Withholding Tax Rates Punjab

2 of the cost of the vehicle. However the rate of Punjab sales tax on franchise services is 16 instead of the 10 rate of Federal excise duty which was being collected by FBR prior to 06-10-2012.

Workshop On Sales Tax Laws On Services Part

042 99330127 Contact DG PLRA.

Withholding tax rates punjab. Punjab Sales Tax on Services Rules. Withholding is an act of deduction or collection of tax at source which has generally been in the nature of an advance tax payment. Certificate for deduction at lower rate.

15 of the cost of the vehicle. It is an effective mechanism and importanttimely source of revenue. Than Sindh on account of the fact that the sales tax rate on services in Punjab 16 is 23 higher than the 13 Tax in Sindh.

PUNJAB SALES TAX ON SERVICES WITHHOLDING RULES 2015 Gazette of Punjab Extraordinary 4th March 2015 No. Description Classification Rate of Tax 1 2 3 4 Se 1 r vi ces po d d by ho tl motels guest houses marriage halls and lawns by whatever name called including pandal and shamiana servicesclubs and caterers. 042 99330111 99330112 Fax.

Motor Cycles up to 50 CC. PRAOrders062012 dated 20-2-2015---In exercise of the powers conferred under section 76 of the Punjab Sales Tax on Services Act 2012 XLII of 2012 the Punjab Revenue Authority with the approval of the Government is pleased to make the following rules. Rates of Road Tax to be paid under the provisions of the Punjab Motor Vehicles Taxation Act 1924 are as follows.

Marriage hall- Marriage hall includes a marriage lawn or banquet. The tax rate shall be 4 percent of the value of motor vehicle on leasing of motor vehicle to persons not appearing in the Active Payers List. Historically Vreplaced AT turnover taxes and also emerged as a precursor of income taxation.

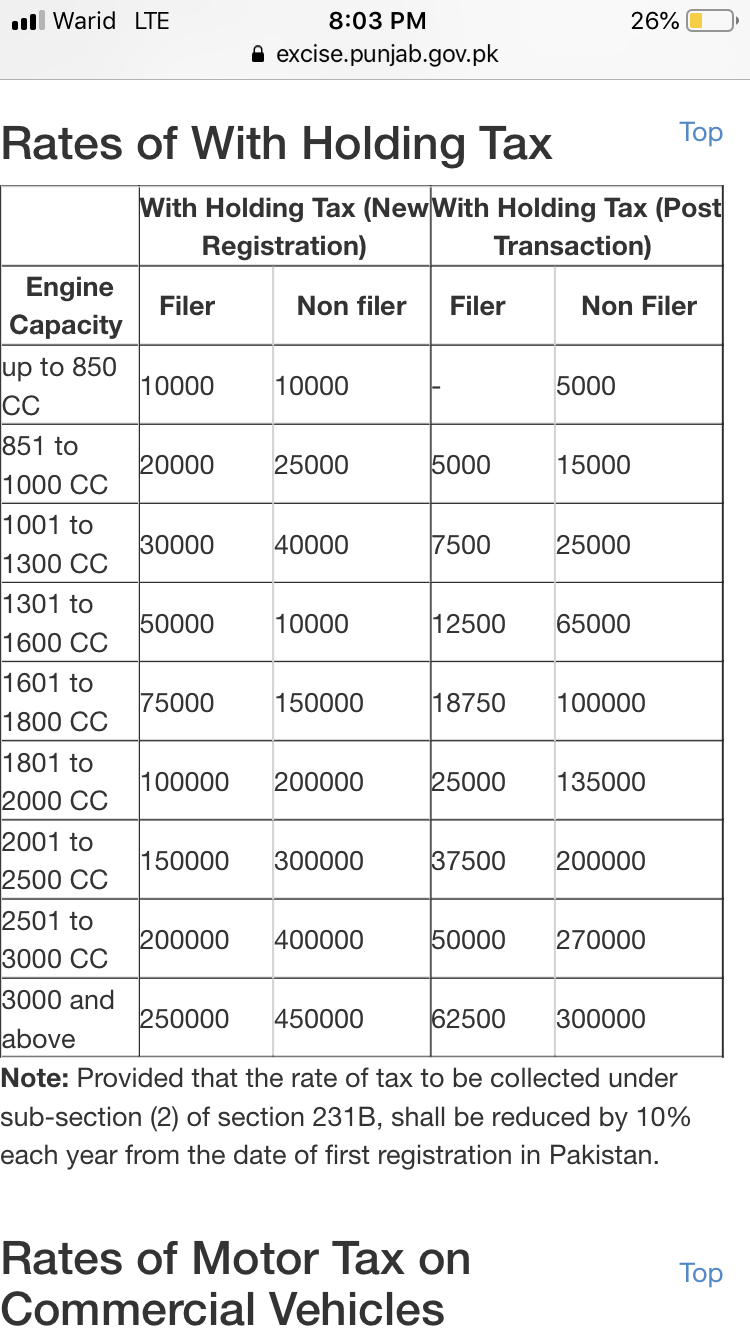

Punjab Sales Tax On Services Act 2012. Enlisted below are the rate of With Holding Tax on vehicles. A proposal was launched by the Swedish government in November 2019 proposing a decreased WHT rate of 1015 based on protocol dated 29 March 2019.

