What Is Louisiana Tax Rate For Payroll

For withholding Louisiana income tax on wages for their employees. Louisiana Unemployment Insurance Tax Rates The 2021 wage base is 7700.

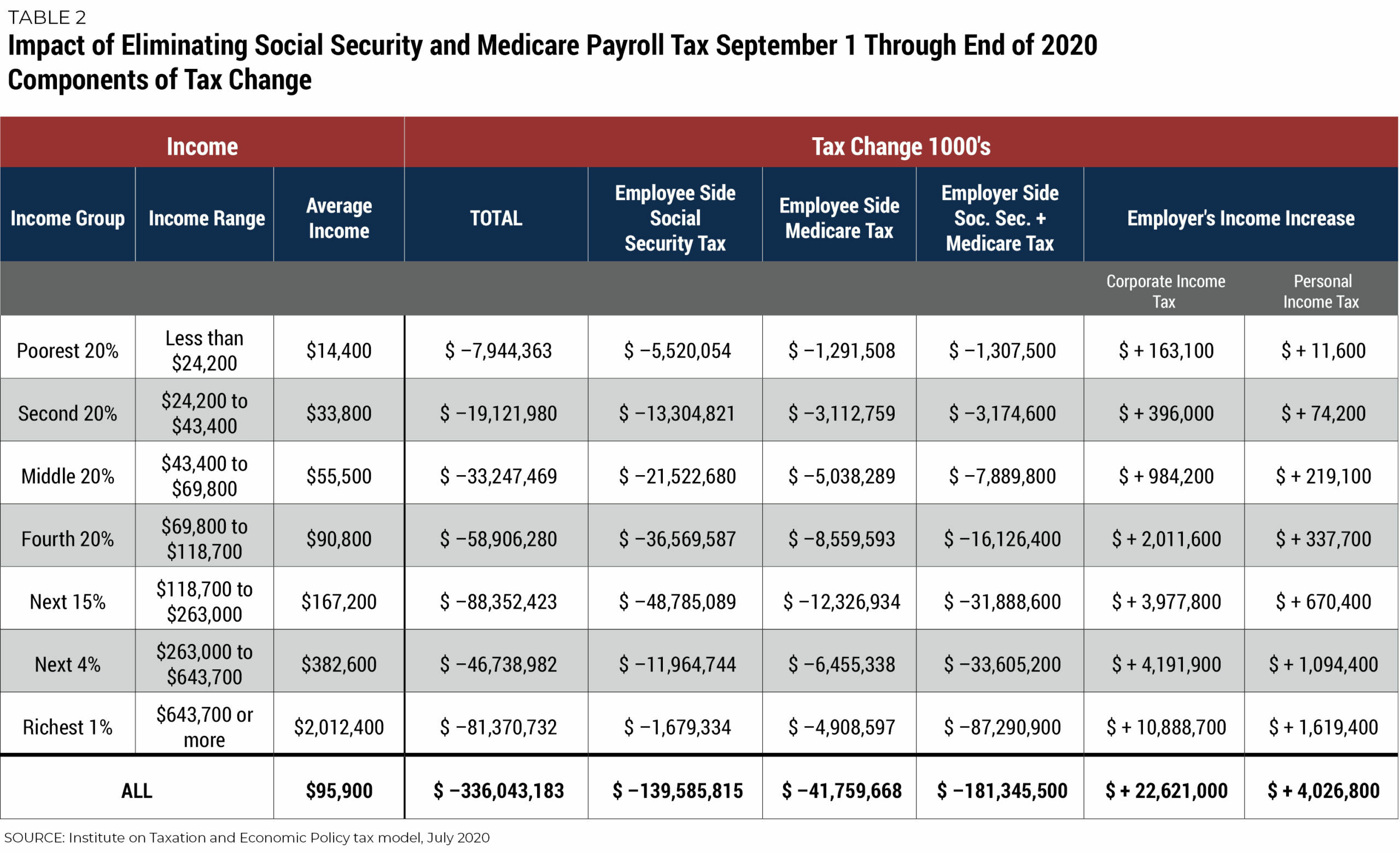

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Check the 2020 Louisiana state tax rate and the rules to calculate state income tax 5.

What is louisiana tax rate for payroll. See how we can help improve your knowledge of Math Physics Tax. Louisiana requires employers to withhold income taxes from employee paychecks in addition to employer paid unemployment taxes. This 6 federal tax is to cover unemployment.

