Income Tax Rates Under Dtaa

Department Directory AHB 2015 Field Offices. The Double Tax Avoidance Agreement DTAA currently in force since 27th January 1986 which was signed with the Czech Republic is also.

Tax rates as per Income-tax Act vis--vis tax treaties.

Income tax rates under dtaa. Credit for taxes paid in India as deduction from tax payable in USA __ 15000. TDS rates under DTAA. Tax residency certificate A tax residency certificate must be obtained from the country in which the person was residing in a particular financial year.

This ensures protection to taxpayers against double taxation and prevent. As per DTAA between Indian and Germany tax on Interest is specified 10 whereas under Income Tax Act 1961 it depends on slab rates for individuals HUF and flat rates generally 30 for other kind of assessees like firm company etc. List of DTAA rates for particular countries is given in the next section.

R Resident of country A earns 100 of Income from country B. Step 4-Calculate the average rate of tax of the foreign country by dividing income tax actually paid in the said country after deducting all relief due. Concessional Rate prescribed in India-USA DTAA.

Facts of the Case. A Rate of tax shall be 10 on income from Global Depository Receipts under Section 115AC1b of Income-tax Act 1961. Interest that adheres to the definitions and extents specified under Section 194LD will be charged at 5.

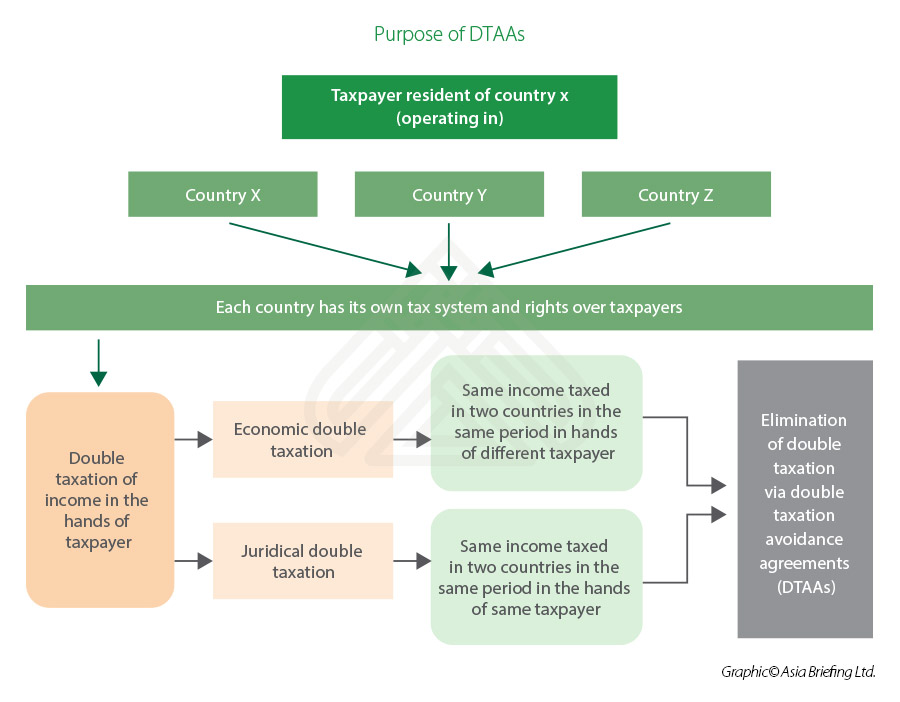

A DTAA simply mitigates double imposition of tax when there is a cross national flow of income and ensures tax neutrality. A tax residency certificate is issued on submission. A reduction in the withholding tax rates is provided by the revised DTAA.

Hence one can follow DTAA and pay tax 10 only. The rates and rules of DTAA vary from country to country depending on the particular signed between both parties. Amount in Rs Tax in India source state.

Tax rate of Country B 40. Tax rate of Country A 50. Tax in USA Resident state.

83 Zeilen 10 if at least 10 of the shares of the company paying the dividend is held for a period of at least 6 months prior to the date of payment of the dividend. Taxability of Assessee R without DTAA is as under. 15 in other cases 20 125.

TDS Rates Under DTAA Withholding tax rates Country Dividendnot being covered under Section 115-O Interest Royalty Fee for Technical Services Albania 10 10Note1. Certain income of non-resident inter-alia dividend interest royalty or fees for technical services shall be taxable as per the rates prescribed under the Income-tax Act or as per the rates prescribed under the DTAAs whichever is more beneficial to such non-resident. Rate of tax shall be 10 on income from Global Depository Receipts under Section 115AC1b of Income-tax Act 1961 other than dividends referred to in section 115-O.