Integration of all Revenue Collections. Typically VATis charged on. ALL REVENUE COLLECTIONS UNDER ONE MINISTRYBODY 1.

WHT 2015 - 2016. Value added taxes or taxation VAT is one of the four marvelous innovations of the twentieth century the other three being atomic energy anti-biotics and computers or information technology. Short title and.

Rate of tax 98011000 98013000 98014000 98015000 98016000 98300000 98370000 and 98620000 Services provided by hotels motels guest houses marriage halls and lawns by whatever name called including pandal and shamiana services clubs including race clubs and caterers. The withheld tax shall be adjustable. Income by way of interest from infrastructure debt fund.

Income by way of interest from Indian Company. Since franchise amounts are paid out of turnover of a business the amount of franchise fee chargeable to Punjab sales tax is deductable from the turnover of a business chargeable to Punjab sales tax. Withholding agents registered in LTUs1 Notwithstanding anything contained in rules 5 and 6 a withholding agent falling under clause e of sub-rule 2 of rule 1 who receives taxable services from a registered service provider who is also registered in the LTU shall deduct and withhold one percent of value of taxable services received by him as sales tax from the payment due to that.

Their contribution is about 41 percent of total direct tax revenues. Reduction in tax rates for individuals Paraqraph Division I Part I of the First Schedulel Prior to the Finance Act 2018 the minimum threshold for taxable income was Rs400000- for individuals and tax rates for non-salaried and salaried individuals were separately provided in paragraphs 1 and IA respectively in Division l Part-I of the. Withholding Income Tax Regime WHT Rates Card Guideline for the Taxpayers Tax Collectors Withholding Tax Agents - as per Finance Act 2020 updated up to June 30 2020 Disclaimer-This Withholding Tax Rates Card is just an effort to have a ready reference and to facilitate all the Stakeholders of Withholding Tax Regime.

Sales Tax Return Form. Register for Income Tax. The original Statue Income Tax Ordinance 2001 as.

The withholding tax rates under Section 231B 2. The 15 tax rate is to be applied on royalties arising from the use of or the right to use. Increase from Rs5b in 1991 to above Rs 422b in 2012 speaks of exponential growth and consequential heavy reliance on withholding taxes.

Amended List of Taxable Services. Motor Cycles above 50 CC. Withholding Tax Rates - Federal Board Of Revenue Government Of Pakistan.

Punjab Sales Tax Ordinance 2000. Change your personal details. 3 of the cost of the vehicle.

Four Wheelers for Personal Use. 042 99330298 For Appointment. There is no change in rate of tax in case of restaurant services and advertisements.

Punjab Revenue Authority Act 2012. 25 0 0 The Parliament has adopted a 15 withholding tax rate on the gross payment on interest royalties and certain lease payments to related parties resident in low-tax jurisdictions with an effective date of 1 July 2021 1 October 2021 for lease payments. Punjab Sales Tax on Services An Overview.

Punjab Land Records Authority - PLRA Government of the Punjab 2-Kilometer Main Multan Road Opposite EME-DHA Housing Society Lahore. Taxes levied in Punjab are recommended to be harmonized with other provinces of the country to ensure that ensure level playing field for investors in Punjab. For Transfer Only PKR CC RANGE.

Punjab Sales Tax on Services - An Overview. Income in respect of units of non-residents. Payments to non-resident sportsmen or sports associations.

For New Registration PKR WHT 2015 - 2016. 98011000 98013000 98014000 98015000 98016000 98370000and 98620000 Six n er ent 2.

Omission And Merger Of Withholding Tax Provisions In Finance Act 2021 Budget

Workshop On Sales Tax Laws On Services Part

Budget 2020 21 Finance Bill Shows All Relief No Clear Revenue Plan Newspaper Dawn Com

Unique Tax Corporate Law Consultant Posts Facebook

Salient Features Of Income Tax Income Tax Is

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Punjab National Bank Pnb Has Released Its New Logo Significantly Pnb Is Going To Merge With United Bank Of India And Oriental Bank O Merge Logo Release

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

First Detailed View On Tax Exemptions Emerges Newspaper Dawn Com

Online Tax Consulting In 2020 Online Taxes Tax Consulting Business Finance Management

Salient Features Of Income Tax Income Tax Is

Withholding Tax On Prize Bonds Prize Money Rates Have Been Revised

A J On Twitter Income Tax Slabs According To Finance Bill 2021 22

A J On Twitter Income Tax Slabs According To Finance Bill 2021 22

Government To Impose A New Bag Of Taxes On Vehicles News Articles Motorists Education Pakwheels Forums

Workshop On Sales Tax Laws On Services Part

Wht Rate Card 2021 Pdf Withholding Tax Taxation In The United States

Income Tax Rates Slab For Fy 2021 22 Or Ay 2022 23 Ebizfiling

Fbr Not To Tax Annual Property Rent Income Of Up To Rs0 2 Million

Posting Komentar untuk "Withholding Tax Rates Punjab"