Uk Withholding Tax Rates 2019

Changes You Need to Know. Interest payments are subject to final withholding tax of 20 15 if on loan with term of one year or more and 5 if on loan granted for development of certain infrastructur.

Thailand Tax Update Covid 19 And Tax Relief Measures In Thailand Lexology

1 January 2019 2 Corporation tax.

Uk withholding tax rates 2019. This difference is due to tax treaties between these countries and the US. 2020 Global Withholding Taxes. Additionally if the tax is paid more than 30 days late a penalty of 5 percent of the tax unpaid is charged.

Plus information about Universal Credit that eventually. 153 Zeilen The rate has increased from 7 to 10 for 3 years from 1 August 2019 to 31 July 2022. This table lists the income tax and withholding rates on income other than for.

Withholding tax 15Only 75 rate applies to dividends paid from profits taxed at corporate level. Relating to the exploitation of IP and other property rights in the UK. Rate Income after allowances 2021 to 2022 Income after allowances 2020 to 2021 Income after allowances 2019 to 2020 Income after allowances 2018 to 2019.

You dont pay any tax on savings income up to 5000 if your total other UK income is less than 17500. Dividend Withholding Tax Rates by Country for 2020. When relying on a UK or any other DTA it will be crucial to ensure.

As a general rule UK domestic law requires companies making payments of interest to withhold tax at 20. As this is greater than the foreign tax paid on the interest the FTCR is. In brief the rules will apply a 20 per cent UK income tax liability on payments.

UK withholding taxoverview Tax collected from the payer. What You Need to Know. 6 April 2019 However the MLI only comes into effect on these dates if it has also come into effect in the other jurisdiction party to the DTA.

For example the US Government charges non-US residents withholding tax of 30 on any income received from US investments. Read on to find out what this years changes are and who needs to pay what. Another 5 percent is charged if the delay exceeds 6 months and again another 5 percent penalty is charged if the delay exceeds 12 months.

This guide presents tables that summarize the taxation of income and gains derived from listed securities from 123 countries as of December 31 2020. Dividends paid to a local individual are taxed at a 7 tax rate for fiscal year 2020 and 13 as of fiscal year 2021. In this article well explain how the Child Tax Credit works how much you can claim.

UK withholding tax is a method of collecting tax at source from the person who makes a payment instead of raising an assessment on the recipient. For example in developed Europe Switzerland has a very high 35 withholding tax rate for non-residents while the UK charges 0 for stocks only for Americans. However there are a number of exceptions to this.

The UK government has double taxation agreements DTAs in place with. Withholding tax is an effective way for tax authorities such as Her Majestys Revenue Customs HMRC to collect tax. It passes the administrative burden onto the person making the.

Claiming UK Child Tax Credit. As of January 1 2021 the Netherlands will levy a conditional withholding tax of 217 percent on outbound payments of interest and royalties to low-tax jurisdictions and in abusive situations. Where the diverted profits tax applies the applicable tax rate is 25 percent and income subject to the ORIP rules is taxed at 20 percent.

The digital services tax rate is 2 percent of group revenue derived from UK users in excess of a de minimis revenue of GBP25 million although there is an alternative safe harbour calculation for groups. HMRC has authorised gross payments The tax treaty in place with the relevant member state reduces the withholding tax to nil. Bond ETFs pay interest.

Between 05 percent and 15 percent on the amount or value of the consideration given for the shares transferred or in certain cases the value of the shares transferred subject to exemptions including where the amount or value of the consideration for the sale is GBP 1000 or less. 1 April 2019 3 Income tax. The standard corporation tax rate is 19 percent.

After Brexit UK companies will be required to deduct withholding tax at 20 on interest payments unless. The UK tax due on the foreign interest is therefore 600 8160 - 7560. 1 Withholding taxes.

2019 Global Withholding Taxes. UK Company Car Tax Rates 2019-2020. The tax due on this amount would be 7560.

Basic rate tax payers have a 1000 tax free allowance and higher rate tax payers have a 500 tax allowance. If your UK income is over that amount theres a personal savings allowance. The UK may currently pick up a certain amount of VAT on the sales but misses out on direct tax regardless of the amount or proportion of profit derived from UK customers.

Company car tax rates and rules change every year.