Louisiana new employer rate range from. The tax rate ranges from 2 on the low end to 6 on the high end. If you want to simplify payroll tax calculations you can download ezPaycheck payroll software which can calculate federal tax state tax Medicare tax Social Security Tax and other taxes for you automatically.

Every employer who has resident or nonresident employees performing services except employees exempt from income tax withholding within Louisiana is required to withhold Louisiana income tax based on the employees withholding exemption certificate. While most states calculate income tax based on a workers earnings several states tax dividend and interest income only. 350 Ohio Administrative Code 5703-7-10 last revised November 23 2018.

Louisiana State Payroll Taxes. Louisiana state income tax rate table for the 2020 - 2021 filing season has three income tax brackets with LA tax rates of 2 4 and 6. The income tax rate ranges from 2 to 6.

2021 Louisiana state sales tax Exact tax amount may vary for different items The Louisiana state sales tax rate is 4 and the average LA sales tax after local surtaxes is 891. 2020 payroll taxes by state. Louisiana has a population of just under 47 million 2019 and is known for its unique culture jazz music and Mardi Gras.

Also unlike some other. One of a suite of free online calculators provided by the team at iCalculator. In most cases youll be credited back 54 of this amount for paying your state taxes on time resulting in a net tax of 06.

Louisianas state sales tax rate is 445. The median household income is 49973 2018 and it ranks among the lowest in the United States. 030 142 including solvency surtax California.

2020 Louisiana tax brackets and rates for all four LA filing statuses are shown in the table below. The Louisiana Salary Calculator allows you to quickly calculate your salary after tax including Louisiana State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Louisiana state tax tables. 050 employee share 15 59.

No additional state payroll tax. Wages of Louisiana residents performing services in other states are subject to withholding of Louisiana income tax if the wages are not subject to withholding of net income tax. You can find Louisianas tax rates here.

States Louisiana has a state income tax. SUI New Employer Tax Rate Employer Tax Rate Range 2021 Alabama. Compare that to New Jersey where the top rate doesnt kick in until your income hits 5 million.

ONlINe FIlING aPPlICaTIONs Louisiana Taxpayer Access Point LaTap is a free online. Louisiana does not have any reciprocal agreements with other states. 116 to 289 based upon industry and rates classification for 2021.

2021 PDF 2020 PDF 2019 PDF. 31 Zeilen Supplemental withholding rate. You can try it free for 30 days with no obligation and no.

The tax rate is based on withholdings chosen on the employees W-4 form. Standard rate 257 207 employer share. Youll also see that several states dont assess state income taxes.

No local income taxes. Unfortunately for Louisiana consumers and visitors that base rate is augmented by significant parish what Louisiana calls its counties and city sales tax rates. Employees complete Form L-4 Employees Withholding Exemption Certificate used for calculating withholdings.

Review the 2020 state income tax rates for each state. It is not intended as a substitute for the actual statutes and regulations. Groceries are exempt from the Louisiana sales tax.

To see the tax rate schedule ratio rate table and the FUTA creditable factors for ratio-rated employers select the year. 065 68 including employment security assessment of 006 Alaska. 307 plus employee unemployment insurance tax rate of 006.

The state charges a progressive income tax meaning the more money your employees make the higher the income tax. 15 62 emergency 15 surcharge. This resource lists the highest tax rate each state charges.

The table below shows the state and parish sales tax rates for every parish in Louisiana and the total state and local sales tax rates for the states. Local Taxes There are no local income taxes imposed in Louisiana. Alone that is one of the lowest rates in the nation.

And unlike some of the other income tax states Louisianas top tax bracket starts at a relatively low income. In Louisiana the top rate of 6 kicks in at income over 50000 for single filers and income over 100000 for joint filers. Calculate your state income tax step by step 6.

Now that were done with federal taxes lets look at Louisiana income taxes. The responsibility for withholding income tax on wages applies to all employers.

