What Is Withholding Tax In Usa

8233 Exemption From Withholding. Do so in early 2021 before filing your federal tax return to ensure the right amount is being withheld.

What Is A Tax Withholding Certificate Freedomtax Accounting Payroll Tax Services

The amount you earn.

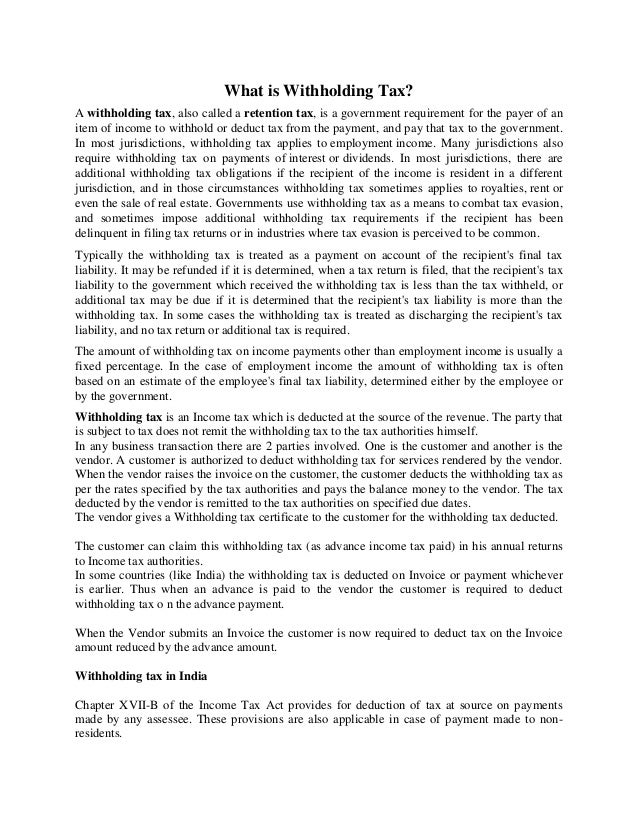

What is withholding tax in usa. No more waiting just e-file now. Tax can be withheld by governments on dividends or income received by non-residents. Last reviewed - 06 February 2021.

2019 Global Withholding Taxes. An exemption application should therefore not be made. For help with your withholding you may use the Tax Withholding Estimator.

1042-S Foreign Persons US. 1042 Annual Withholding Tax Return for US. Listed below are Monotypes current reference for these tax treaty rates s Based on.

Withholding Tax on US Dividends - Articles 10 and 23. Source Income of Foreign Persons. Or the results may point out that you need to make an estimated tax payment to the IRS before the end of the year.

Sources an einen steuerlich nicht-ansssigen Auslnder nonresident alien eine Quellensteuer withholding tax in Hhe von 30 einbehalten und unmittelbar an die US-Steuerbehrde IRS abfhren. E-file your expat taxes instantly with Expatfile. Quellensteuer Withholding Tax Nach IRC 1441 muss ein Quellensteueragent withholding agent bei Zahlungen aus US-Quellen US.

Let us see how a. No more waiting just e-file now. The German bank must be.

My client UK Limited Company sells to a company based in USAThe clients customer is withholding 30 and has stated that our client shoul. This tax is deducted from your investments at source and often most clients are unaware their funds are being charged. For small business entrepreneurs with foreign vendors the US.

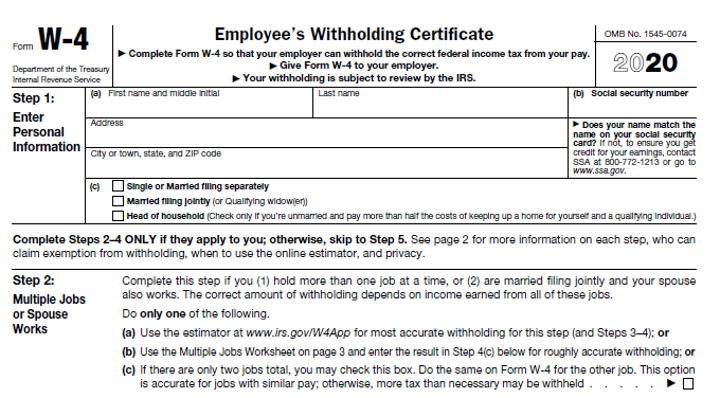

But given that the penalties for non-compliance in the cross-border context. IRS Publication 515 Withholding of Tax on Non-Resident Aliens and Foreign Entities and IRS Publication 519 US Tax Guide for Aliens. The information you give your employer on Form W4.