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

Global Corporate And Withholding Tax Rates Tax Deloitte

Dividend Withholding Tax Rates By Country For 2021 Topforeignstocks Com

Host Country Withholding Tax Rates On Cross Border Payments Of Download Table

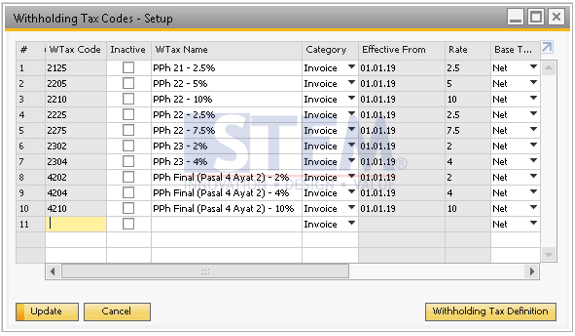

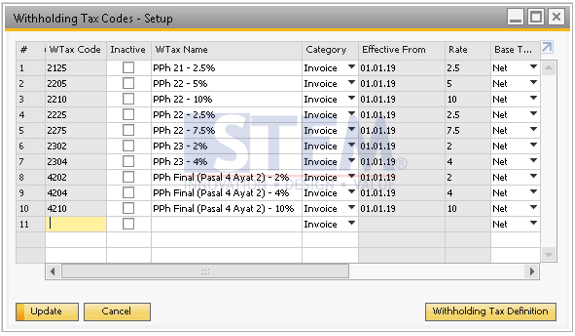

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

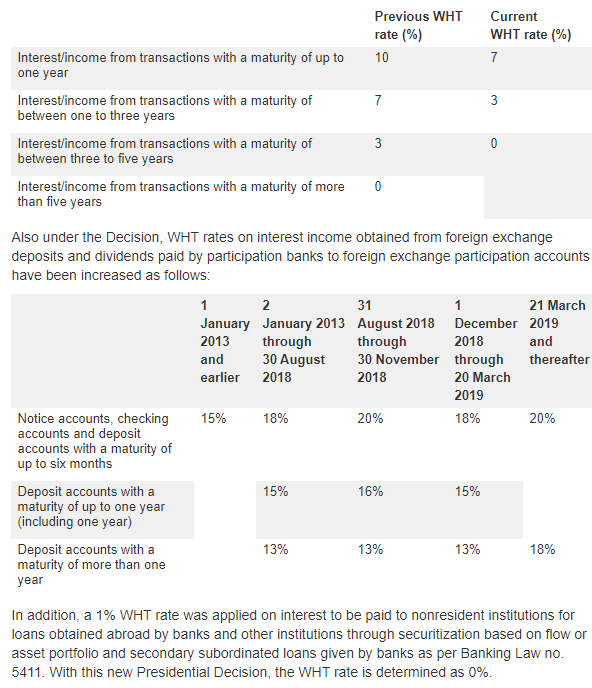

Turkey Announces Change In Withholding Tax Rates On Interest Obtained From Deposits Issued Abroad And Foreign Exchange Deposits Ey Global

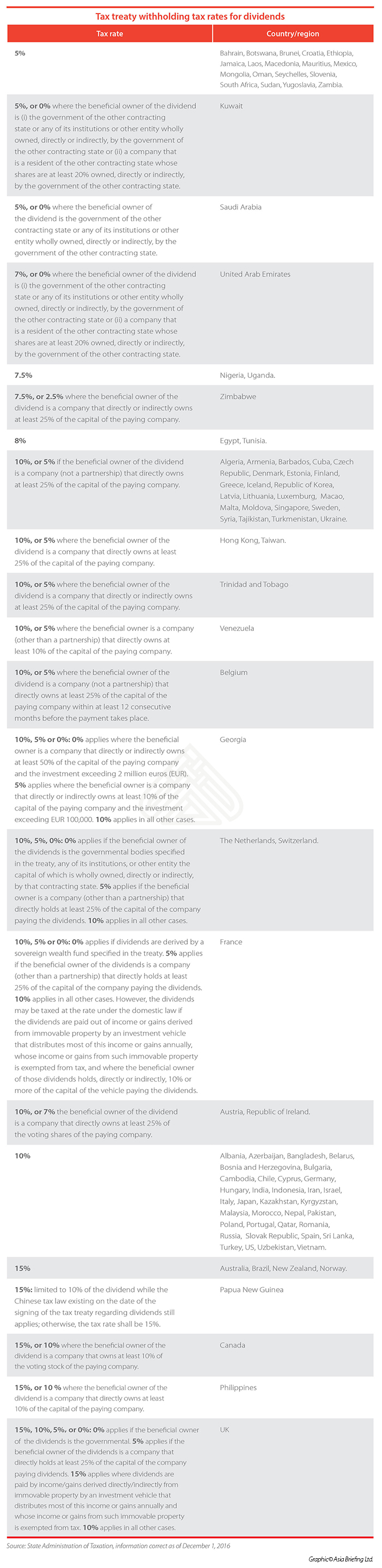

Withholding Tax In China China Briefing News

New Feature Global Withholding Tax In Msd365 Fo Dynamics 365 Finance Community

Panama Tax Treaties Tax Panama

Global Corporate And Withholding Tax Rates Tax Deloitte

Taxes In Switzerland Income Tax For Foreigners Academics Com

Withholding Tax Codes In Sap Business One Sap Business One Indonesia Tips Stem Sap Gold Partner

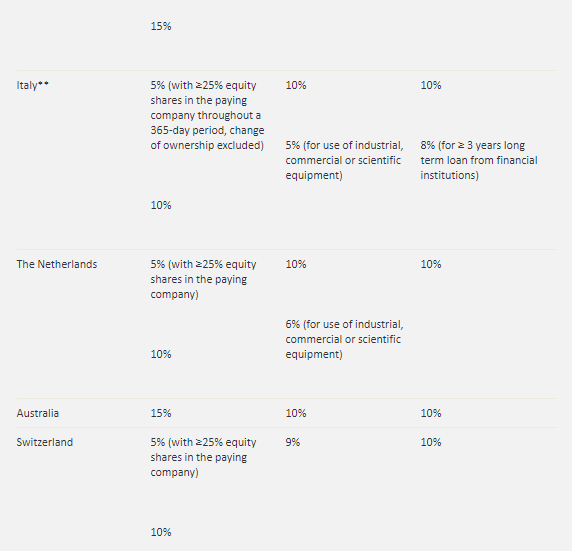

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

China Tax Treaties A Quick Guide To Withholding Tax Rates Of Royalty Dividend And Interest Lexology

What Is Withholding Tax And When To Pay It In Singapore Singaporelegaladvice Com

Posting Komentar untuk "Uk Withholding Tax Rates 2019"