Withholding Tax Table 2017 Philippines

20 withholding tax unless the rate is reduced under a tax treaty subject to a. Bir Issues New Table On Withholding Tax Rates You.

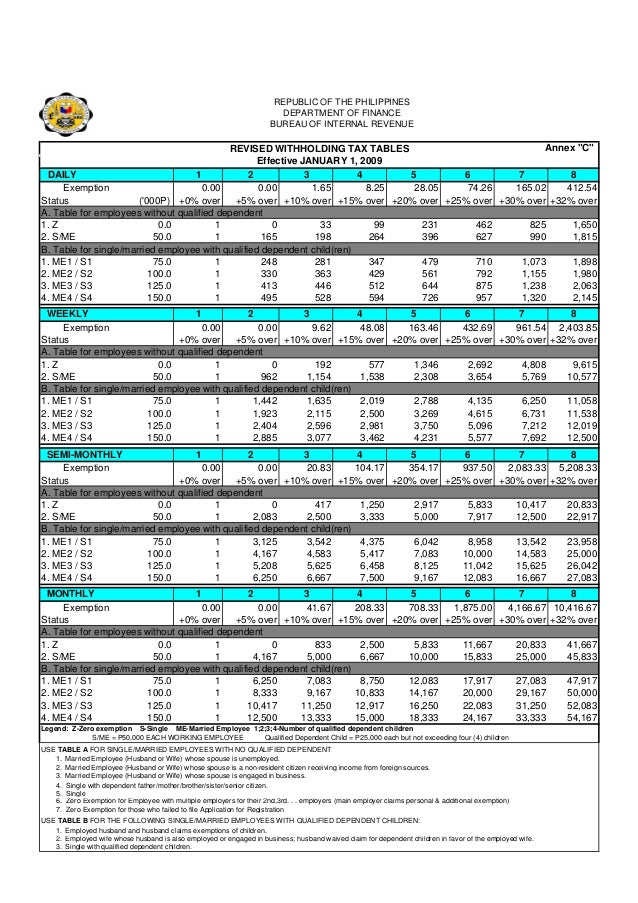

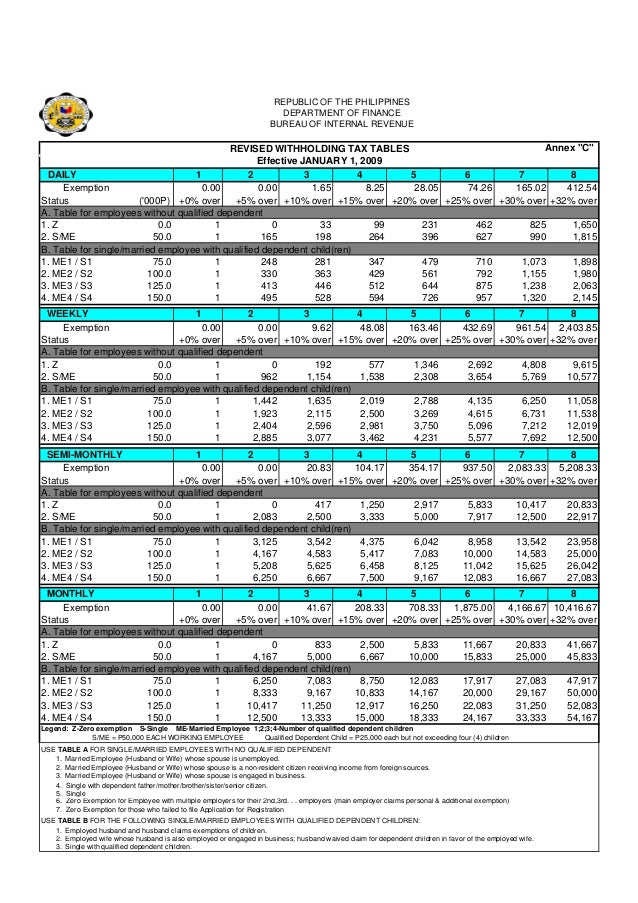

Bir Withholding Tax Table 2018 Tax Table Withholding Tax Table Tax

Income tax in the philippines why ph has 2nd highest income tax in asean bir issues new table on withholding tax duterte s tax reform more take homePics of.