How High Are Capital Gains Taxes In Your State Tax Foundation

Colorado Sales Tax Due Dates Tax Guide Sales Tax Business Tax

2021 Payroll Calculator Tax Rates Free For Employers Onpay

The Calculator Gives Taxes On Regularly Taxed Income And Qualified Dividends And Long Term Capital Gains Income Tax Personal Finance Budget Tax

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Shrinking The Delaware Tax Loophole Other U S States To Incorporate Your Business

Colorado Income Tax Rate And Brackets 2019

Funny Tax Deductions Funny Infographics Tax Deductions Deduction Business Tax

The Stunning Success Of The Uk Labor Market Lowering Wages Increases Employment Labour Market Employment Aggregate Demand

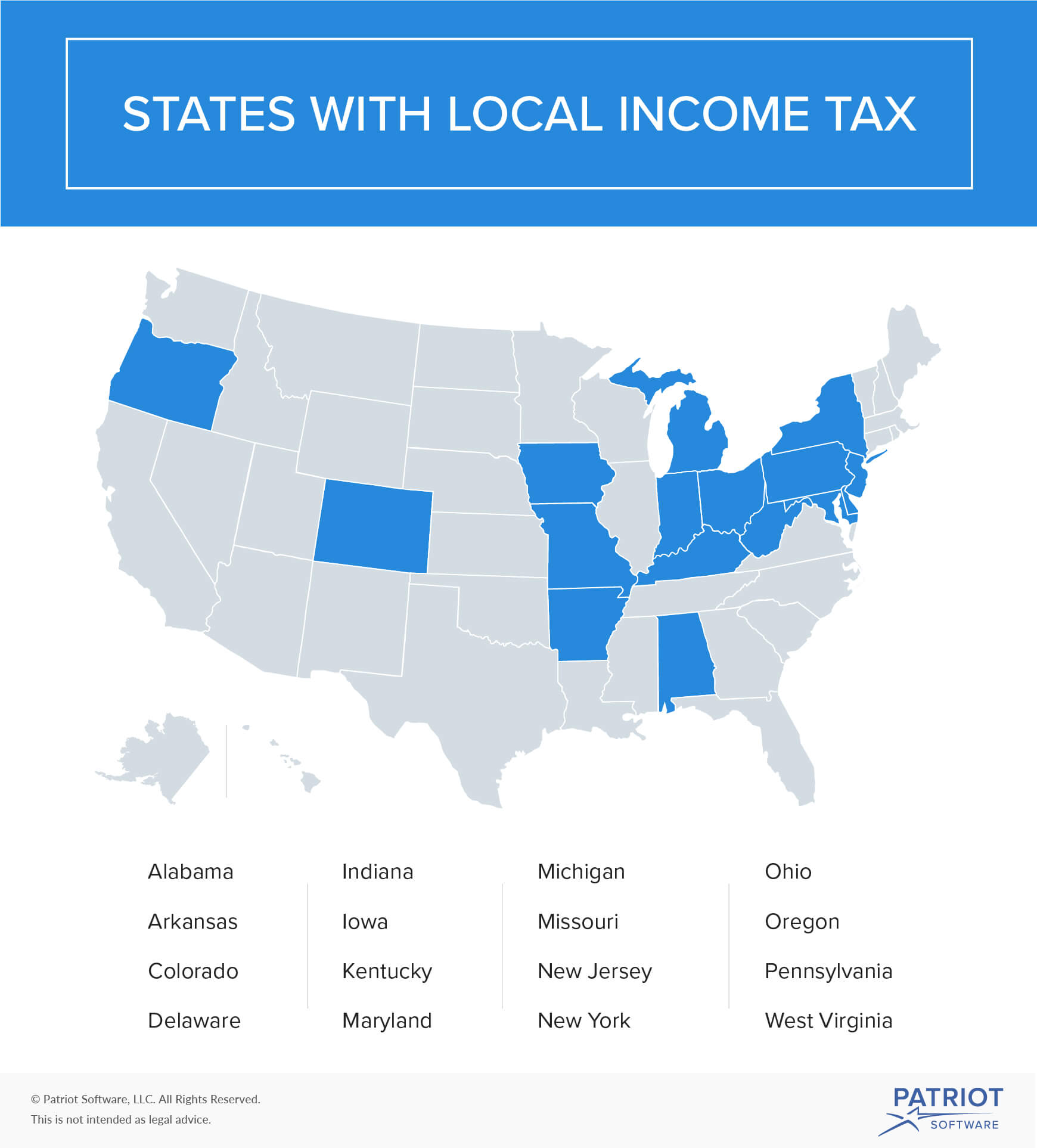

What Is Local Income Tax Types States With Local Income Tax More

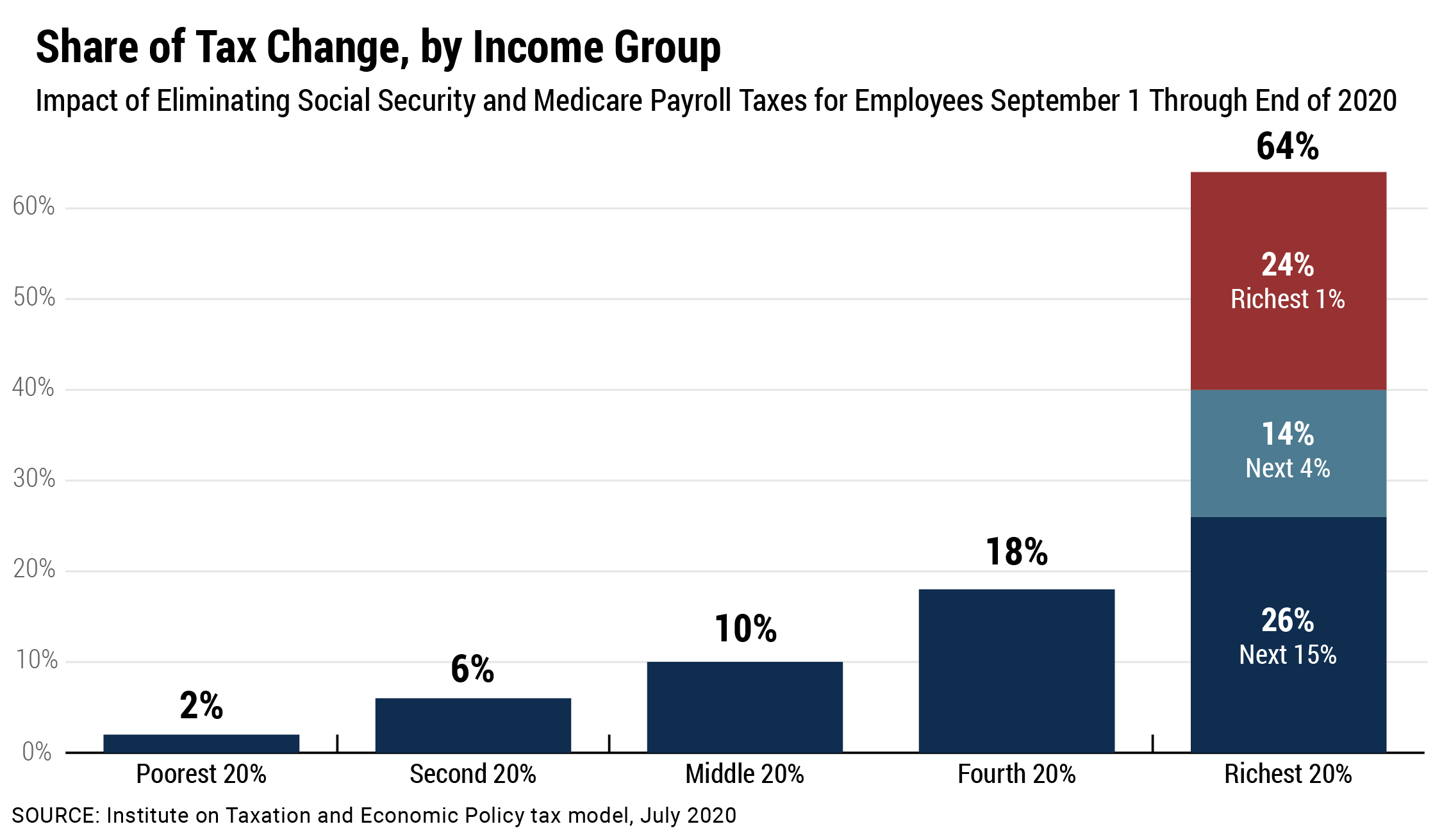

Trump S Proposed Payroll Tax Elimination Itep

An Updated Analysis Of A Potential Payroll Tax Holiday Itep

Trump S Proposed Payroll Tax Elimination Itep

2021 Federal State Payroll Tax Rates For Employers

Not Only Do Oil And Gas Companies Not Get Subsidies They Pay Higher Taxes Than Most Other Employers Gas Industry Oil And Gas Gas Company

2021 Federal State Payroll Tax Rates For Employers

States With Highest And Lowest Sales Tax Rates

Posting Komentar untuk "What Is Louisiana Tax Rate For Payroll"