It is a declaration that the assessee resided in the foreign country which is covered under a DTAA with India and hence the tax rate applicable to the income is at the rate mentioned in the DTAA. This write up provides all such rates as prescribed under the Act and under various DTAAs entered into between. 92 Zeilen a15 per cent of the gross amount of the dividends where those dividends are.

Dividend Income other than dividends covered us 115-O Tax Rates applicable on dividend Income other than dividend covered under Section 115-O as per Income Tax Act. GSTCGST ACTSGST ACTIGST ACTUTGST ACTGST RULESGST LATEST UPDATESINCOME TAXINCOME TAX ACT 1961INCOME TAX UPDATESINCOME TAX RULES. Step 3 Calculate the average rate of tax by dividing the tax computed under Step 2 with the total income inclusive of such foreign income.

B Rate of tax shall be 20 under Section 115A on dividend received by a foreign company or a non-resident non-corporate assessee. Dadra. Interest in the form of distributed income as specified in Section 194LBA 2 will be charged at 5.

The AO raised the TDS liability on account of the payments made by the assessee to non-resident 1030 10 tax 030 on account of education cess secondary and higher education cess as against 10 deducted by the assessee. 95 Zeilen 10 if at least 10 of the shares of the company paying the dividend is held for a period of. TDS rates on interests earned for most countries is either 10 or 15 though rates range from 750 to 15.

Tax Rates DTAA v. Double Taxation Avoidance Agreement Country List. The revised tax rates range from 15 to 10 on dividends 20 to 10 for the royalties and 175 to 10 for management and professional services fees.

Taxation as per local applicable rates. C Rate of tax shall be 20 under Section 115AD on dividend received by a Foreign institutional investor. Benefits granted in the India-USA DTAA.

The agreement between the negotiating countries provides specific guidelines on how the income generated in one country and transferred to another is to be taxed by the source and resident country.

Double Taxation Avoidance Agreement Between France And Hong

Double Taxation Avoidance Agreement How To Avoid Paying Taxes Twice

Claiming Credit Of Taxes Paid In Foreign Countries

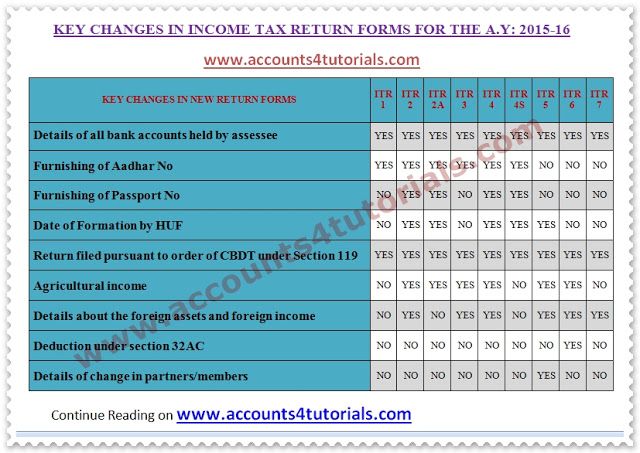

Accounting Taxation Key Changes In Income Tax Return Forms For The A Y 2015 16 Income Tax Income Tax Return Tax Return

The Double Tax Avoidance Agreement Dtaa Upsc Ias Samajho Learning

Basic Aspects Of International Taxation And Dtaa

Countrywise Withholding Tax Rates Chart As Per Dtaa

Basic Aspects Of International Taxation And Dtaa

Nri Can Use Double Tax Avoidance Agreement Dtaa To Save Tax Nri Saving And Investment Tips Investment Tips Savings And Investment Investing

Double Tax Avoidance Agreements Taxation

Accounting Taxation Key Changes In Income Tax Return Forms For The A Y 2015 16 Income Tax Return Income Tax Tax Return

Issues Relating To Taxation Of Nri Covering Dtaa

Read This Guide To Understanding Estimated Chargeable Income Eci And Learn When To File Eci How To File Eci And Its Exempt Infographic Understanding Income

What Is Double Taxation Avoidance Agreement Dtaa Professional Utilities

Tiea What Are Tax Information Agreements Offshore Bank Offshore Banking

Double Tax Avoidance Agreement Dtaa Guide Tax2win Blog

Issues Relating To Taxation Of Nri Covering Dtaa

Posting Komentar untuk "Income Tax Rates Under Dtaa"