Employment Tax Rates Nz

Employment rate by sex seasonally adjusted March 2006-March 2021 quarters. Minimum wage rates apply to all employees aged 16 and over who are full-time part-time fixed-term casual working from home and paid by wages salary commission or piece rates some exceptions.

Tax Withholding For Pensions And Social Security Sensible Money

This indicator is the official unemployment rate for New Zealand.

Employment tax rates nz. Extra qualities or skills an employee brings to a job. From NZ14001 to NZ48000 Taxable Income 1750. The unemployment rate reflects conditions of the labour market and economy overall.

Penal rates are negotiated between an employee and an employer. There is no specific legal entitlement to allowances. Different minimum wage rates.

Trusts and trustees - the initial amount of money put into a trust. Main and secondary income tax rates tailored and schedular tax rates and a calculator to work out your tax. Employees should check their employment agreement to see if theyre entitled to any penal rates.

Legislation allows employers to use FBT rates that correspond to the personal income tax rates of the employee receiving the benefit with the top rate of FBT payable being 4925 percent based on the top marginal tax. Penal rates are special rates for. If we approve your application well let you know what your tailored tax rate is.

Companies pay income tax at 28 on profits. Tax rate estimation tool for contractors. If youre a self-employed contractor you need to pay your own tax.

Note that to give you a more accurate estimate the tax rates displayed below are including the mandatory ACC Levy currently around 139. Working particular days or shifts. There are five PAYE tax brackets for the 2021-2022 tax year.

Non-profit organisations registered and incorporated under the Incorporated Societies Act 1908. New Zealands tax and PAYE system is designed so that employees are taxed at the correct rate. Schedular payment tax rates.

Tax rates for individuals. The income tax rates in New Zealand are as follows. It gives a sense of the number of people seeking work.

Employment statistics count and describe people in New Zealand with paid jobs. The tax rate for individuals. Find information about occupations and industries income types of work work-related injuries and employment conditions.

Generally allowance payments are used to recognise. Number of unemployed people. Agriculture fishing and forestry.

Unemployment statistics count and describe people who dont have a paid job but could be working. The payment of and level of allowances over and above salary or wages can be agreed to by the employer and employee. You need a tax code if you receive salary wages income-tested benefit or other income which has tax taken out before you get paid.

Find out more on the IRD website. Our current tax rates for individuals are as follows. Tax codes help your employer or payer work out how much tax to deduct from your pay benefit or pension.

We have a progressive tax system so that individuals pay a higher rate of tax as they earn more. Make sure theyre using the right code or you could pay the wrong amount of tax. You can get a tailored tax rate for income you get from.

The tax rate for individuals. Tax rates for individuals operating as a business that is individuals who are self-employed are the same as for employees. New Zealand tax residents can pick any rate from 10 per cent up to 100 per cent.

These are the rates for taxes due in April 2022. Up to NZ14000 Taxable Income 1050. Tailored tax rates for salary wages and pensions.

Those hired and paid through a recruitment agency or other labour hire business must have tax deducted. Previous minimum wage rates. There is no minimum wage for employees under the age of 16.

See individual tax rates above Goods and Services Tax. Benefits-in-kind are generally subject to Fringe Benefit Tax FBT payable by the employer. The data in this indicator is seasonally adjusted.

Apply for an IRD number external link Tax codes and rates external link. 0 - 14000 105. Current minimum wage rates.

Created with Highcharts 5014 Percent Employment rate by sex seasonally adjusted March 2006-March 2021 quarters Men Women Total Mar-06 Sep-06 Mar-07 Sep-07 Mar-08 Sep-08 Mar-09 Sep-09 Mar-10 Sep-10 Mar-11 Sep-11 Mar-12 Sep-12 Mar-13 Sep-13 Mar-14 Sep-14 Mar-15 Sep-15. People paid wages may have penal rates in their employment agreement. Young employees aged 16 to 19 years can be paid a different minimum wage than adult workers.

They may be included as part of the employment agreement or negotiated as a one-off. Types of wage rates. All contractors can pick the rate to have tax deducted at.

You need to apply for a tailored tax code first. When working out your total income from all sources do not include any losses you may be carrying forward from the previous tax year. 1050 1750 30 33 and 39Your tax bracket depends on your total taxable income.

Your tax code might be different for different types of income. Your employer will deduct tax using the code you gave them when you started work.

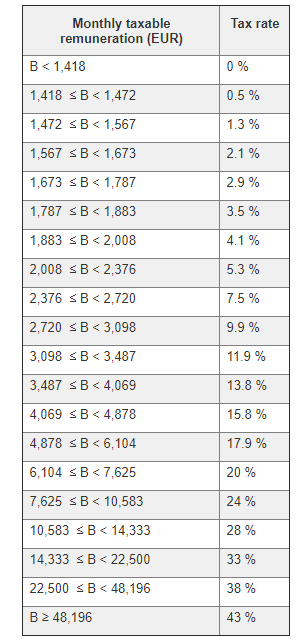

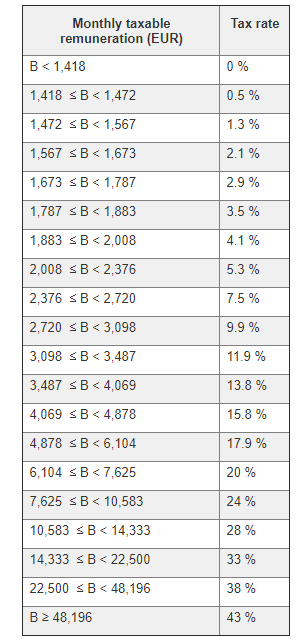

Your Bullsh T Free Guide To Taxes In Germany

Important 2019 Dates For The Self Employed Small Business Bookkeeping Employment Application Small Business Finance

Top Tax Write Offs For The Self Employed Tax Write Offs Tax Turbotax

France S 2020 Social Security Finance And Income Tax Bills To Introduce Significant Changes Ey Global

What Is Self Employment Tax And What Are The Rates For 2019 Workest

How To Calculate Income Tax In Excel

14 Tax Tips For The Self Employed Taxact Blog

Your Bullsh T Free Guide To Taxes In Germany

Doing Business In The United States Federal Tax Issues Pwc

How To Calculate Income Tax In Excel

Oecd Ulkeleri Bordro Ve Gelir Vergisi Income Tax Payroll Payroll Taxes

Why Is My Tax Return So Low 2020 Tax Year Edition Picnic S Blog

How To Calculate Income Tax In Excel

New Income Tax Table 2020 Philippines Income Tax Tax Table Income

Completing Form 1040 With A Us Expat 1040 Example

On Average 2 2 Of Workers In Oecd Are Self Employed Women W Staff How Does Your Country Compare Self Employment Primary Activities

Tax Withholding For Pensions And Social Security Sensible Money

How To Become A Tax Filer In Pakistan Tax Return Income Tax Income Tax Return

Posting Komentar untuk "Employment Tax Rates Nz"