My client UK Limited Company sells to a company based in USAThe clients customer is withholding 30 and has stated that our client shoul. Anzeige Expats can now e-file their 2020 expat taxes in as quick as 10 minutes. In most cases however following these rules is simply a matter of documentary procedure rather than mastering any tax complexities.

The advance payment system of WHT for resident beneficiaries referred to above also applies if. 13930 Instructions on how to apply for a Central Withholding Agreement. 13930-A Application for Central Withholding Agreement Less than 10000.

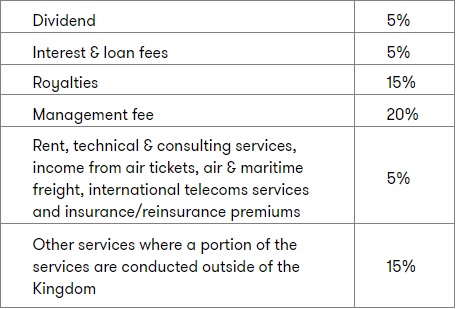

The treaty allows both the US and the UK to tax dividends paid to a resident of the other country but subject to certain conditions limits. If you are an individual file either Form 1040NR US Nonresident Alien Income Tax Return or 1040NR-EZ US. Withholding tax rules can sneak up on you if youre not paying close enough attention.

Der Zahlungsempfnger erhlt eine Bescheinigung ber die. 1042-T Annual Summary and Transmittal of Forms 1042-S. Log in Sign up.

In outside India terminology used for Tax Deducting at Source is withholding tax. It depends on the tax treaty that the US. But if we talk about India here withholding tax is applicable on various income sources such as salary earned from work commission rent professional services technical services or income from business etc.

Under US domestic tax laws a foreign person generally is subject to 30 US tax on the gross amount of certain US-source non-business income. Anzeige Expats can now e-file their 2020 expat taxes in as quick as 10 minutes. This guide presents tables that summarize the taxation of income and gains derived from listed securities from 123 countries as of December 31 2020.

List of Withholding Tax Rates by Country. There are similar US forms for trusts and corporations. Principal International Tax KPMG US.

The amount of income tax your employer withholds from your regular pay depends on two things. 2020 Global Withholding Taxes. A withholding tax does not apply to price gains on share sales in Germany.

After you submit the applicable tax forms and Monotype is able to validate and accept your information what will your new tax rate be. Working on withholding Tax is quite like the working of Tax Deducted at Source. In the case of resident beneficiaries however it is simply an advance payment of a tax that is then normally self-assessed by the resident taxpayer in the final annual tax return.

Corporate - Withholding taxes. Source Income Subject to Withholding. Ordinarily WHT is the mechanism by which the Spanish tax authorities collect the final tax levied on non-residents.

For example the US Government charges non-US residents withholding tax of 30 on any. All persons making US-source payments to foreign persons withholding agents generally must report and withhold 30 of the gross US. Has directly with your country of residence which can change from time to time.

If you adjusted your withholding part way through 2020 the IRS recommends that you check your withholding amounts again. For employees withholding is the amount of federal income tax withheld from your paycheck. Withholding tax is a tax levied by an overseas government on dividends or income received by non-residents.

For example the US Government charges certain non-US residents withholding tax of 30 on any income from dividends received from US investments. E-file your expat taxes instantly with Expatfile. Income Tax Return for Certain Non-Resident Aliens with No Dependents to obtain a refund.

Personal tax Business tax HMRC.

Withholding Tax In Purchase Transactions Finance Dynamics 365 Microsoft Docs

How To Fill Manage Tax Info In Google Adsense Withholding Tax W 8ben Form Us Tax Treaty In 2021 Adsense Google Adsense Info

Understanding Us Dividend Withholding Tax In Tfsa Rrsp Youtube

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

What Is Withholding Tax And When To Pay It In Singapore Singaporelegaladvice Com

Tax Information Form W 8 Requirements For Non Us Authors Envato Author Help Center

Withholding Tax An Overview Sciencedirect Topics

Tax Time Need Help Tax Time Tax Services Paying Taxes

Indie Publishing Rj Scott Rj Scott Usa Today Bestselling Author Of Mm Romance Tax Refund Finance Investing

Tax Withholding Calculator For Employers Federal Income Tax Income Tax Calculator

Business Registration Application For Income Tax Withholding Sales And Use Tax And Machinery Equipment And Manufacturing Income Tax Registration Tax Forms

Usa Tax Made Simple Tax Brackets Irs Taxes Tax App

Indian Withholding Taxes For Individuals And Companies Income Tax Return Filing Taxes Income Tax

How To Adjust Your Tax Withholdings For A 0 Return The Dough Roller

E Filling Income Tax Return Filing Taxes Tax Services Income Tax Return

Posting Komentar untuk "What Is Withholding Tax In Usa"