Withholding Tax Table 2019 Pdf

2021 Form IT-2104 to verify if the number of withholding allowances or additional dollar amount claimed is correct for tax year 2021. Federal Withholding Tables.

Withholding Tax Computation Under The Train Law Lvs Rich Publishing

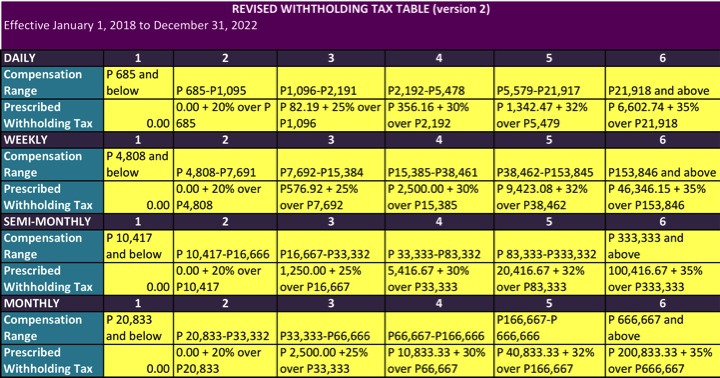

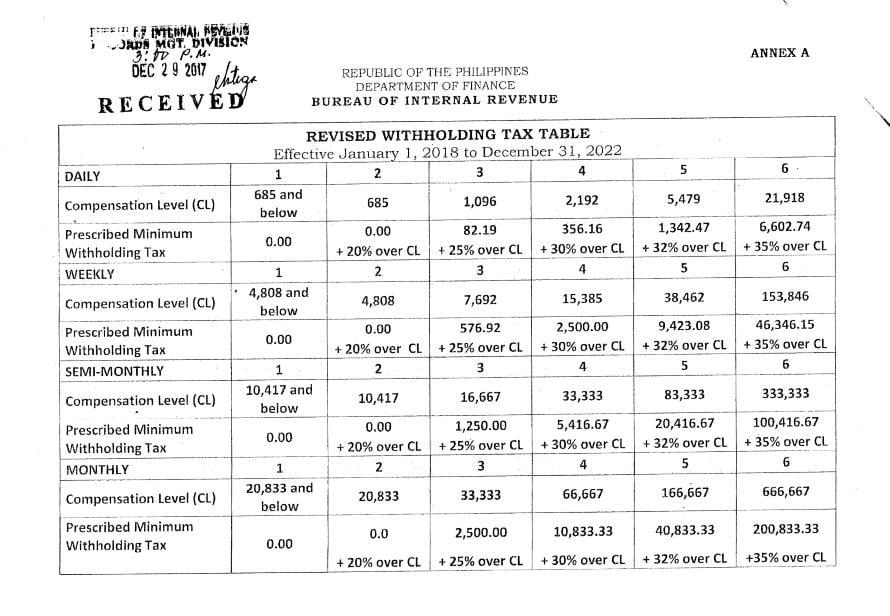

The Bureau of Internal Revenue BIR has issued a memorandum on the revised withholding tax table.

Withholding tax table 2019 pdf. Alternative Methods for Figuring Withholding. The Federal Tax Withholding Tables 2021 PDF can be used after you follow the method to determine the federal tax withholding. Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members.

TW pay per period x PP - 650 x number of exemptions Taxable Wage Withholding Deduction. Tax tables for previous years are also available at Tax rates and codes. The amounts in the tables are approximate.

Percentage Method Tables for Manual Payroll Systems With Forms W-4 From 2019 or Earlier. IRS Publication 15-T PDF The full directions of Federal Income Tax Withholding are issued by the IRS Internal Revenue Service annually. There is no wage base limit for Medicare tax.

Wage Bracket Method Tables For Income Tax Withholding Federal Withholding Tables 2021 is the process needed by the US. To get a copy of the PDF select the tax table you need and go to the heading Using this table. All companies must update their employees compensation records which has already started last January 1 2018 under the implementation of Tax Reform Law RA 10963 also known as Tax Reform for Acceleration and Inclusion TRAIN.

By the amount of money being held back the employees are able to declare income tax return credit score. This worksheet employed to matter tax withholding with W-4 form dated 2019 and previously can vary with the worksheet used for W-4 form in 2020 version and afterwards inspite of the slight difference. Find out the tentative withholding amount Step 2a.

It includes a number of changes like the tax bracket changes and the tax rate yearly together with the option to employ a computational connection. This technique is a 4-step method in order to find the final amount of tax withheld. This publication includes the 2019 Percentage Method Tables and Wage Bracket Ta-bles for Income Tax Withholding.

2019 Income Tax Withholding Instructions This document is designed to provide you with an overview of the Vermont Withholding Tax. Caused withholding tax changes for taxpayers with taxable income. Social security and Medicare taxes apply to the wages of household workers you pay 2300 or more in.

