Withholding Tax Rates In Pakistan 2020-21 Pdf

The FBR updated the withholding tax card 2020-2021 after incorporating amendments to Income Tax. - Foreign produced film imported for the.

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

Official Email FBR Employees Government Links.

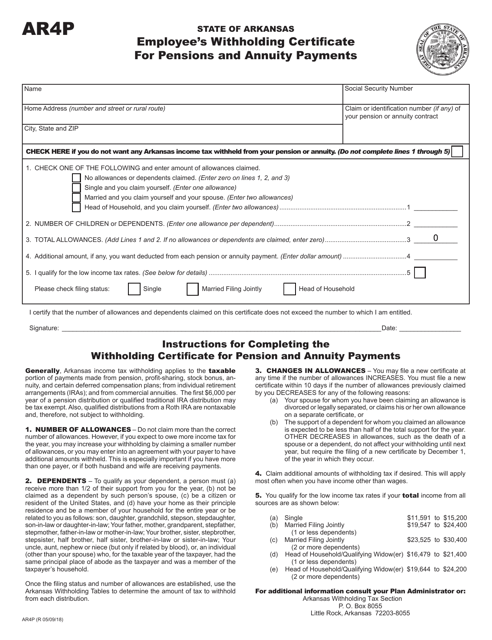

Withholding tax rates in pakistan 2020-21 pdf. Taxable Income Up to Rs 600000 Rs. Royalties and fees for technical service paid to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 15 percent. The withholding tax rate on dividend is 125 percent where the recipient is a filer of Pakistan tax return and 20 percent where the recipient is a non-filer.

Advance tax collected after 17 April 2020 under section 236K of the 2001 Ordinance on purchase of an immoveable property utilized in an eligible project. Everyone should file a tax return. WITHHOLDING TAX RATES SECTION WITHHOLDING AGENT Rate 1531a sales of goods Every Prescribed Person section 1537 Company 4 of the gross amount Other than company 45 of the gross amount No deduction of tax where payment is less than Rs.

There shall be no refund of any tax collected or deducted under the 2001 Ordinance. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime. Royalties and fees for technical service paid to non-residents that have no permanent establishment in Pakistan are subject to withholding tax of 15 percent.

1 7 10 2 07 7 0267 05. Sale of cigarettes pharma products. Rate of tax withholding Part I 1 Part II 2 Part III 55 The advance tax collected under section 148 in following cases is now also proposed to be minimum tax on income of the importer in all cases.

Previously this salary slab was not included in the income tax deduction bracket. FBR updates withholding tax rates for income from property. Updated up to June 30 2020.

According to the income tax slabs for FY 2021-22 a certain amount of income tax will be deducted from the salaries of individuals earning more than PKR 600000- per annum. The National Assembly approved the Finance Bill 2020 with certain amendments proposed therein and after the assent of the President of Pakistan Finance Act 2020 has been enacted on 30 June 2020. In case of a stock fund if dividend receipts of the fund are less than capital gains the rate of tax deduction shall be 125 instead of 10 httptagmcopdfWithHoldingRatesTaxYear2019pdf Tariq Abdul Ghani Maqbool Co.

- Large import houses. Section 113 and 113C of the 2001 Ordinance regarding minimum tax and alternate corporate. Other Tax payers Ship breakers Advance Tax on Contracts By Company By individual and AOP Filer 55 6 45 Filer 7 75 S No.

Federal Board of Revenue FBR has updated withholding tax on rental income from immovable properties for tax year 2021. The withholding tax card also included the 100 percent higher tax rates for persons not on the Active Taxpayers List ATL. III PIII 1stSch Cl 24A 24C P II 2ndSch Sale of rice cottonseed oil edible oil 15 3 Advance Tax for Listed companies and Companies Engaged in Manu-facturing.

Foreign produced commercials Sec 235B Sec 153120 Final Tax SUPPLY OF GOODS S1531a Div. 600001 to Rs Rs 2500000 Rs to Rs Rs to Rs ICMA Pakistan Estd. Latest Income Tax Slab Rates in Pakistan for Fiscal Year 2021-22 Latest Income Tax Slab Rates in Pakistan.

Mandatory tax filing The distinction between a filer and a non-filer must be abolished. The withholding tax rate on the dividend is 125 percent where the recipient is a filer of Pakistan tax return and 20 percent where the recipient is a non-filer. Now lets learn more about the latest tax slab rates in Pakistan.

57. The original Statue Income Tax Ordinance 2001 as. 75000-in aggregate during a financial year S1531a 1531b services Every Prescribed Person section.

The Federal Revenue Board FBR revised the rates to 30 June 2019. Withholding Tax RegimeRates Card Guidelines for the Taxpayers Tax Collectors Withholding AgentsUpdated up to June 30 2021. The Finance Bill 2020-21 rightly proposes filing Withholding Statements under section 165 on a quarterly basis now.

G orxu ploov dqg h hdohuv dqg vxe ghdohuv ri vxjdu fhphqw dqg hgleoh rlo rqo wkrvh dsshdulqj rq 7 0rwruffoh ghdohuv 6dohv 7d 5hjlvwhuhg q doo rwkhu fdvhv 6hfwlrq dlq lq glvsrvdo ri dvvhwv rxwvlgh 3dnlvwdq. This publication contains a review of changes made in Income Tax Ordinance 2001 Sales Tax Act 1990 Federal Excise Act. Applicable Withholding Tax Rates.

1951 Tax Rate Card for Tax Year 2020. The complete list of withholding tax rates for taxation year 2020 is given below. Payment for advertisement services to a non- resident person relaying from outside Pakistan Any Other payment except payment to foreign news agencies syndicate services non-resident contribution having no permanent establishment in Pakistan PAYMENT TO NON-RESIDENTS 151 Nature of payment Rate TY 2018-19 700 1300 WITHHOLDING TAX DEDUCTION CHART.

Taxesrates and the forecasting capacity of the FBR needs to improve. January 5 2020 0. Minimum Tax for other cases.

721 576 66 7. - Motor vehicles in CBU condition by manufacturers of motor vehicles. It helps to reduce some compliance burden.

Honda 125 2021 New Model Price In Pakistan Bise World Pakistani Education Entertainment Honda 125 Honda New Model

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

Letter No Dd M E Transfers 2019 By The Government Of The Punjab School Education Department Monitorin Elementary School Teacher Teachers Elementary Schools

Lic Of India Agent Commission Chart 2020 Life Insurance Quotes Life Insurance Marketing Life And Health Insurance

Pakistan S Top Tax Payers Pakistan Dawn Com

Circular No 02 07 2018 Public Dated Islamabad The 1st February 2019 Regarding Bank Holiday With All Public Holidays Year Calendar Public Holidays Holiday Day

Ratta Pk B Com Part 2 Income Tax Notes Pdf Bcom Ii Income Tax Income Tax

Synopsis Of Taxes In Pakistan Tax Year 2021 39th Edition Mirza Munawar Hussain Cbpbook Pakistan S Largest Online Book Store Synopsis Online Bookstore Class Notes

Pin On Aimsconsultants Webs Com

Https Khilji Net Pk Wp Content Uploads 2020 07 Kco Rate Card 2020 2021 Pdf

Tds Rate Chart Fy 19 20 Ay 20 21 Simple Tax India Chart Tax Deducted At Source Rate

Property Tax In Pakistan 2019 2021 Graana Com Blog

Posting Komentar untuk "Withholding Tax Rates In Pakistan 2020-21 Pdf"