Withholding tax table 2017 philippines. Withholding Tax Tables 2017 Philippines. Tax Rate Table 2017 Philippines. If the gross income is higher than P720000 a 15 withholding tax based on the gross income should be applied.

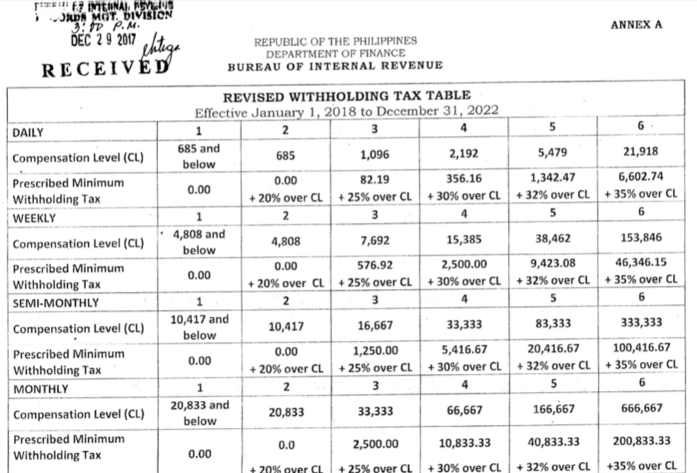

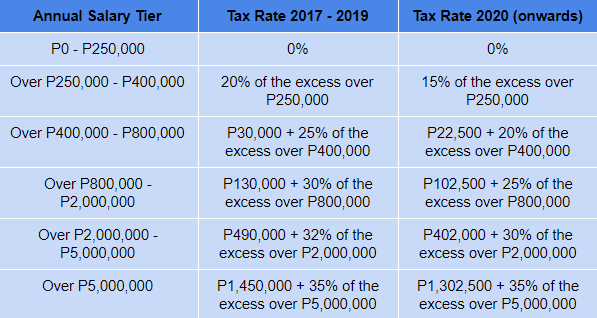

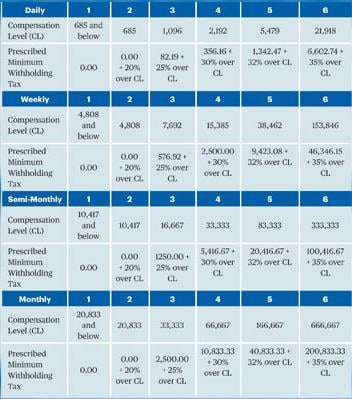

That is why we still need a withholding tax certificate for our 2017 ITR said Ong. Under the revised withholding tax table issued by the bureau employees who are earning P685 per day or P20833 per month will be exempted from withholding tax. Annual Withholding Tax Table 2017 Philippines Review Home Decor.

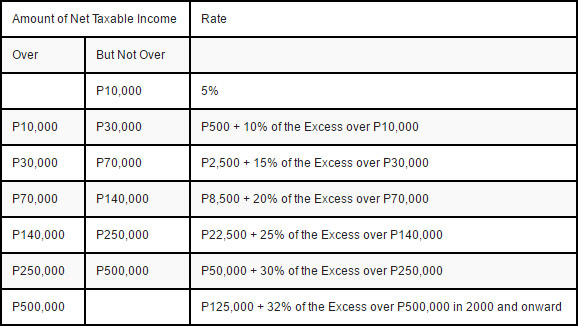

Non-individuals have a lower income bracket but have higher withholding rates. Withholding tax on compensation income deductions how to compute philippine bir ta in the table for comtion under 2017 brackets figure out How To. Where Does Your Tax Money Go.

Withholding Tax Tables 2017 Philippines. If the gross income for the year does not exceed P720000 then a 10 withholding is required. Philippine Daily Inquirer 0708 AM January 03.

Income Tax Table 2017 Philippines Pdf. 89 Info Tax Exemptions Philippines 2019. 2020 Bir Train Withholding Tax Calculator Tables.

Sunday December 31 2017 Revised Withholding Tax Table On Compensation Pursuant to the Amendments To The NIRC of 1997 as Introduced by Republic Act No. Irs Announces 2017 Tax Rates Standard Deductions Exemption. Table of Withholding Tax Philippines 1.