12102018 14153 PM. Federal Tax Withholding Tables Weekly Federal Withholding Tables 2021 is the procedure needed by the US. Optional Computer Formula Effective January 1 2019 In order to determine the employees taxable wage use the following formula.

Federal government in which companies deduct taxes from their employees pay-roll. If you need further clarification contact information for the Business Section of the Vermont Department of Taxes is found on page 2 of this document or by visiting our website at wwwtaxvermontgov. 1 Withholding Tax Guide This Withholding Tax Guide is a translation of the 2019 edition of Gensen Choushu no Shikata.

Therefore the tax rate on these wages is 62. 1038 available at IRSgovirb 2018-51_IRBNOT-2018-92 provides that until April 30 2019 an employee who has a reduction. Alternative Methods for Figuring Withholding.

How To Get Tax Help. Notice 2018-92 2018-51 IRB. This is an unofficial translation and reference material designed to help you understand the Japanese withholding tax system.

2019 Income Tax Withholding Tables Created Date. The Medicare tax rate is 145 each for the employee and employer unchanged from 2020. Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay.

5000 or less WD TW x 005 PP. While submitting the worksheet provided within the document you will need to search for the data shown in 2021 IRS Tax Withholding Tables PDF. By Federal Withholding Tables.

Have the sum of modified wage the ways are written in Step 1 a-h. Withholding Formula and Tables for 2019 and After All the tables on pages 1 through 10 have been updated. The social security wage base limit is 142800.

Government in which employers subtract tax obligations from their staff members pay-roll. Thus no liability is accepted. The link to the PDF is in the Get it done section.

How To Treat 2019 and Earlier Forms W-4 as if They Were 2020 or later Forms W-4. 2019 federal income tax withholding. 2019 Income Tax Withholding Tables Keywords.

Formula For Computing Virginia Tax To Be Withheld Legend G Gross pay for pay period P Number of pay periods per year A Annualized gross pay G x P. Tax tables with an asterisk have downloadable look-up tables available in portable document format PDF. How To Treat 2019 and Earlier Forms W-4 as if They Were 2020 or later Forms W-4.

This year of 2021 is also not an exception. Starting in tax year 2019 there are additional allowances for taxpayers. How To Get Tax Help.

Tables for Withholding on Distributions of Indian Gaming Profits to Tribal Members. Review further to comprehend exactly how the procedure functions formally. Use the formula below for exact amounts.

July 31 2021. By the quantity of cash being kept the workers are able to claim income tax return debt. More than 5000 but not more than 10000 WD.

December 2020 Department of the Treasury Internal Revenue Service. Withholding Tax Tables and Methods Effective July 1 2021. Federal Withholding Tables 2021 As with every other before year the newly adjusted PDF Publication 15-T was released by IRS to get ready for this particular years tax time of year.

Withholding Tax Computation Under The Train Law Lvs Rich Publishing

Revised Withholding Tax Table Bureau Of Internal Revenue

How To Calculate Payroll Taxes For Your Small Business The Blueprint

Michigan Family Law Support Jan 2021 2021 Tax Rates 2021 Federal Income Tax Rates Brackets Etc And 2021 Michigan Income Tax Rate And Personal Exemption Deduction Joseph W Cunningham Jd Cpa Pc

Tax Table Wild Country Fine Arts

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

Revised Withholding Tax Table Bureau Of Internal Revenue

Taxes In Switzerland Income Tax For Foreigners Academics Com

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

Revised Withholding Tax Table For Compensation Grant Thornton

Excel Formula Income Tax Bracket Calculation Exceljet

Tax Table Wild Country Fine Arts

Tax Table Wild Country Fine Arts

Michigan Income Tax Rate And Brackets 2019

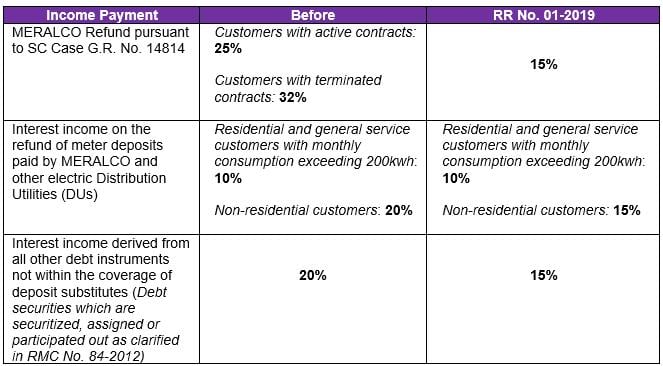

Updated Withholding Tax Rates On Meralco Payments And Interest On Loans Grant Thornton

Posting Komentar untuk "Withholding Tax Table 2019 Pdf"