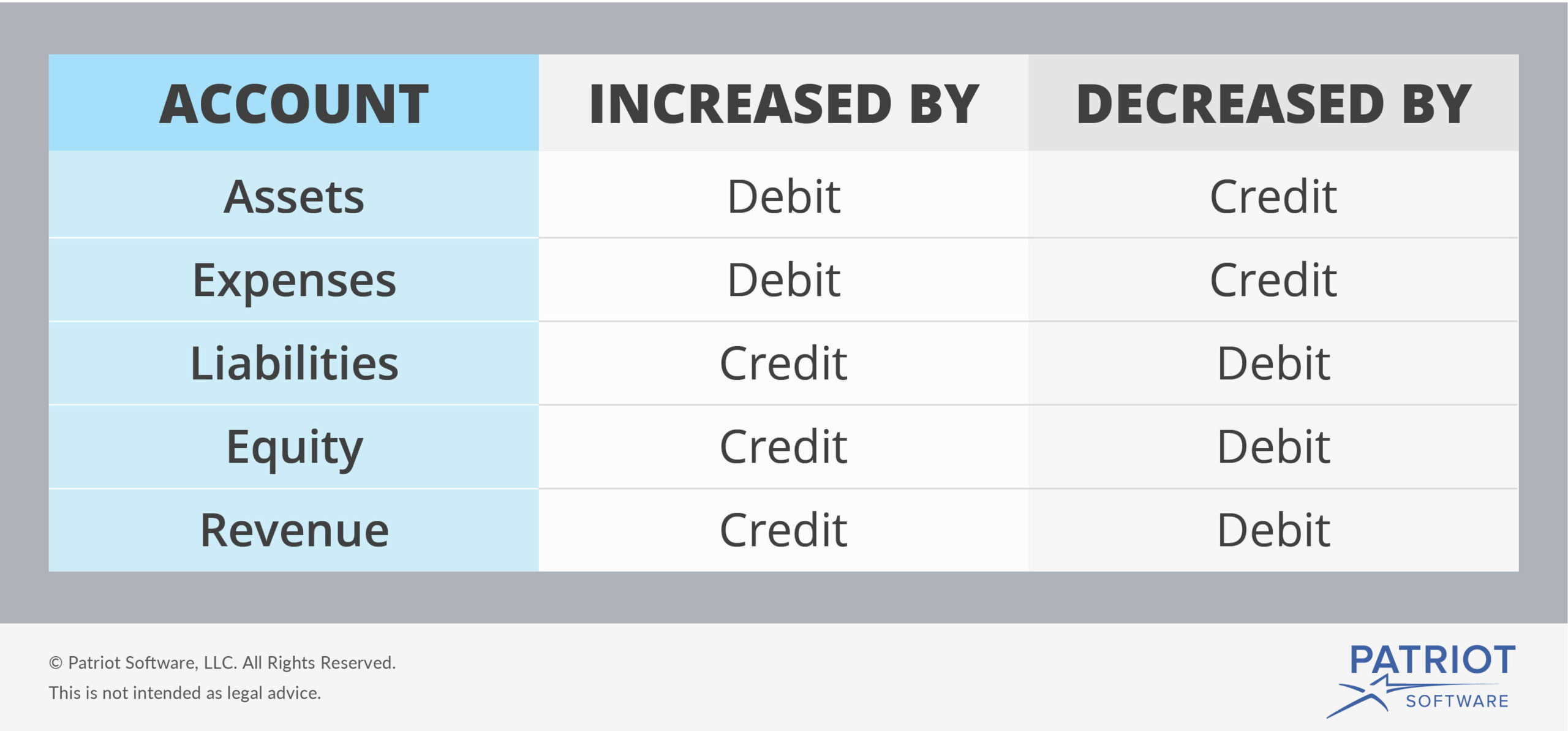

The Basics Of Sales Tax Accounting Journal Entries

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Workshop On Sales Tax Laws On Services Part

Understanding The Budget Revenues

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

Workshop On Sales Tax Laws On Services Part

First Detailed View On Tax Exemptions Emerges Newspaper Dawn Com

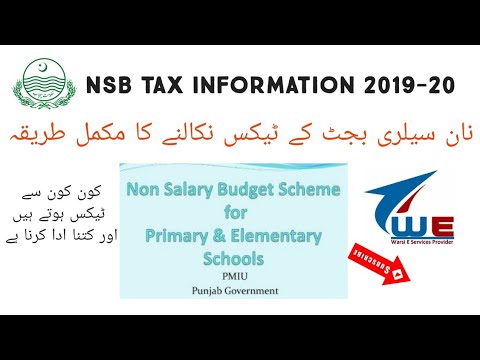

Nsb Tax Information And Calculation 2019 19 Introduction Of Sales Tax Services Tax Income Tax Youtube

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Posting Komentar untuk "Punjab Sales Tax Withholding Rates"