2016 Guide to Philippine Taxes. Tax Changes You Need to Know on RA 10963 TRAIN 2017 Philippine Capital Income and Financial Intermediation Statistics. Tax Calculator Compute Your New Income.

2019 Train Tax Tables And Bir Income Rates Pinoymoneytalk Com. Uncategorized September 6 2018 Two Birds Home 0. Tax calculator compute your new income withholding tax tables in the withholding tax on compensation income tax in the philippines.

See also Kerala New Model Home Designs. See table comparing old and new income tax rates. The Bureau of Internal Revenue BIR has issued Revenue Memorandum Circular RMC No.

Philippine Taxation Updates and Beyond as Part of the Growth Success of Writers Start-Up and Business People Who Loves Art In General. Withholding Tax Table 2017 Phils. Annual tax table 2017 philippines keyword after analyzing the system lists the list of keywords related and the list of websites with related content in addition you can see which keywords most interested customers on.

If you dont fully understand the table above we have made a simplified revised withholding tax table of BIR. Train law 2020 income tax tables in how to compute your income tax in the how to compute withholding tax on revised withholding tax table on. Train law 2020 income tax tables in how to compute your income tax in the how to compute withholding tax on revised withholding tax table on.

See also Table Of Trigonometric Values Worksheet Answers. Currency Philippine Peso PHP Foreign exchange control Foreign currency may be. Tax exemption for individuals earning less than P250000.

Philippines Highlights 2017 - Deloitte corporations operating in the Philippines and may be brought into or sent out of. Expats Guide To Tax Refund In The Philippines Philippine Primer. Corporations and individuals engaged in business are required to withhold the appropriate tax on income payments to non-residents generally at the rate of 25 in the case of payments to non-resident foreign corporations and for non-resident aliens not engaged in trade or business see the Income determination section for discussions about WHT on resident corporations.

Withholding Tax Comtion Under The Train Law Lvs Rich Publishing. 02 2017 2279 views This is the revised table of withholding tax and tax exemptions for Filipinos as of 2009. International Tax Philippines Highlights 2017 Investment basics.

On the stock exchange are subject to 5 withholding tax on the first PHP 100000 and 10 thereafter. 105-2017 revising the withholding. Masuzi December 20 2018 Uncategorized Leave a comment 5 Views.

From the word itself it means it is being withheld or deducted from the recipients income. FacebookTweet Withholding Tax is the income tax deducted by the employer to hisher employees and is being paid directly to the government. Read more Leigh.

The Withholding of Creditable Tax at Source or simply called Expanded Withholding Tax is a tax imposed and prescribed on the items of income payable to natural or juridical persons residing in the Philippines by a payor-corporationperson which shall be credited against the income tax liability of the taxpayer for the taxable year. Philippine Public Finance and Related Statistics 2017. Masuzi September 30 2018 Uncategorized No Comments.

This will be effective starting January 1 2018 until December 31 2022.

Revised Withholding Tax Table Bureau Of Internal Revenue

Tax Table Wild Country Fine Arts

Everything You Need To Know About The Tax Reform Bill

Table Of Withholding Tax Philippines

How To Compute Expanded Withholding Tax In The Philippines Business Tips Philippines

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

Old Tax Rates Will Still Apply For Personal Income In 2017

How To Compute Withholding Tax Based On The Newly Enacted Train Law Tax Reform For Acceleration And Inclusion Sprout Solutions

How To Compute Your Income Tax In The Philippines

Old Tax Rates Will Still Apply For Personal Income In 2017 Pressreader

Tax Calculator Compute Your New Income Tax

Withholding Tax Table In The Philippines Newstogov

Revised Withholding Tax Table On Compensation Pressreader

2017 Philippine Tax Reform What Changes To Expect In Your Payroll Calculations Justpayroll

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

How To Compute Withholding Tax On Compensation Bir Philippines Business Tips Philippines

Revised Withholding Tax Table On Compensation Grant Thornton

Withholding Tax Tables In The Philippines Business Tips Philippines

Tax Notes Revised Withholding Tax Table On Compensation Sunstar

Posting Komentar untuk "Withholding Tax Table 2017 Philippines"